Net bookings of $577 million easily topped the Zacks Consensus Estimate of $516.9 million. On a year-over-year basis, net bookings were up 20%.

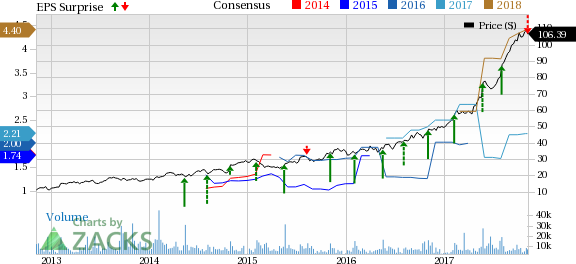

Take-Two Interactive Software, Inc. Price, Consensus and EPS Surprise

Take-Two Interactive Software, Inc. Price, Consensus and EPS Surprise | Take-Two Interactive Software, Inc. Quote

The company's net revenues came in at $443.6 million, higher than $420.2 million reported in the year-ago period.

Per the company, digital revenues (68% of total revenue) increased 31.3% to $302.9 million while revenues from Physical retailer and other segments (32% of total revenue) were down 25.7% to $140.7 million.

Region-wise, revenues from the United States (62% of total revenue) were up 9.3% to $276 million. International markets revenues were flat at $167.6 million.

Given the strong performance of Grand Theft Auto Online and Grand Theft Auto V, NBA 2K17, WWE2K17, XCOM2 and WWE: SuperCard, digitally-delivered net sales (68% of total net revenue) were up 31% to $302.9 million.

Margins

Take Two’s gross margin was 44.4%, compared with 51.1% reported in the prior-year quarter.

Loss from operations was $11.3 million, compared with income from operations of $47.2 million reported in the prior-year quarter.

Balance Sheet and Cash Flow

As of Sep 30, 2017, Take Two had $1.26 billion in cash and short-term investments, compared with $1.39 billion as of Mar 31, 2017. During the first six months of fiscal 2018, net cash used in operating activities was $1.1 million.

Outlook

Take Two provided guidance for the third quarter and fiscal 2018. Strength in franchises like Grand Theft Auto, NBA 2K and WWE 2K will boost the top line in the fiscal year, despite a light slate of new releases along with Social Point.

The company has pushed the release of its much-anticipated Red Dead Redemption 2 from fall of 2017 to spring of 2018. Earlier this year, Take Two acquired the popular simulation game, Kerbal Space Program. A new Kerbal game, Kerbal Space Program: Making History Expansion, is also slated for launch this year.

For the third quarter, the company expects net bookings to be in the band of $610–$660 million. GAAP net revenues are projected in the band of $440–$490 million.

The company projects operating expenses to be in the range of $220 million to $230 million, up 16% at mid point due to higher acquisition costs as well as higher R&D expenses. The company projects GAAP loss per share in the range of 25–35 cents.

For fiscal 2018, net bookings are projected in the band of $1.93–$2.03 billion, compared with $1.65–$1.75 billion. Net bookings from current consumer spending are expected to increase 50% and digitally-delivered net bookings are projected to increase 25%.

Operating cash flow is estimated to be around $300 million, up from $200 million expected earlier.

GAAP net revenues are likely to be in the band of $1.74–$1.84 billion compared with $1.62–$1.72 billion projected earlier. The company now projects earnings per share in the range of 55–80 cents compared with $1.00–$1.25 projected earlier.

Our Take

The company continues to benefit from its popular offerings like Grand Theft Auto V and Grand Theft Auto Online, along with its other releases like NBA 2K and WWE 2K. In fact, higher sales of the digital version of the games add to the company’s margins. Take Two continues to expect growth in digital revenues, driven by higher sales of full game downloads and increase in recurrent consumer spending.

The company recently forayed into the free-to-play games space with the acquisition of game developer, Social Point. The acquisition will help it to boost its performance, going ahead. Management expects Social Point to contribute 5% of the net bookings in the current fiscal.

Nonetheless, stiff competition from other game makers such as Activision Blizzard Inc. (NASDAQ:) , Electronic Arts (NASDAQ:) and Glu Mobile Inc. (NASDAQ:) remains a major concern.

Currently, Take Two carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past six months, the company has returned 63.5% compared with the industry’s gain of 10.7%.

Wall Street’s Next Amazon (NASDAQ:)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.