- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Splunk (SPLK) Beats Q3 Earnings & Revenue Estimates, View Up

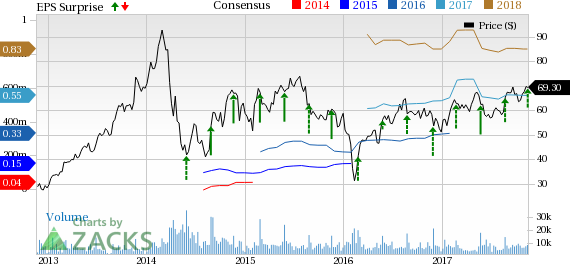

Splunk Inc. (NASDAQ:SPLK) reported third-quarter fiscal 2018 non-GAAP earnings of 17 cents per share, beating the Zacks Consensus Estimate by 3 cents. Moreover, the figure surged 72.6% year over year.

Revenues increased 34.3% year over year to $328.7 million and surpassed the Zacks Consensus Estimate of $310 million. The year-over-year growth was primarily driven by strong product portfolio and expanding clientele.

Cloud revenues totaled $24.4 million in the quarter. Overall software revenues including license and cloud revenues grew 34% year over year.

Total billings jumped 38% year over year to $381.6 million. Moreover, the company won more than 581 orders worth $100K, individually. Splunk added more than 450 new enterprise customers. Existing clients like Atlassian Corporation (NASDAQ:TEAM) expanded its EAA in the quarter. Another partner Nutanix (NASDAQ:NTNX) quadrupled its use of Splunk Enterprise for visibility in IT and security.

International operations represented 24% of total revenues. Education and professional services represented 10% of revenues.

Splunk’s shares have returned 12.9% year to date, slightly outperforming the industry’s 11.4% rally.

Product Update

During the quarter, the company launched Splunk Enterprise 7.0, Splunk Cloud, IT Service Intelligence 3.0, Enterprise Security Content Updates and User Behavior Analytics 4.0.

Splunk also introduced new versions of the Splunk Add-on for Amazon (NASDAQ:AMZN) Web Services (AWS) and Splunk App for AWS with major enhancements around ingestion speed and setup usability.

Booz Allen Hamilton's Cyber4Sight for Splunk, a solution that provides security analysts and threat hunters with actionable threat intelligence, was released for general use during the quarter.

The company also released new integrations between Splunk and Puppet. This includes the Splunk App for Puppet Enterprise and Splunk ITSI Module for Puppet Enterprise. The solutions help customers address issues in real-time through machine learning.

Operating Details

Non-GAAP gross margin contracted 60 basis points (bps) from the year-ago quarter to 83.7%.

Operating expenses, as percentage of revenues, declined 360 bps to 73.9%. Research & development (R&D) expenses, sales & marketing (S&M) expenses and general & administrative (G&A) expenses declined 160 bps, 150 bps and 50 bps, respectively.

Non-GAAP operating margin expanded 300 bps to 9.8%.

Acquisitions

Splunk acquired selected assets of Rocana Inc., a provider of analytics solutions for the IT market. The company also bought SignalSense, a company offering cloud-based advanced data collection and breach-detection solutions.

The acquisitions will further boost the company’s data platform and machine learning capabilities across its product portfolio.

Balance Sheet

Splunk exited the quarter with cash & cash equivalents including investments of $1.1 billion.

Cash flow from operations was $52.3 million, while free cash flow totaled $46.9 million at the end of the quarter.

Guidance

For fourth-quarter fiscal 2018, Splunk expects revenues between $388 and $390 million. Non-GAAP operating margin is likely to be around 16%.

Buoyed by encouraging third-quarter results, the company increased full-year 2018 revenues and billings guidance. The company now expects revenues between $1.239 and $1.241 billion, up from the previous range of $1.210-$1.215 billion.

Cloud revenues are now expected at $90 million, up from previous range of $85 million.

Billings are now anticipated to be $1.485 billion compared with the previous guidance of $1.450 billion. Cloud billings are projected at $170 million, up from previous guidance of $150 million.

Splunk now projects non-GAAP operating margin of almost 8.5%, up 50 bps from the previous range for fiscal 2018.

Management stated that it remains on track to generate operating cash flow of $250 million for fiscal 2018.

For fiscal 2019, Splunk expects revenues of $1.550 billion and non-GAAP operating margin of almost 10.5%.

Management reiterated fiscal 2017 revenue target of $2 billion. Operating margin is anticipated in the range of 12-14%. Moreover, customer base is expected to expand 20K by 2020.

Conclusion

Splunk’s market opportunity is growing on the back of its software, which is traditionally used for IT operational intelligence, security, fraud-detection, app analytics and other relevant cases. Additionally, partnerships with the likes of AWS, Booz Allen Hamilton and Accenture (NYSE:ACN) are helping the company to launch products. The portfolio expansion is driving clientele, which is a key catalyst.

Moreover, the company is well poised to benefit from the ongoing shift to modern analytics-based security information and event management (SIEM) from a traditional structured data legacy-based one. This is driving large security orders for the company.

Although Splunk’s win rate against tracked competitors is impressive (generally 80% to upwards of 95%), intense competition remains a major concern.

Splunk carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Atlassian Corporation PLC (TEAM): Free Stock Analysis Report

Splunk Inc. (SPLK): Free Stock Analysis Report

Nutanix Inc. (NTNX): Free Stock Analysis Report

Accenture PLC (ACN): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

In a striking reversal of fortunes, equities in developed markets ex-US are now leading the major asset classes in 2025 while US shares are posting a modest loss year to date,...

US index futures broke lower after Marvell Technology's earnings missed. Nasdaq and S&P 500 are now testing key support zones. Meanwhile, Amazon, Oracle, Tesla and...

There was some modest buying today from the open, but volume was light and markets are below trading range support established during the latter part of 2024. It's hard to see...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.