- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Square (SQ) Q3 Revenues Top Estimates, GPV Soars 31%

Square, Inc. ( (NYSE:SQ) ) just released its third-quarter financial results, posting non-GAAP earnings of $0.07 per share and revenues of $585 million.

Currently, SQ is a Zacks Rank #2 (Buy) and is down 1.66% to $36.10 per share in trading shortly after its earnings report was released.

Square:

Beat earnings estimates. The company posted non-GAAP earnings of $0.07 per diluted share, beating the Zacks Consensus Estimate of $0.06. GAAP net income came in at a loss of $0.04 per diluted share.

Beat revenue estimates. The company saw revenue figures of $585.16 million, beating our consensus estimate $574.28 million.

Quarterly gross payment volume (GPV) reached $17.4 billion, an increase of 31% from the $13.2 billion recorded in the prior-year quarter. About 20% of total GPV came from sellers witnessing over $500,000 in annualized GPV, up from 14% last year.

“In the third quarter, we saw ongoing strength in both transaction-based and subscription and services-based revenue,” the company said. “Our open platform strategy is working: Sellers using business systems that are integrated with Square contributed nearly 20% of third-quarter GPV.”

Management also provided fourth-quarter guidance. Square expects total net revenue in the range of $585 million to $595 million. Adjusted earnings are expected to fall between $0.05 and $0.06 per share. Our current consensus estimates are calling for revenues of $587.65 million and earnings of $0.07 per share.

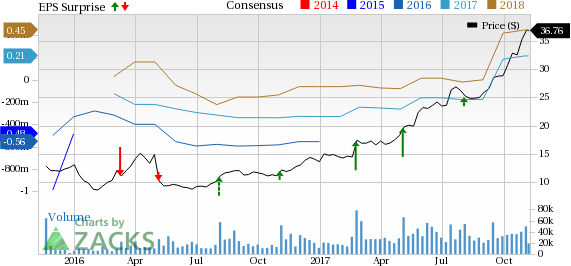

Here’s a graph that looks at Square’s earnings surprise history:

Square, Inc. offers financial services and marketing services. The Company provides payments and point-of-sale which include hardware and software to accept payments, streamline operations and analyze business information. Its payments and POS services include In-Person Payments, Online Payments, Square Cash, Square Register, Square Analytics, Square Appointments and Square App Marketplace. The Company's financial services include Square Capital and Square Payroll.

Check back later for our full analysis on Square’s latest earnings report!

Want more stock market analysis from this author? Make sure to follow @Ryan_McQueeney on Twitter!

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Square, Inc. (SQ): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Professional traders get paid because of one skill and one skill only: the ability to foresee what the world (or the economy, at least) might look like in six to nine months....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.