- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Starbucks (SBUX) Trims Guidance Due To Coronavirus Outbreak

Starbucks Corporation’s (NASDAQ:SBUX) China business is reeling under the impact of the coronavirus outbreak. However, the company stated that the pandemic disease hasn’t impacted its U.S. business.

Starbucks had closed nearly 80% of its stores in China in early February due to Lunar New Year holiday and the coronavirus outbreak. However, the company announced that it has reopened 90% of the closed stores. Nevertheless, the stores are “operating under elevated safety protocols.”

These store closures have resulted in decline in comparable store sales. In February, Starbucks China’s comparable store sales plunged 78%, year over year, primarily on account of store closures, reduced operating hours and customer traffic. In the second week of February, the company witnessed steepest decline in comparable store sales in China.

The company now expects comparable store sales in China to be down nearly 50% in second-quarter fiscal 2020 compared with the prior estimate of growth of approximately 3%. Consequently, the company anticipates the company’s China revenues to be impacted by $400 million to $430 million due to the coronavirus outbreak. Moreover, the company’s GAAP and non-GAAP earnings per share for the second quarter is likely to be impacted in the range of 15 to 18 cents due to the deadly virus.

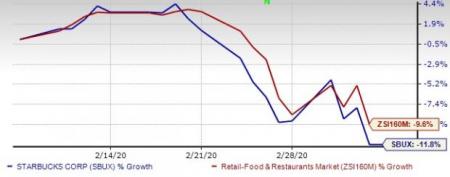

Shares of Starbucks have decreased 11.8% in the past month, compared with the industry’s decline of 9.6%.

Global Impact of Coronavirus on Starbucks

Apart from China, the deadly virus has spread to countries including the United States, Italy, South Korea, India, Israel, Saudi Arabia, Sweden, France, Denmark and Japan. In fact, cases of coronavirus have been reported across 75 countries and territories.

Per management, its operations in Japan, South Korea and Italy have also been impacted by store closures and dismal traffic. However, the company is unable to estimate the impact of the coronavirus outbreak in these markets as it is in early stage.

Other major restaurant companies like Yum China Holdings, Inc. (NYSE:YUMC) , Papa John's International, Inc. (NASDAQ:PZZA) and McDonald's Corporation (NYSE:MCD) have also shutdown majority of their restaurants in China.

Starbucks currently carries a Zacks rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft (NASDAQ:MSFT) in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Starbucks Corporation (SBUX): Free Stock Analysis Report

McDonald's Corporation (MCD): Free Stock Analysis Report

Papa John's International, Inc. (PZZA): Free Stock Analysis Report

Yum China Holdings Inc. (YUMC): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Broadcom stock is in a dynamic rebound phase. Markets seem optimistic ahead of the earnings release. Let's take a deep dive into what to expect from the report. Get the...

Consumers are feeling the pinch from inflation every time they go to the grocery store. Money is a zero-sum game; as disposable income and buying power erodes, consumers are...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.