- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Suncor (SU) To Increase Production And Reduce Capex In 2018

Integrated energy player Suncor Energy Inc. (NYSE:SU) recently announced its corporate guidance. Capital budget is estimated in the range of C$4.5-C$5 billion for 2018, much lower than C$5.4- C$5.6 billion guided for 2017.

Suncor has allotted 25% of the total capital expenditure for its upstream growth projects. Moreover, the total plant turnaround at the Edmonton refinery is included in the company's 2018 capital program along with other downstream refineries' maintenance and oil sands upgrades.

The company also said that it expects 2018 upstream production to average between 740,000 and 780,000 barrels of oil equivalent per day (Boe/d), representing an increase of 10% year over year. Suncor expects its refinery utilization to be in the range of 90% to 94% for 2018. Focusing investments on these operations are expected to increase efficiency. The production guidance of the company does not include operations in Libya, which are still being impacted by political unrests.

The rise in production and fall in capital expenditure are expected to enable Suncor Energy to return more free cash flow to its stockholders through share buybacks and dividends.

In addition, Suncor Energy expects cash operating costs per barrel at Syncrude to be in the range of C$32.50 and C$35.50, while the same for Fort Hills - which was acquired from Total S.A. (NYSE:TOT) - will be within C$20.00 to C$30.00. The company expects its cash operating costs per barrel for its Oil Sands operations to retain at C$23.00 - C$26.00.

About Suncor Energy

Calgary, Alberta-based Suncor Energy is Canada’s premier integrated energy company. Suncor's operations include oil sands development and upgrade, conventional and offshore crude oil and gas production, petroleum refining, and product marketing under the Petro-Canada brand. Additionally, Suncor explores, acquires, develops, produces and markets crude oil and natural gas in Canada and internationally, and transports and refines crude oil and market petroleum and petrochemical products primarily in Canada. Suncor’s business can be divided into three main segments: Oil Sands, Exploration and Production (E&P), and Refining and Marketing.

We like Suncor Energy for its impressive portfolio of assets, strong production outlook and significant generation of free cash flow.

Through its aggressive expense management, Suncor has been able to lower its cash costs amid the industry downturn. This has helped the company take advantage of the rebound in oil prices. Moreover, Suncor's healthy financial profile allows it to pay an attractive dividend while pursuing an aggressive share repurchase program.

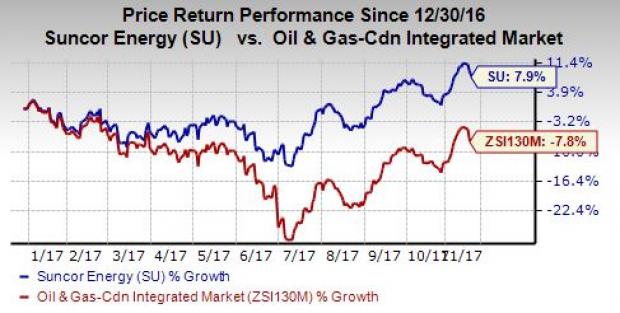

Price Performance

Suncor Energy has gained 7.9% year to date against 7.8% decline of its industry.

Zacks Rank and Stock to Consider

Suncor presently has a Zacks Rank #2 (Buy).

Some better-ranked stocks in the oil and energy sector include ConocoPhillips (NYSE:COP) and Denbury Resources Inc. (NYSE:DNR) . Both stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Houston, TX-based ConocoPhillips is a major global exploration and production company. The company’s sales for 2017 are expected to increase 24.4% year over year. The company delivered an average positive earnings surprise of 152.3% in the last four quarters.

Plano, TX-based Denbury Resources is an oil and gas company. The company’s sales for the fourth quarter of 2017 are expected to increase 4.8% year over year. The company delivered an average positive earnings surprise of 125% in the last four quarters.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Suncor Energy Inc. (SU): Free Stock Analysis Report

TotalFinaElf, S.A. (TOT): Free Stock Analysis Report

Denbury Resources Inc. (DNR): Free Stock Analysis Report

ConocoPhillips (COP): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

As the digital economy starts to go online across businesses and the world, investors have to be aware of the companies and services that will be at the forefront of this...

Wall Street Indexes remain under pressure today but have held above the lows we saw on Tuesday as the Trump administration tariffs came into force. The announcement of tariffs on...

These stocks provide a compelling case as safe-haven stocks in the face of an escalating trade war. Each company operates within sectors that are relatively resilient to economic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.