- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Stress Testing Six Tactical Asset Allocation ETFs: Part II

Morningstar recently tested the niche world of publicly traded tactical-allocation funds and found mediocre results at best. The Capital Spectator came to a similar conclusion a couple of months back in a mini-study of a handful of tactically minded ETFs. Let’s update the numbers and see if anything’s changed.

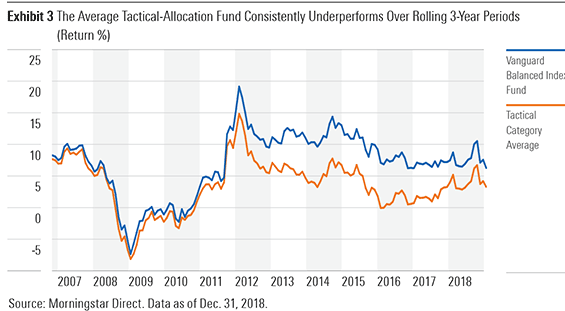

But first, a quick recap of Morningstar’s analysis, which reviews a broader sample of funds, including open-end products. For a benchmark, the study used Vanguard Balanced (VBINX), a simple non-tactical 60%/40% mix of stocks and bonds. The main takeaway: the tactical strategies fared poorly. Morningstar’s summary:

Over the past 15 years through December 2018, the average tactical-allocation fund returned 3.4 percentage points annually, lagging Vanguard Balanced Index by 3.2 percentage points per year with similar risk. This underperformance has been consistent, too. Vanguard Balance Index beat the tactical-allocation category average in every rolling three-year period during the trailing 12 years through December 2018.

Underperforming the benchmark might be tolerable if risk control was impressive, but that wasn’t the case either. According to the Morningstar report, “During the 15 years through December 2018, the average fund in the tactical-allocation category tended to lose 5% more than Vanguard Balanced Index in months that the Vanguard fund posted negative returns.”

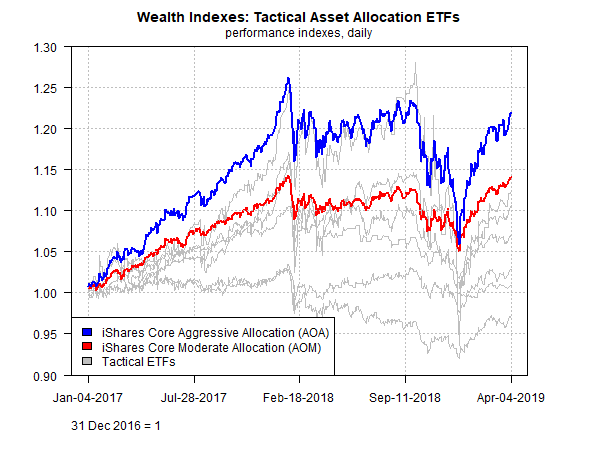

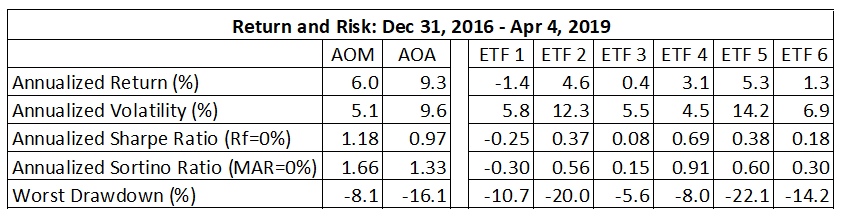

In February, The Capital Spectator came to a similar conclusion, based on crunching the numbers on six tactical asset allocation ETFs. Two months on, has anything changed? No. Comparing the half-dozen funds to a pair of plain-vanilla asset allocation ETFs — iShares Core Moderate Allocation (AOM) and iShares Core Aggressive Allocation (AOA) – reaffirms that the six strategies continue to fall short. Notably, the late-2018 correction and subsequent year-to-date 2019 rebound in markets has been especially rough on the tactical strategies practiced by the six ETFs.

The chart below compares the six tactical funds with the two benchmark portfolios (red and blue lines), using a Dec. 31, 2016 start date. Why that date? Two of the funds were launched in 2016, which defines how far back we can analyze the group as a whole. The short sample should be taken with a grain of salt, but when viewed in context with the Morningstar results it’s clear that publicly traded tactical funds have faced headwinds, to put it mildly. (The six tactical ETFs remain anonymous for this analysis; interested readers can contact The Capital Spectator for funds’ identities.)

It’s striking that AOM and AOA outperformed all six tactical funds for the sample period. Ditto for reviewing the numbers through a risk-adjusted prism. Using Sharpe and Sortino ratios reveals that AOM and AOA generated stronger risk-adjusted performances. To be fair, two of the tactical funds posted lower maximum drawdowns, but compared with AOM the modestly lower peak-to-trough declines aren’t terribly impressive.

The lesson here is that designing and managing a tactical strategy that delivers encouraging results is challenging. That doesn’t mean it’s pointless to try. But the numbers above demonstrate that trying to beat a simple asset allocation strategy — either with higher return, lower risk or both – tends to be the exception rather than the rule.

As Morningstar concludes, “tactical investing is hard and most who try it fail. For most investors, the best bet is to stick to a suitable long-term asset allocation.”

To the extent you disagree, it’s a safe assumption that you won’t be using data for publicly traded funds to make your case.

Related Articles

While market cap weighting is still the go-to for many investors due to its low cost and low turnover, it's becoming increasingly fragile these days thanks to the concentration...

The oldest ETF, the SPDR S&P 500 Trust, had the most inflows in February. The $14.6 billion in inflows allowed it to surpass the Vanguard S&P 500 ETF. Which ETFs saw the...

Leveraged exchange-traded funds (ETFs) substantially increase the potential reward of an investment by affording investors the chance to generate double or triple the returns of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.