- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Upbeat Near-Term Outlook For Real Estate Operation Stocks

The Zacks Real Estate Operations industry includes companies that offer leasing, property management, investment management, valuation, development services, facilities management, project management, transaction and consulting services, among others. However, real estate investment trusts (REITs) are excluded from this group.

Performance of this industry depends on economic trends, government policies, as well as the global and regional real estate markets. Particularly, overall economic activity and employment growth, interest-rate levels and changes in interest rates, the cost and availability of credit, tax and regulatory policies, as well as the geopolitical environment are the key factors shaping up the global real estate market’s fate.

Post the financial crisis, the industry has been making a steady run, as commercial real estate markets enjoyed elevated demand, rising absorptions, high occupancy and escalating rents. This came amid recovering economy, job-market gains, low-cost credit availability, as well as rising institutional capital inflows toward commercial real estate. Specifically, the slow-but-steady pace of economic growth and low interest rates provided a decent impetus, aiding the industry to excel.

Let us now look at the major themes in the industry:

Capital availability and technology investments: Though economic growth is likely to be less robust this year, the level should remain stable, supporting the industry. Moreover, easy availability of capital and comparatively lower levels of interest rates, and low unemployment level are anticipated to keep the momentum upbeat. These apart, constituent companies in this industry are likely keep focusing on investments in strategic acquisitions, human capital and technology. Such moves provide significant competitive edge, aid in market-share expansion, and help differentiate from peers.

Outsourcing of real estate needs: There is an increasing trend among occupiers of real estate, like corporations, public sector entities, health-care providers and others, toward the outsourcing of real estate needs. Particularly, companies are depending on the expertise of third-party real estate specialists for execution and efficiency improvement. As such, this is providing opportunity to the constituents of the real estate operations industry and large players are banking on this trend, with both existing as well as new client wins.

Maturing cycle, global economic and geopolitical uncertainty: The industry seems to be entering the later stages of its growth cycle. Further, global economic and geopolitical uncertainty is affecting business sentiment. Therefore, amid this environment, after recording decent growth for years, property sales volumes might be softer, given the cautious approach of investors, although there is ample availability of relatively low-cost financing.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Real Estate Operations industry is housed within the broader Zacks Finance sector. It carries a Zacks Industry Rank #98, which places it at the top 38% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bright near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the top 50% of the Zacks-ranked industries is a result of positive earnings per share outlook for the constituent companies in aggregate.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

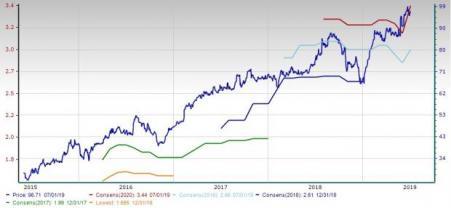

Industry’s Stock Market Performance

The Zacks Real Estate Operations industry has lagged both the broader Zacks Finance sector, and the Zacks S&P 500 composite in a year’s time.

The industry has declined 2.2% during this period compared to the S&P 500’s uptick of 8.1%. During the same time frame, the broader Finance sector has inched up 1.8%.

One Year Price Performance

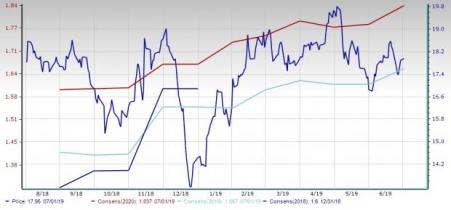

Industry’s Current Valuation

On the basis of forward 12-month price-to-EPS ratio, which is a commonly used multiple for valuing Real Estate Operations stocks, we see that the industry is currently trading at 19.40X compared to the S&P 500’s forward 12-month price-to-earnings (P/E) of 17.04X. The industry is also trading above the Finance sector’s forward 12-month P/E of 13.80X. This is shown in the chart below.

Forward 12 Month Price-To-Earnings Ratio

Over the last five years, the industry has traded as high as 27.16X, as low as 13.99X, with a median of 19.13X.

Bottom Line

In a nutshell, amid healthy economic and employment growth, occupancy levels are high and rents remain decent. Also, interest-rate levels are still low and there is decent availability of capital in the market. Further, the real estate operations industry is having solid scope for growth as there is a rising trend of outsourcing of real estate needs by companies.

Here we present three stocks from the industry with a favorable Zacks Rank that investors may consider adding to their portfolios.

FirstService Corporation (FSV): Headquartered in Toronto, Canada, FirstService Corporation offers property services to commercial, institutional and residential customers, primarily in North America and internationally. Currently, the stock sports a Zacks Rank # 1 (Strong Buy). The Zacks Consensus Estimate for 2019 earnings per share moved up nearly 5% to $2.96, over the last 30 days. The figure also indicates 13.4% year-over-year earnings per share growth in 2019.

CBRE Group (NYSE:CBRE), Inc. (CBRE): Headquartered in Los Angeles, CBRE Group is a commercial real estate services and investment firm. It offers a wide range of services to tenants, owners, lenders and investors in office, retail, industrial, multi-family and other types of commercial real estates in all major metropolitan areas across the globe. CBRE Group holds a Zacks Rank of 2 (Buy), currently. The Zacks Consensus Estimate for the current-year earnings per share has been revised 0.8% upward over the past two months. Moreover, it indicates a projected increase of nearly 10.1% year over year.

Cushman & Wakefield (CWK): Headquartered in Chicago, IL, Cushman & Wakefield is a global real estate services firm offering property, facilities and project management, leasing, capital markets, valuation and other services. The stock carries a Zacks Rank of 2, at present. The company’s 2019 earnings per share have been revised marginally north to $1.66, in seven days’ time. Additionally, the company’s long-term growth of earnings is projected to be 10%.

FirstService Corporation (FSV): Free Stock Analysis Report

Cushman & Wakefield PLC (CWK): Free Stock Analysis Report

CBRE Group, Inc. (CBRE): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Emini S&P March collapsed on Thursday from strong resistance at 6010/6015The low and high for the last session were 5873 - 6014.(To compare the spread to the contract you...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.