- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

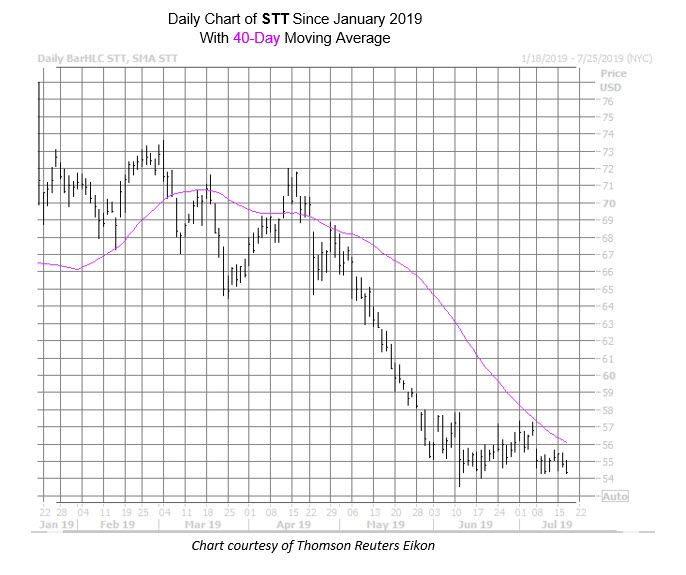

State Street Stock Flashes Bear Sign During Earnings Week

Bank stocks have been a major focus this week, with Citigroup (NYSE:C) unveiling an impressive earnings report on Monday, and several sector peers slated to report later this week. This list includes State Street Corporation (NYSE:NYSE:STT), which will unveil its second-quarter earnings before the open this Friday, July 19. While it's been a relatively good run for the financial sector so far, a technical signal just flashed on the charts for State Street that might put the stock in hot water before its report.

By taking a look at STT's recent behavior, it's clear the stock has been struggling. While a floor at the $54 area has kept it from dropping back towards its roughly three-year low of $53.53, the security has recently found a ceiling at its 20-day moving average, and as mentioned before, just came within one standard deviation of its historically bearish 40-day trendline.

According to data from Schaeffer's Senior Quantitative Analyst Rocky White, this signal has sounded seven times during the past few years. One month later, STT was in the red 67% of the time, averaging a loss of 5.4%. At State Street's current perch of $54.62, a similar move would have the equity bottoming out at a fresh low, around $51.67.

Historically, State Street's post-earnings performance hasn't fared so well, either, with the stock finishing below breakeven the day after five of its last eight earnings reports -- including an 8.5% plummet last October, averaging a 4.1% post-earnings swing during the last two years. This time around the options market is pricing in a slightly bigger move, at 6.5%.

While the majority of analysts are cautious over the financial concern, with eight in coverage calling it a "hold" or worse, there's plenty of room for downgrades to push the security even lower, since six members of the brokerage bunch still call State Street a "buy" or better. Plus, The consensus 12-month target price of $63.21 hasn't been touched by the equity since May, and sits at a roughly 16% premium to current levels.

Options traders, on the other hand, have been piling on the bearish bets ahead of State Street's report, with 4.5 puts bought for every call during the past 10 days on the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX). This ratio is in the 81st percentile of its annual range, which means puts have been picked up at a much quicker clip of late.

Related Articles

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

“Quality” stocks with strong fundamentals tend to be rewarding places to stash hard-earned money. Since 2009, investing in a basket of quality stocks over a standard index has...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.