- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Tapestry (TPR) To Report Q2 Earnings: What Awaits The Stock?

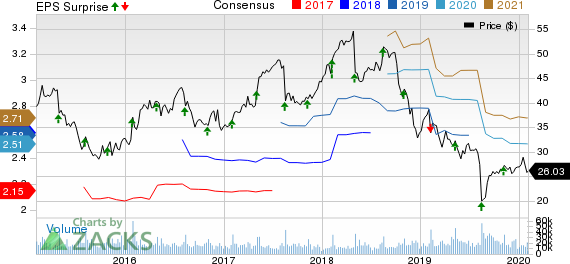

Tapestry, Inc. (NYSE:TPR) is slated to report second-quarter fiscal 2020 results on Feb 6, before the opening bell. This house of lifestyle brands, and designer and marketer of fine accessories and gifts has a trailing four-quarter positive earnings surprise of 1.7%, on average. In the last reported quarter, the company witnessed positive earnings surprise of 8.1%.

The Zacks Consensus Estimate for second-quarter earnings has been stable over the past 30 days at 99 cents, suggesting a decline of 7.5% from the year-ago reported number. The consensus estimates for revenues is pegged at $1,803 million, which is almost flat with the year-ago quarterly figure.

Key Factors to Note

Tough retail backdrop in North America, unfavorable currency movements, soft margins and weakness in Kate Spade brand have been hurting Tapestry’s performance.

In the last earnings call, management guided flat revenues for the second quarter compared with the year-ago period. The projection takes into account low-single-digit growth in comps at Coach but a high-single-digit decline in the metric at Kate Spade, with revenues at Stuart Weitzman expected to be roughly even with the prior-year period.

Further we note that SG&A expenses have been increasing for quite some time now. Management had earlier guided mid-single-digit increase in SG&A expenses for the second quarter, including the shift in timing of expenses from the first quarter. Consequently, any deleverage in SG&A expenses is likely to show on margins.

Tapestry envisioned a decline in operating income in the to-be-reported quarter thanks to contraction in gross margin and higher SG&A expenses. A reflection of the same is likely to be visible in the bottom line, which is anticipated to decline year over year.

Nonetheless, Tapestry has been leaving no stone unturned to tackle prevailing headwinds in the retail landscape — soft store traffic, stiff competition from online retailers and aggressive pricing strategy. The company has been undertaking transformational initiatives revolving around products, stores and marketing to counter these challenges. Further, the company has been undergoing a brand transformation and introducing modern luxury concept stores in key markets. These initiatives are likely to show on the fiscal second-quarter performance.

What the Zacks Model Unveils

Our proven model doesn’t conclusively predict an earnings beat for Tapestry this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

Tapestry carries a Zacks Rank #3 and an Earnings ESP of -0.81%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks With Favorable Combination

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Zumiez (NASDAQ:ZUMZ) has an Earnings ESP of +0.24% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Nordstrom (NYSE:JWN) has an Earnings ESP of +1.43% and a Zacks Rank #2.

Gap (NYSE:GPS) has an Earnings ESP of +5.43% and a Zacks Rank #3.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.7% per year. So be sure to give these hand-picked 7 your immediate attention.

See 7 handpicked stocks now >>

The Gap, Inc. (GPS): Free Stock Analysis Report

Zumiez Inc. (ZUMZ): Free Stock Analysis Report

Nordstrom, Inc. (JWN): Free Stock Analysis Report

Tapestry, Inc. (TPR): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Tesla (NASDAQ:TSLA) (NYSE: TSLA), the electric vehicle giant, has recently experienced a significant drop in its stock value, which has fallen nearly 45% since December. This...

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.