- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Strong Premiums, Solid Capital Position Aid Selective Insurance

Selective Insurance Group, Inc. (NASDAQ:SIGI) has been riding on improved premium growth and strong net investment income, which is aiding its top line.

The company has a decent surprise history. It beat estimates in two of the trailing four quarters, the average beat being 5.9%. The stock has seen the Zacks Consensus Estimate being revised 3.2% downward over the last 60 days for current-quarter earnings.

Let’s delve into the factors that bode well for the company.

The P&C insurer continues to ride on geographic expansion for growth and diversification. Constant premium growth across segments helped the company’s total premiums improve 6.6% year over year in 2019. This upside can be attributed to strong retention and new business in the Standard Commercial Lines segment. As a result, the company’s top line registered 10.1% year-over-year growth in 2019.

Selective Insurance banks on impressive investment results. Its net investment income climbed 13% in 2019, driven by active portfolio management and a stellar operating cash flow. For 2020, the firm projects an after-tax investment income of $185 million, up from the prior guidance of $175 million.

The company also flaunts a sound capital structure, and remains committed toward returning value to its policyholders and shareholders via dividend payments. Riding on a solid capital position, the company has been hiking dividends, which register a five-year CAGR (2014-2019) of nearly 12.1%. Such shareholder-friendly moves make it an attractive pick for yield-seeking investors. Its dividend yield of 1.9% appears attractive compared with the industry’s 0.5%.

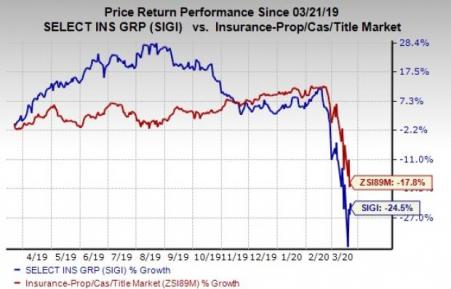

However, shares of this Zacks Rank #3 (Hold) company have depreciated 24.5% in a year’s time compared with the industry’s fall of 17.8%. Escalating expenses are likely to strain margin expansion.

Nevertheless, we believe the company’s healthy fundamentals will drive its shares in the days to come.

Stocks to Consider

Some better-ranked stocks in the same space are Axis Capital Holdings Limited (NYSE:AXS) , First American Financial Corporation (NYSE:FAF) , and RLI Corp. (NYSE:RLI) . While First American Financial and RLI sport a Zacks Rank #1 (Strong Buy), Axis Capital carries a Zacks Rank #2 (Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

All three companies surpassed estimates in the last reported quarter by 150%, 33.33% and 28.57%, respectively.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

RLI Corp. (RLI): Free Stock Analysis Report

Axis Capital Holdings Limited (AXS): Free Stock Analysis Report

First American Financial Corporation (FAF): Free Stock Analysis Report

Selective Insurance Group, Inc. (SIGI): Free Stock Analysis Report

Original post

Related Articles

Regimes are changing in the market, and this could mean a few things, but today, it means that volatility is back. Whenever these shifts come, specifically to the S&P 500...

There are more than two reasons why NVIDIA’s (NASDAQ:NVDA) stock price can rally another 30% or more in 2025, but the two that underpin the others are data center and automotive...

Stocks fell sharply, with the S&P 500 leading the decline, finishing the day down almost 1.6% at 5,860. Meanwhile, the Nasdaq 100 dropped nearly 2.75%, closing at 20,550. This...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.