- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

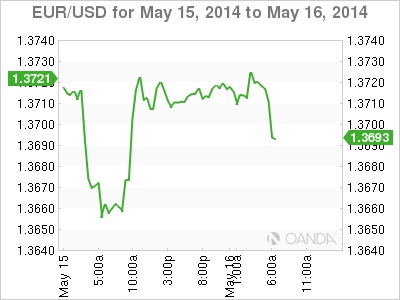

EUR/USD: Flat On Disappointing Growth

The euro is unchanged in Friday's European session, as EUR/USD trades in the low-1.37 range. Weak GDP numbers are weighing on the currency, which has had an uneventful week after last week's rollercoaster excitement. On Thursday, US Unemployment Claims were excellent, as the indicator plunged to a seven-year low. Taking a look at Friday's events, French Preliminary Non-Farm Payrolls came in at -0.1%, matching the estimate. In the US, today's highlights are Building Permits and the Preliminary UoM Consumer Sentiment.

Eurozone GDP releases, the primary gauge of economic growth, mostly disappointed in April. Eurozone Flash GDP dipped to 0.2%, short of the estimate of 0.3% French and Italian GDP releases both weakened and missed expectations. The one bright note was German Preliminary GDP, which jumped 0.8% in Q1, its best showing since Q1 in 2013. This edged above the estimate of 0.7%.

At last week's policy meeting, Mario Draghi, the ECB said it would be comfortable taking monetary action in June, the markets jumped, and the euro has been in a tailspin ever since. However, Draghi gave himself plenty of wiggle room, saying the ECB would take into account growth and inflation forecasts before making any moves. Eurozone Core CPI improved to 1.0% in April, up from 0.7% a month earlier. Eurozone CPI followed suit, as it improved to 0.7%, up from 05%. With both inflation indicators matching their estimates and pointing upwards, the ECB has some breathing room before having to take action. If upcoming inflation numbers meet expectations, we could see the ECB play it safe in June and remain on the sidelines yet again.

In the US, Thursday's employment and manufacturing numbers were strong. Unemployment Claims were outstanding, dropping to 297 thousand last week. This easily beat the estimate of 321 thousand and was the lowest level we've seen since May 2007. On the manufacturing front, the Philly Fed Manufacturing Index dipped to 15.4 points, but this was well above the estimate of 13.9 points. As well, Empire State Manufacturing Index climbed to 19.0 points, crushing the estimate of 5.5. This was the indicator's best showing in two years.

EUR/USD May 16 at 8:45 GMT

EUR/USD 1.3718 H: 1.3725 L: 1.3707

EUR/USD Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.3487 | 1.3585 | 1.3649 | 1.3786 | 1.3893 | 1.400 |

- EUR/USD is unchanged in Friday trade.

- 1.3649 is providing support. 1.3585 is stronger.

- 1.3786 continues to provide strong resistance.

Further levels in both directions:

- Below: 1.3649, 1.3585, 1.3487 and 1.3346

- Above: 1.3786, 1.3893, 1.4000, 1.4149

OANDA's Open Positions Ratio

EUR/USD ratio is unchanged in Friday trading. This is consistent with the pair's current movement, as the euro is drifting close to the 1.36 line. The ratio runs slightly in favor of long positions, indicative of a slight trader bias towards the euro reversing its downward spiral.

EUR/USD has looked quiet for most of the week, and this is continuing on Friday. The pair is unchanged in the European session.

EUR/USD Fundamentals

- 6:45 French Preliminary Non-Farm Payrolls. Estimate -0.1%. Actual -0.1%.

- 8:00 Italian Trade Balance. Estimate 2.47B.

- 9:00 Eurozone Trade Balance. Exp. 17.3B.

- 12:30 US Building Permits. Estimate 1.o1M.

- 12:30 US Housing Starts. Estimate 0.98M.

- 13.55 US Preliminary UoM Consumer Sentiment. Estimate 84.7 points.

- 13:55 US Preliminary UoM Consumer Expectations.

Related Articles

The Japanese yen continues to sparkle on Friday. In the European session, USD/JPY is trading at 144.81, down 0.86% on the day. The yen is trading at its strongest level since...

USD/JPY is at a six-month low near 145.57 on Friday after posting a 2% gain in the previous session. Key Factors Driving the USD/JPY Movement US President Donald Trump’s sweeping...

AUD underperforms on Liberation Day as risk sentiment dives. US hits China with additional 34% tariff, overshadowing Australia’s lighter treatment. EUR/AUD breaks out, eyes...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.