- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Supplement Your Paycheck With These 3 Payroll Providers

The human capital management (HCM) market has witnessed an incredible transformation over the past decade as the standard functions of human resources have evolved. Traditional HR departments such as payroll, recruiting and performance management have shifted into opportunities for companies to drive productivity and business value.

Technology has drastically altered nearly every market for the better, and HCM is no exception. Conventional HR operations are now streamlined, allowing companies to leverage data analytics and make better decisions. Advanced technologies have swiftly automated business operations, with artificial intelligence and data automation enabling companies to capitalize on the value of their workforce.

Rather than viewing HCM as simply a cost of doing business, companies today consider it a vital asset whose value can be maximized. A robust HCM solution not only helps firms to attract and hire talent, it assists them in retaining and nurturing their employees by providing growth opportunities. Hiring the right firm that provides these solutions enables users to proactively plan for succession in executive and other important roles.

The Zacks Outsourcing industry contains some of the best talent management and payroll providers and is currently ranked in the top 37% of all 253 industry groups. Digging a bit deeper, this industry group has outperformed the market this year with a return of 29.43%. Historical studies have shown that about half of a stock’s future price appreciation is due to its industry grouping.

With today’s jobless claims report showing the lowest number of initial claims in over 50 years, the services these three outsourcing leaders provide are in higher demand than ever before. The Outsourcing industry group contains all three stocks we will discuss below.

Automatic Data Processing (NASDAQ:ADP), Inc. (ADP)

Automatic Data Processing is a global provider of HCM solutions and helped to pioneer business process outsourcing. ADP offers services to businesses of all sizes, providing recruit-to-retire services, payroll, benefits and record-keeping. ADP seeks to educate and empower their clients while offering complex tools for talent management, compensation and succession planning.

ADP, a Zacks #2 (Buy) stock, has outperformed its industry this year as the company enjoys a dominant position in the HCM market. A strong business model along with a number of strategic buyouts has allowed the company to strengthen its position despite being in a competitive space.

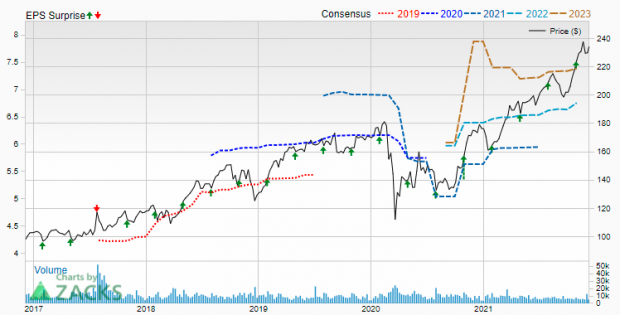

Automatic Data Processing has delivered an earnings beat in each of the last seventeen quarters. ADP last announced EPS in October for the prior quarter of $1.65, a +10.74% surprise over estimates. The company has averaged a positive earnings surprise of 9.65% over the last four quarters, supporting the stock’s 33% advance this year.

Automatic Data Processing (ADP) Price, Consensus and EPS Surprise

What the Zacks Model Unveils

The Zacks Earnings ESP (Expected Surprise Prediction) seeks to find companies that have recently seen positive earnings estimate revision activity. Stocks that exhibit this activity along with a Zacks #3 rank or better have produced a positive surprise 70% of the time. With a current Earnings ESP of +0.75%, our model predicts a beat for ADP for the upcoming earnings announcement.

Analysts covering ADP have increased their estimates for full-year earnings by 1.81% over the past 60 days. The company is now expected to deliver annual EPS of $6.76, representing growth of 12.29% over last year. ADP is scheduled to report on January 26th, 2022.

TriNet Group (NYSE:TNET), Inc. (TNET)

TriNet Group is a provider of a full human resources solution for small and medium businesses. TNET offers tax administration, payroll, performance management, compensation consulting, as well as employee benefit plans. Headquartered in San Leandro, CA, the company has clients in various industries such as marketing and advertising, venture capital, life sciences, financial services and technology.

