- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

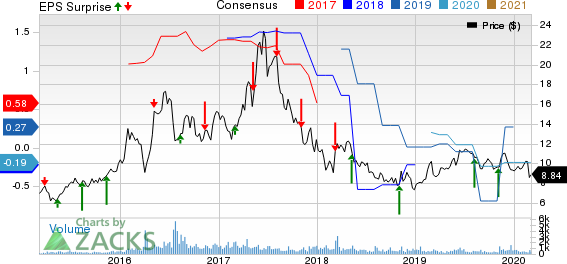

Spark Energy's (SPKE) 2019 Earnings Rise, Sales Drop Y/Y

Spark Energy (NASDAQ:SPKE) reported 2019 operating earnings of 2 cents per share, against loss of 69 cents in 2018.

Total Revenues

Spark Energy’s total revenues came in at $813.7 million, down 19.1% from $1,005.9 million reported in 2018.

Highlights of the Release

During the fourth quarter, the company reported Retail Gross Margin of $64.3 million compared with $50.2 million in the year-ago quarter. This increase is due to electricity unit margins and volumes returning to normal after a downturn in 2018, offset by lower customer counts.

Spark Energy reported Adjusted EBITDA of $92.4 million in 2019 compared with $70.7 million in 2018. The year-over-year improvement was primarily due to higher Retail Gross Margin.

Nearly 70% of all new sales of Spark Energy in 2019 came from clean energy sources.

Financial Update

Cash and cash equivalents as of Dec 31, 2019 were $56.7 million compared with $41 million as of Dec 31, 2018.

Long-term debt as of Dec 31, 2019 was $123 million compared with $129.5 million as of Dec 31, 2018.

Cash from operating activities in 2019 was $91.7 million compared with $59.8 million in 2018.

Zacks Rank

Currently, Spark Energy has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Releases

FirstEnergy Corporation (NYSE:FE) came up with fourth-quarter 2019 operating earnings of 55 cents per share, which beat the Zacks Consensus Estimate of 48 cents by 14.6%.

Exelon Corporation’s (NASDAQ:EXC) fourth-quarter 2019 operating earnings of 83 cents per share surpassed the Zacks Consensus Estimate of 73 cents by 13.6%.

Dominion Energy Inc. (NYSE:D) reported fourth-quarter 2019 operating earnings of $1.18 per share, beating the Zacks Consensus Estimate of $1.16 by 1.7%.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our latest Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

See 5 Stocks Set to Double>>

FirstEnergy Corporation (FE): Free Stock Analysis Report

Exelon Corporation (EXC): Free Stock Analysis Report

Dominion Energy Inc. (D): Free Stock Analysis Report

Spark Energy, Inc. (SPKE): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Tesla (NASDAQ:TSLA) (NYSE: TSLA), the electric vehicle giant, has recently experienced a significant drop in its stock value, which has fallen nearly 45% since December. This...

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.