- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Target (TGT) Falls Despite Q3 Earnings Beat: Here's Why

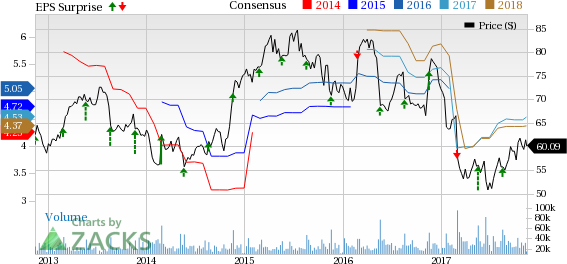

Target Corporation (NYSE:TGT) continued with its upbeat performance in fiscal 2017 as reflected from its better-than-expected third-quarter results. The company’s strategic endeavors, turnaround plan as well as improved traffic trends remain the driving factors. These helped this Zacks Rank #3 (Hold) stock to gain 10.1% in the past six months compared with the industry’s growth of 3.1%.

Despite reporting positive earnings surprise during the quarter, shares of this Minneapolis-based company are down roughly 4% in the pre-market trading hours. This is because the year-over-year decline in the bottom line and management’s commentary about highly competitive environment in the fourth quarter was not well perceived by investors. Further, the company’s not so encouraging outlook for the final quarter also hurt investors' sentiments.

.jpg)

Let’s Unveil the Picture

The company posted third-quarter adjusted earnings of 91 cents a share that outpaced the Zacks Consensus Estimate of 86 cents but declined 13.1% from the prior-year period. We observed that rise in cost of sales, increased SG&A expenses and higher interest expense hurt the bottom line.

The company generated total sales of $16,667 million that also surpassed the Zacks Consensus Estimate of $16,613 million and rose 1.4% from the year-ago quarter.

Target’s initiatives such as the development of omni-channel capacities, diversification and localization of assortments along with emphasis on flexible format stores and cost reduction are encouraging. In a bid to stimulate its digital sales this holiday season, Target is also strengthening its relationship with Google (NASDAQ:GOOGL) by allowing customers nationwide to shop through Google Express including voice-activated shopping.

The company also rolled out Target Restock program that allows customers to restock their shipping box with essential items online and get them delivered at door steps by the next business day for a nominal charge. These endeavors are important due to changing retail landscape that encompasses increasing online penetration and aggressive pricing that may hurt sales and margins.

Notably, comparable sales for the quarter increased 0.9% compared to a 0.2% decline witnessed in the year-ago period. While the number of transactions rose 1.4%, the average transaction amount declined 0.5%. Comparable digital channel sales surged 24% and added 0.8 percentage points to comparable sales.

Gross profit grew 1% to $4,955 million while gross margin contracted 10 basis points to 29.7%. Operating income plummeted 17.8% to $869 million, while operating margin shriveled 120 basis points to 5.2%.

Target’s debit and credit card penetration remained flat at 12.9% and 11.4%, respectively. Total REDcard penetration climbed to 24.2% from 24.3% in the year-ago quarter.

Other Financial Details

During the quarter, Target repurchased shares worth $171 million and paid dividends of $339 million. The company still had about $4 billion remaining under its $5 billion share buyback program.

The company ended the quarter with cash and cash equivalents of $2,725 million, long-term debt and other borrowings of $11,277 million and shareholders’ investment of $11,137 million.

A Glance at the Outlook

Management now anticipates fourth-quarter comparable sales to be flat to up 2%. The company expects fiscal 2017 comparable sales to be flat to up 1%.

Target now envisions fourth-quarter earnings in the band of $1.05-$1.25 and fiscal 2017 earnings between $4.40 and $4.60 up from $4.34 and $4.54 per share, projected earlier. The current Zacks Consensus Estimate for the fourth quarter and fiscal 2017 stands at $1.27 and $4.53, respectively.

Interested in the Retail Space? Check Out These

Big Lots, Inc. (NYSE:BIG) delivered an average positive earnings surprise of 81.1% in the trailing four quarters. The company has a long-term earnings growth rate of 13.5% and carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Dollar Tree, Inc. (NASDAQ:DLTR) has a long-term earnings growth rate of 13.2% and carries a Zacks Rank #2.

Ross Stores, Inc. (NASDAQ:ROST) pulled off an average positive earnings surprise of 6.3% in the trailing four quarters. It has a long-term earnings growth rate of 10% and carries a Zacks Rank #2.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Dollar Tree, Inc. (DLTR): Free Stock Analysis Report

Target Corporation (TGT): Free Stock Analysis Report

Ross Stores, Inc. (ROST): Free Stock Analysis Report

Big Lots, Inc. (BIG): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Defense stocks took a tumble heading into 2025 as President Trump returned to the White House for his second term. Trump has stated his intent as a peacemaker to bring the wars in...

Using the Elliott Wave Principle (EWP), we have been tracking the most likely path forward for the Nasdaq 100 (NDX). Although there are many ways to navigate the markets and to...

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.