- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Sun Hydraulics (SNHY) Beats Q3 Earnings, Sales, Ups '17 View

Sun Hydraulics Corporation (NASDAQ:SNHY) reported impressive results for third-quarter 2017, marking the third consecutive quarter of a positive earnings surprise.

The quarter’s non-GAAP adjusted earnings came in at 43 cents per share, surpassing the Zacks Consensus Estimate of 36 cent by 19.4%. Also, the bottom line increased 126% from the year-ago tally of 19 cents.

Organic and Inorganic Gains Drive Revenues

Net sales in the quarter were $88 million, topping the Zacks Consensus Estimate of $80 million by 9.6%. Also, the top line surged 95% year over year on the back of solid organic growth of 27%, benefits from acquired assets of Enovation Controls (completed in December 2016) and favorable impact of foreign currency translation.

On a geographical basis, sales from the Americas increased 143.5% year over year to $52.1 million, representing 59% of net sales. Europe/Middle East/Africa sales comprising roughly 22% of net sales were $19 million, up 35.7% year over year. Sales from Asia Pacific grew 72.4% to $16.9 million. It represented 19% of net sales.

The company reports its quarterly sales under two segmental heads. Details for this quarter are provided below:

Hydraulics’ revenues totaled $56.6 million, increasing 27.6% year over year. It represented 64.4% of net sales. The segment gained from strengthening foothold in new markets as well as investments in field application specialists.

Revenues from Electronics totaled $31.4 million, significantly above $0.8 million generated in the year-ago quarter. It represented 35.6% of net sales. The performance was driven by benefits derived from new products launched, solid demand in the power controls and recreational vehicle markets and gains from sales initiatives.

Margin Profile Improves

Sun Hydraulics’ cost of sales in the quarter increased 74% year over year, partially offsetting 95% growth in the quarter’s net sales. Gross profit grew 134% year over year while gross margin came in at 41.2% versus 34.4% in the year-ago quarter.

Selling, engineering and administrative expenses, as a percentage of revenues were 19.2% compared with 18.1% in the year-ago quarter. Operating income escalated 142% year over year to $17.4 million while margin came in at 19.8% compared with 15.9% in the year-ago quarter.

Balance Sheet & Cash Flow

Exiting the third quarter, Sun Hydraulics’ cash and cash equivalents were $81.2 million, up from $78.7 million in the preceding quarter.

In the first nine months of 2017, the company generated net cash of $38.4 million from its operating activities, up 22.7% over the year-ago period. Capital spending totaled $8.3 million, increasing 84.4% year over year. During the period, the company paid dividends amounting to $7.8 million.

Outlook

Sun Hydraulics is working diligently to improve its product portfolio and serve its customers better. The company aims to improve its operational execution, product development and market penetration.

The company has increased its revenue guidance for 2017 to $330-$340 million from the earlier projection of $315-$330 million. On a segmental basis, Hydraulics’ revenues are predicted to be $225-$230 million, up from $215-$225 million expected earlier. Electronics’ revenues are anticipated to be within $105-$110 million, increasing from $100-$105 million expected earlier.

Operating margin projection was reaffirmed at 22−24% while capital spending still is projected to be in $20-$25 million range. Effective tax rate will be 32-34%.

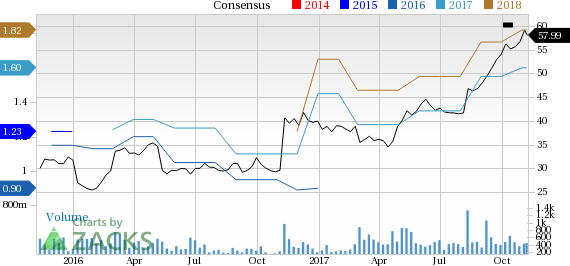

Sun Hydraulics Corporation Price and Consensus

Sun Hydraulics Corporation (SNHY): Free Stock Analysis Report

Kadant Inc (KAI): Free Stock Analysis Report

Altra Industrial Motion Corp. (AIMC): Free Stock Analysis Report

Twin Disc, Incorporated (TWIN): Free Stock Analysis Report

Original post

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Professional traders get paid because of one skill and one skill only: the ability to foresee what the world (or the economy, at least) might look like in six to nine months....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.