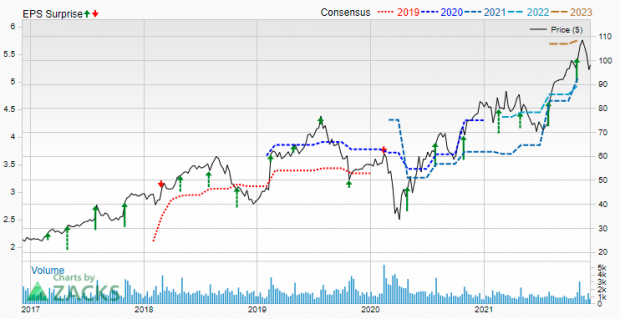

TNET is a Zacks #2 Buy and trades at a relatively attractive P/E ratio of 19.3 compared to the industry average of 21.13. The company last reported EPS back in October of $1.31, a +59.76% surprise over consensus. TNET has a trailing four-quarter average earnings surprise of 54.43% and has exceeded estimates in each of the last seven quarters.

TriNet (TNET) Price, Consensus and EPS Surprise

Analysts are in agreement in terms of earnings revisions and have upped their TNET estimates by 9.01% over the past 60 days, arriving at full-year EPS of $5.08. If achieved, TriNet will deliver growth of 14.41% over 2020 EPS.

Paychex (NASDAQ:PAYX), Inc. (PAYX)

PAYX is a leader in the outsourcing industry and provides human resource, payroll and benefits to small and medium-sized businesses. Headquartered in Rochester, NY, Paychex’s offerings also include insurance and retirement, tax administration, and employee payment services.

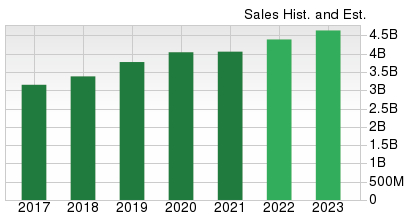

PAYX continues to impress in terms of revenue growth, with analysts anticipating $4.39 billion in sales this year – an 8.23% increase over 2020. Notably, sales have grown at a 5-yr compound annual growth rate of 6.5%. The solid growth trend in revenues is illustrated below.

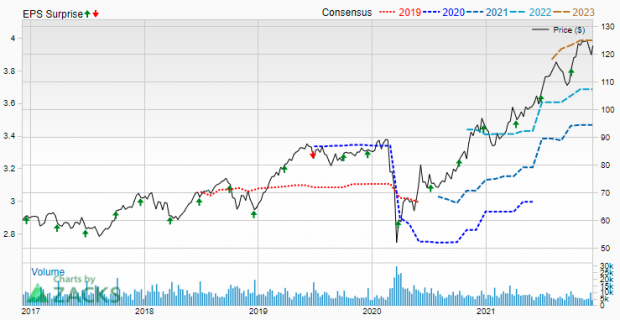

PAYX has also put together a solid track record of earnings surprises, surpassing estimates in each of the last seven quarters. The company most recently reported EPS back in September of $0.89, a +9.88% surprise over consensus. With a trailing four-quarter average surprise of 7.8%, it’s not difficult to see why the stock has risen over 32% YTD.

Paychex (PAYX) Price, Consensus and EPS Surprise

The Zacks Consensus Estimate for full-year EPS stands at $3.46, representing a 13.82% growth rate over 2020. PAYX is due to report quarterly earnings later this month on December 22nd.

Zacks’ Top Picks to Cash in on Artificial Intelligence

This world-changing technology is projected to generate $100s of billions by 2025. From self-driving cars to consumer data analysis, people are relying on machines more than we ever have before. Now is the time to capitalize on the 4th Industrial Revolution. Zacks’ urgent special report reveals 6 AI picks investors need to know about today.

See 6 Artificial Intelligence Stocks With Extreme Upside Potential>>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Paychex, Inc. (PAYX): Free Stock Analysis Report

Automatic Data Processing, Inc. (ADP): Free Stock Analysis Report

TriNet Group, Inc. (TNET): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Related Articles

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

“Quality” stocks with strong fundamentals tend to be rewarding places to stash hard-earned money. Since 2009, investing in a basket of quality stocks over a standard index has...

Palantir Technologies (NASDAQ:PLTR) continues to sell off. On March 6, PLTR stock fell over 10% on nearly double the daily volume, bringing its 30-day decline to over 27%. A drop...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.