- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

S&P 500 Weekly Update: $4 Jump In ’21 Estimate; 2022 Still Murky

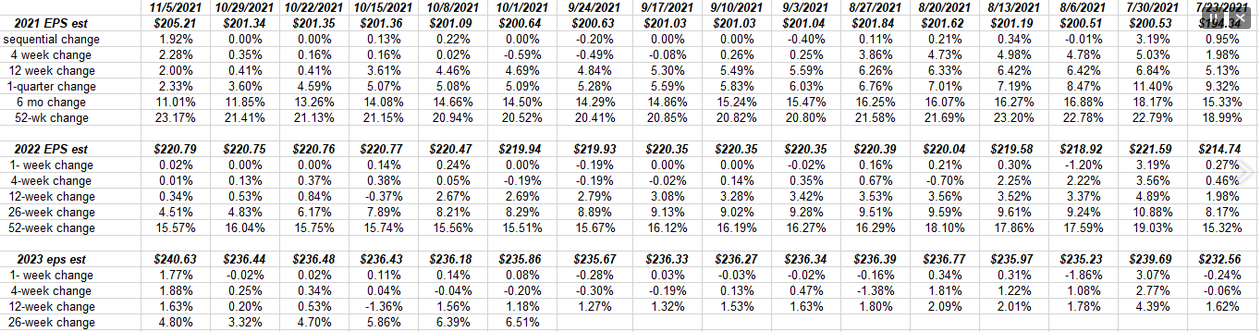

The S&P 500 2021 full-year calendar estimate rose this week to $205.21 from $201.34, which is probably a function of the fact that, like the last week of July ’21, the “Big 5” all reported their earnings in the last week of October ’21. The S&P 500 EPS sequential dollar increase the last week of July ’21 was over $5.

Data source: IBES by Refinitiv

Look at the change in the 2021 EPS estimate this week, and then between July 23 and July 30. As explained above, the common factor was the Big 5 released their Q2 ’21 financial results all in the same week.

Note too the stability in 2022’s S&P 500 estimate while 2023 rose $4 this week, which in and of itself is unusual. Not sure why a strategist boosted the 2023 EPS estimate so sharply when we are still 12 months away from the start of the year. Refinitiv (IBES data) doesn’t give subscribers the 2023 4 quarterly bottom-up estimates until late March ’22 or roughly 8 – 9 months in advance of the year.

S&P 500 metrics tracked weekly

- The forward 4-quarter estimate declined sequentially this week to $214.95 from last week’s $215.32. In normal (non-pandemic) years there can be sequential declines in the forward estimate as forward quarters are tweaked and impacted by current events. It’s been rare since May ’20 that a week has seen a sequential decline in the forward estimate, in fact there have only been 5 sequential declines in the estimate since July 1, ’20 or the last 72 weeks.

- The PE ratio on the forward estimate is now 21.85 vs last week’s 21.4x.

- The S&P 500 earnings yield fell to 4.58% from 4.68% last week thanks to the 2% rise in the S&P 500 this week.

- The 3rd quarter bottom-up estimate this past week finished at $53.25, above the 2nd quarter bottom-up actual EPS of $52.58. Nick Colas over at Datatrek raised the issue in August ’21 and Josh Brown picked up on it and talked about it briefly on CNBC, so that was worthwhile.

- Speaking of quarterly bottom-up estimates, Q4 ’21 is just $51 and has been rotating around $51 since July 30 (see attached s/sheet above). It’s now below Q3 ’21, but that should begin to change after Jan 10 ’22.

2022 by quarter

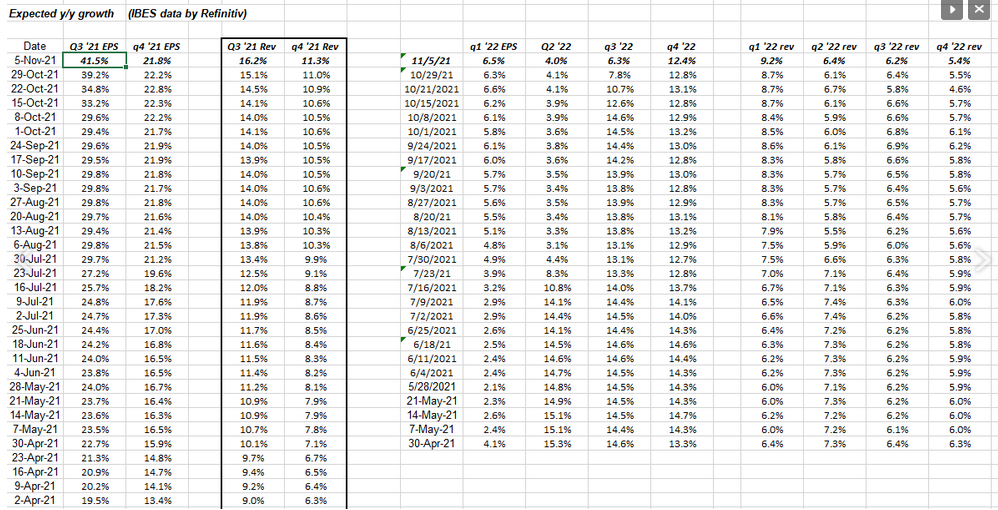

Q4 ’21 is still seeing steady upward revisions to the S&P 500 “expected” EPS and revenue growth rates but that’s about it. Understandably, the 2022 metrics are jumping all over the place since no analyst wants to stick his or her neck out.

As a comparison, exactly one year ago, on Nov. 6, ’20, the “expected” S&P 500 EPS growth rates for Q1 and Q2 of ’21 were 15% and 43.8%, respectively. Actual S&P 500 EPS growth rates for Q1 and Q2 ’20 were 52.8% and 96.3%, respectively.

2022 won’t see that kind of “upside surprise” but readers can see that these EPS estimates can be well off the mark, particularly when we see an event like a pandemic.

The “average S&P 500 EPS upside surprise” (Jeff Miller and I used to talk about this frequently and which Ed Yardeni has written about, who is another good source of S&P 500 EPS data) is 2% – 6% per quarter in a “normal” economy and normal markets. (A blog post this week talked about upside surprises.)

Summary/conclusion

Unless we start seeing upside earnings preannouncements in December ’21, which I wouldn’t expect, it isn’t likely that we get a good grasp on what 2022 will look like until the Q4 ’21 earnings releases start on Jan. 10 ’22, which also then will provide earnings guidance for full-year 2022.

The story is the same now, and has been for a while. The thing is companies are saying demand is strong but material and labor shortages and other constraints are keeping a lid on what is likely a very strong economy. Q3 ’21 GDP growth was depressed for a number of reasons, but according to JP Morgan, Q4 ’21 GDP growth should rebound to 4% – 6%, which should bode well for 2022.

We will keep showing the data every week but “price” (meaning market action) is everything.

The 10-year and 30-year Treasury yields traded up 1.6% and 2% during the Powell presser on Wednesday and then the Treasury curve flattened sharply the next two days as the longer Treasury maturities rallied. (Probably not a great scenario for the financial sector.)

2022 may turn out to be a pretty normal year. Investors probably shouldn’t expect a 25% annual return for the S&P 500 again. Predictions and forecasts are easy though. Being right is a lot harder.

Take everything you read on the blog with a lot of skepticism. In the capital markets, conditions change quickly.

Related Articles

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

“Quality” stocks with strong fundamentals tend to be rewarding places to stash hard-earned money. Since 2009, investing in a basket of quality stocks over a standard index has...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.