- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Corn Edges Up, Soy Rebounds

Various positive news

Grains futures prices have reached the lower boundary of the upward channel and are struggling for growth on the relatively insignificant positive news. The full reversal upwards is possible only subject to really poor weather and El Nino effects. The probability rises if winter turns out to be extremely warm. Will the prices continue to increase?

The corn edged up after the U.S. Energy Information Administration reported the record weekly production volumes of ethanol in the US. The weekly increase was 3.4% with the volumes reaching 1mln barrels a day, which requires 100mln bushels of corn. Egypt tendered the purchase of 240 thousand tonnes of wheat. The soy is rebounding from the multiyear low. The oats are on increase too. Let’s consider the personal composite instrument &Grain_4.

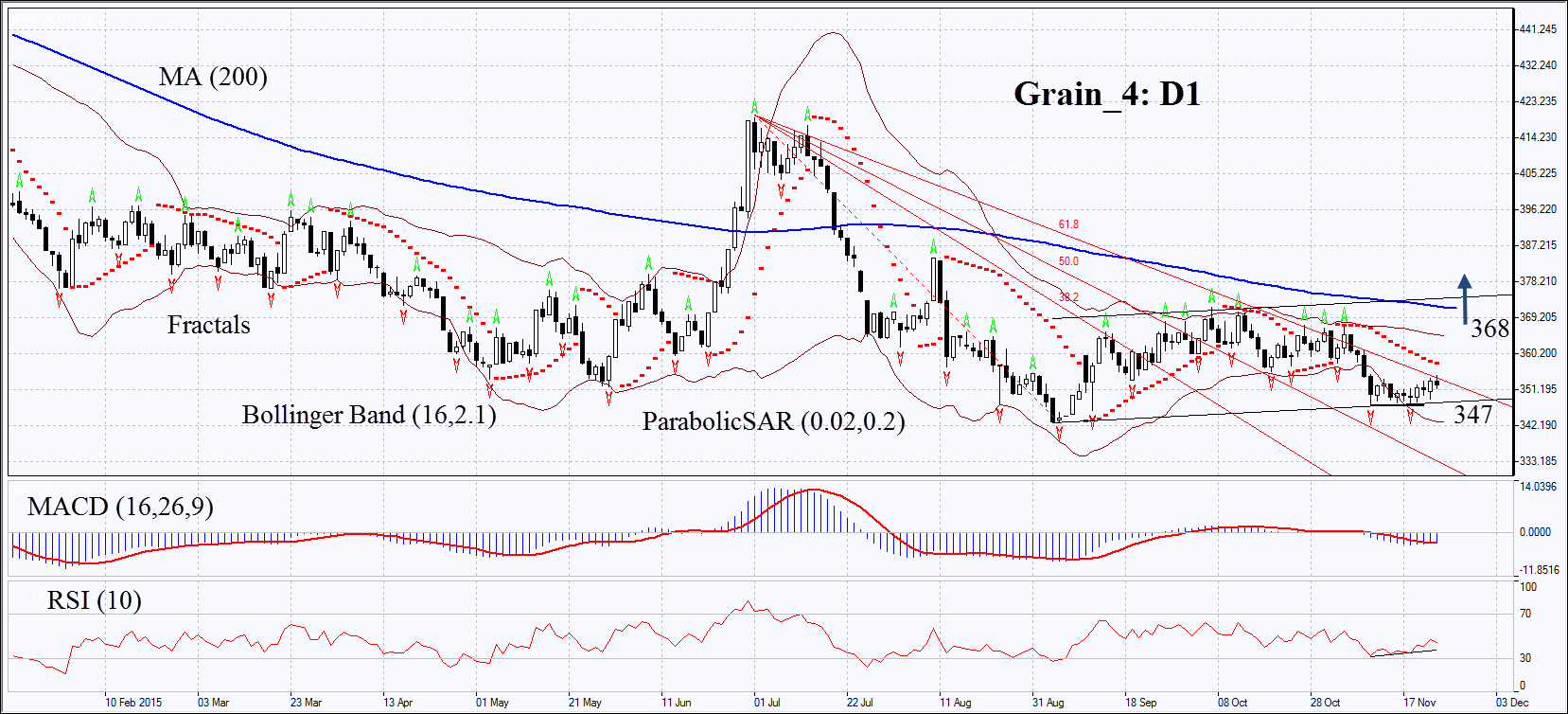

On the daily chart, the PCI instrument &Grain_4: D1 is consolidating near the lower boundary of the uptrend. The Parabolic indicator continues giving sell signal, while MACD has formed a signal to buy. The Bollinger bands® have widened a lot, which may mean higher volatility. The RSI has formed small positive divergence. The bullish momentum may develop if the PCI surpasses the upper Parabolic signal, the Bollinger Band and the last fractal high at 368. This level may serve the point of entry. The initial risk-limit may be placed below the two last fractal lows at 347. Having opened the pending order, we shall move the stop to the next fractal low following the Parabolic and Bollinger signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. The most risk-averse traders may switch to the 4-hour chart after the trade and place there a stop-loss moving it in the direction of the trade. If the price meets the stop-loss level at 347 without reaching the order at 368, we recommend cancelling the position: the market sustains internal changes which were not taken into account.

Position Buy Buy stop above 368 Stop loss below 347

Related Articles

Gold bounces off $2,860 Remains below short-term ascending trend line RSI flattens, MACD eases Gold prices have recovered some of their losses from the previous days, touching...

Oil prices are weaker as OPEC+ confirms it will start reversing supply cuts, while tariff uncertainty is also hitting sentiment Energy- OPEC+ Set to Increase Supply Oil prices are...

Oil prices rise as peace is allusive. Instead of giving peace a chance, Volodymyr Zelensky, blew up the minerals deal and a path to ceasefire. He instead chose to continue the...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.