- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Target (TGT) Q4 Earnings Surpass Estimates, Increase Y/Y

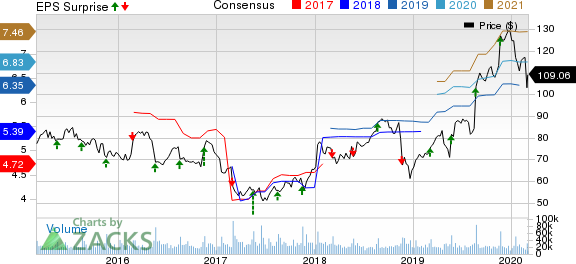

Target Corporation (NYSE:TGT) came up with fourth-quarter fiscal 2019 results, which marked the fourth straight quarter of an earnings beat. However, total revenues fell shy of the Zacks Consensus Estimate. On a brighter note, both the top and the bottom line continued to increase year over year. Again, management highlighted that this was the 11th successive quarter of comparable sales growth buoyed by decent performance in both stores and digital channels.

However, we note that the rate of comparable sales growth decelerated on a sequential basis. This may be due to disappointing holiday season with sales coming in below expectations. Softer-than-expected performance across Electronics, Toys and portions of Home assortment hurt the overall holiday sales. Nonetheless, Target continued to gain market share across core merchandise categories, namely Apparel, Essentials & Beauty and Food & Beverage.

Let’s Delve Deeper

This operator of general merchandise stores reported adjusted earnings of $1.69 per share that surpassed the Zacks Consensus Estimate of $1.66 and improved 10.6% from the prior-year period. This year-over-year growth can be attributable to higher sales and share repurchase activity.

Target envisions first-quarter fiscal 2020 adjusted earnings between $1.55 and $1.75 per share, the mid-point of which — $1.65 — is higher than $1.53 reported in the year-ago period and in line with the Zacks Consensus Estimate. For fiscal 2020, management anticipates adjusted earnings in the band of $6.70-$7.00, the mid-point of which — $6.85 — is higher than the Zacks Consensus Estimate of $6.84. The company had reported earnings of $6.39 in fiscal 2019.

The company generated total revenues of $23,398 million that increased 1.8% from the year-ago period but fell short of the Zacks Consensus Estimate of $23,472 million. We note that sales jumped 1.8% to $23,133 million, while other revenue rose 9.3% to $265 million.

Target is deploying resources to enhance omni-channel capacities, coming up with new brands, remodeling or refurbishing stores, and expanding same-day delivery options. Target has undertaken rationalization of supply chain with same-day delivery of in-store purchases along with technology and process improvements.

Meanwhile, comparable sales for the quarter increased 1.5% compared with 5.3% growth witnessed in the year-ago period. The number of transactions rose 1.3%, while the average transaction amount improved 0.2%. Comparable digital channel sales surged 20% and added 2.2 percentage points to comparable sales. Management envisions low-single digit increase in comparable sales during the first quarter as well as fiscal 2020.

Gross margin expanded 60 basis points to 26.3% during the quarter on account of cost optimization, pricing, promotions and assortment, and favorable category sales mix.

Operating income increased 7.3% to $1,198 million, whereas operating margin expanded 20 basis points to 5.1%. Target expects mid-single digit increase in operating income in both the first quarter and fiscal 2020.

Target’s debit card penetration shrunk 20 basis points to 12.4%, while credit card penetration fell 10 basis points to 10.9%. Total REDcard penetration declined to 23.3% from 23.6% in the year-ago quarter.

Other Financial Details

During the quarter, Target repurchased shares worth $606 million and paid dividends of $334 million. The company still had about $0.1 billion remaining under its $5 billion share buyback program approved in 2016. In September 2019, the company’s board authorized a new $5 billion share repurchase program.

This Zacks Rank #3 (Hold) company ended the quarter with cash and cash equivalents of $2,577 million, long-term debt and other borrowings of $11,338 million and shareholders’ investment of $11,833 million.

Check These 3 Trending Stocks

Zumiez (NASDAQ:ZUMZ) has a long-term earnings growth rate of 12% and sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Burlington Stores (BURL) has a long-term earnings growth rate of 15.1% and carries a Zacks Rank #2 (Buy).

Costco (NASDAQ:COST) has a long-term earnings growth rate of 8.1%. The stock carries a Zacks Rank #2.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Target Corporation (TGT): Free Stock Analysis Report

Costco Wholesale Corporation (COST): Free Stock Analysis Report

Zumiez Inc. (ZUMZ): Free Stock Analysis Report

Original post

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Professional traders get paid because of one skill and one skill only: the ability to foresee what the world (or the economy, at least) might look like in six to nine months....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.