- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Tech Data (TECD) Q2 Earnings & Sales Beat Estimates, Stock Up

Tech Data Corporation (NASDAQ:TECD) reported top and bottom-line beat in second-quarter fiscal 2020, which marked the fourth straight quarter of earnings beat. Further, results reflected sales beat for the company after two consecutive misses. Results benefited from strong and balanced growth across all regions, which led to top-line gain, and double-digit growth in operating income and earnings. Moreover, the company generated solid operating cash flow during the quarter.

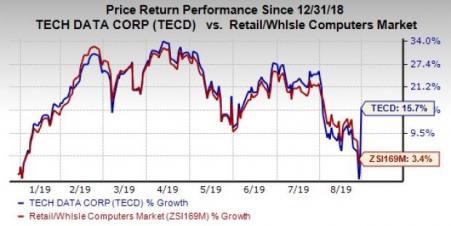

Shares of Tech Data rose sharply, following the solid second-quarter fiscal 2020 results. The stock recorded growth of 15.7% during the trading session on Aug 29. We note that shares of this Zacks Rank #3 (Hold) company have gained 15.7% year to date compared with the industry’s growth of 3.4%. The chart clearly reflects strong rally witnessed yesterday, which caused most of growth in the year-to-date period.

Q2 Details

Tech Data’s adjusted earnings of $2.69 per share in the fiscal second quarter improved 34% year over year and surpassed the Zacks Consensus Estimate of $2.33.

Net sales of $9,092.2 million grew 2% year over year and beat the consensus mark of $8,745 million. Moreover, net sales rose 5% on a constant-currency (cc) basis. Sales gained from broad-based growth across geographies along with stable demand and solid execution.

Net sales from the Americas (47% of global net sales) rose 7% to $4,316.7 million. Sales from Europe (49% of global net sales) declined 2% to $4,439.6 million. Sales from the Asia Pacific (4% of global net sales) grew 14% to $335.9 million. On a cc basis, net sales rose 7% in the Americas, 2% in Europe and 17% in the Asia Pacific.

Margins

The company’s gross profit rose 7% to $561.7 million in the reported quarter. Gross margin expanded 25 bps to 6.2%. Adjusted selling, general & administrative (SG&A) expenses increased 5% to $410.2 million. As a percentage of sales, adjusted SG&A expenses expanded 10 bps to 4.5%.

Adjusted operating income of $151.4 million grew 12% from $110.4 million in the year-ago quarter. Meanwhile, adjusted operating margin expanded 15 bps to 1.7%. Segment wise, adjusted operating margin expanded 14 bps to 2.5% in the Americas, 10 bps to 1.1% in Europe and 42 bps to 1.3% in the Asia Pacific.

Balance Sheet and Cash Flow

As of Jul 31, 2019, Tech Data had cash and cash equivalents of approximately $738.3 million, long-term debt of $1,297.2 million, and total stockholders’ equity of $2,889.6 million.

The company generated net operating cash flow of nearly $40 million during the fiscal second quarter. Cash from operations totaled $103 million in the first half of fiscal 2020, of which the company returned $118 million to shareholders through share buybacks. In the fiscal second quarter, it bought back 833,000 shares for $82 million.

Keeping in lines with its commitment to return value to shareholders, the company authorized a new $200 million worth of share repurchase program. The new authorization will add to the $75 million remaining under its current buyback program that was announced in July. Combining the latest announcement and the authorizations made in July and October, the company has authorized share buybacks worth of $500 million since October 2018.

Outlook

Tech Data issued third-quarter fiscal 2020 view, wherein it anticipates net sales of $9.2-$9.5 billion.

Further, the company expects earnings (GAAP) of $2.33-$2.63 per share in the fiscal third quarter, with adjusted earnings of nearly $2.85-$3.15 per share. It assumes effective tax rate of 24-25% in the quarter.

Moreover, the company notes that the second half of fiscal 2019 was exceptionally strong. Hence, it anticipates growth rates in the second half of fiscal 2020 to be moderate compared with the prior year. Additionally, it expects adverse currency rates to linger through the rest of the fiscal year.

Looking for More? Check These Solid Picks

PC Connection, Inc. (NASDAQ:CNXN) , with long-term earnings per share growth rate of 8%, currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Boot Barn Holdings, Inc. (NYSE:BOOT) , with long-term earnings per share growth rate of 17%, presently carries a Zacks Rank #1.

Burberry Group (LON:BRBY) PLC (OTC:BURBY) , with long-term earnings per share growth rate of 9%, currently carries a Zacks Rank #2 (Buy).

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Burberry Group PLC (BURBY): Free Stock Analysis Report

PC Connection, Inc. (CNXN): Free Stock Analysis Report

Tech Data Corporation (TECD): Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Coming into today, the Russell 2000 IWM (Gramps) was at a key life support level on the 200-week moving average. The 200 level is now under threat. SPDR® S&P Retail ETF...

The Stock Market Vigilantes have spoken. They don't like tariffs, and they don't like mass firings of federal workers. That's because they don't like stagflation, and they fear...

Looking for the positives when there aren't many. The Russell 2000 (IWM) was able to recover some of its intraday losses, finishing on the measured move target derived from the...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.