- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Target (TGT) Sharpens Edge, Outlines 2020 Strategic Plans

Target Corporation (NYSE:TGT) is leaving no stone unturned to gain a prominent presence in the ever-changing retail landscape and stave off competition from e-commerce giant Amazon (NASDAQ:AMZN) .

To this end, the Zacks Rank #3 (Hold) company recently outlined certain strategic plans for fiscal 2020. From expanding grocery and beverage in its same-day delivery service to enhancing omni-channel capabilities with small-format store openings and remodel programs, Target is making all smart moves. Again, its constant efforts toward supply-chain transformation are in the limelight.

Some of the highlights in fiscal 2019 include respective sales growth of roughly 500% and 50% in its Drive Up and Order Pickup facilities. Impressively, Target's small format stores contributed more than $1 billion to total sales.

Chalking Out FY20 Plans

Target has been gaining from its same-day delivery options. Management looks to expand same-day services by adding fresh grocery and adult beverage items to its Order Pickup and Drive Up capabilities. It further notes that testing the service will start in Minneapolis stores this spring, meeting its plans to expand this service to roughly 50% of its stores for the holiday season in 2020. It will also test beverage fulfillment via Order Pickup and Drive Up in more than 100 stores in Florida and Oregon this spring.

Target continues to emphasize on developing flexible format stores to penetrate deeper into urban areas. The company plans to open roughly three dozen new small format stores in fiscal 2020. Target intends to add the Drive Up facility across most of its small-format stores nationwide. It added that the company will explore sites for stores of roughly 6,000 square feet, which is about half the size of its smallest small-format outlet. Impressively, management expects the first store lease to be signed in fiscal 2020 and intends to open this store next fiscal.

Furthermore, Target aims to accomplish milestones for its Remodel Program. The company plans to remodel 300 stores this year. Notably, the average sales increase of a remodeled Target store is usually in the band of 2-4% in the first year, followed by an average of more than 2% in the second year. Target will also introduce a transformed electronics department across its 200 stores this year and to 200 more stores by next fiscal.

As part of its supply-chain endeavors, management will commence robotics solutions. This will enhance precise sorting and aid store-team members to fill shelves faster and hence reduce backroom inventory. During fiscal 2020, the company will open warehouses near its major markets like New York and Southern (NYSE:SO) California to replenish stores in high-volume areas.

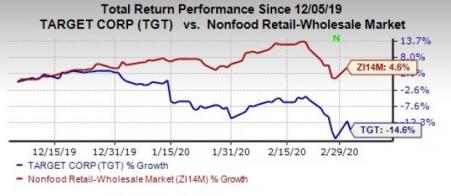

Price Performance

Shares of the Minneapolis, MN-based company have lost 14.6% against the industry’s 4.6% rise in the past three months.

The stock came under pressure in spite of an earnings beat during fourth-quarter fiscal 2019. We note that the top line fell shy of the Zacks Consensus Estimate after surpassing the same in the preceding three quarters. Also, the rate of comparable sales growth decelerated on a sequential basis. This may be due to disappointing holiday season with sales coming in below expectations. Softer-than-expected performance across Electronics, Toys and portions of Home assortment hurt the overall holiday sales.

2 Key Picks in Retail

Stitch Fix (NASDAQ:SFIX) has an expected long-term earnings growth rate of 15% and a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Chico's FAS (NYSE:CHS) has an expected long-term earnings growth rate of 15% and carries a Zacks Rank #2 (Buy).

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Target Corporation (TGT): Free Stock Analysis Report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Chico's FAS, Inc. (CHS): Free Stock Analysis Report

Stitch Fix, Inc. (SFIX): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

“Quality” stocks with strong fundamentals tend to be rewarding places to stash hard-earned money. Since 2009, investing in a basket of quality stocks over a standard index has...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.