- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

S&P Makes New Highs Ahead Of Jobs Report

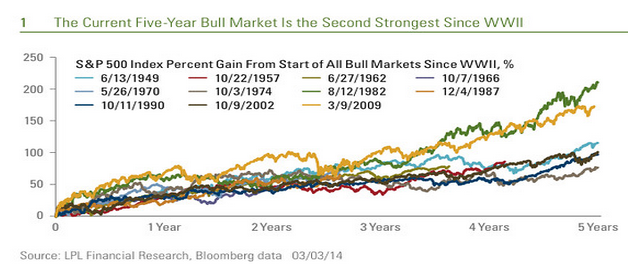

The S&P 500 marched to another all-time record high and is now up 170% off its March 2009 low. The S&P 500 traded into its sixth record high in the last six sessions yesterday.

Traders started cutting back on Wednesday and the lackluster trade continued right into yesterday. On the close the S&P [CME:SPH14] was fractionally higher, up 3.22 points or 0.2%. The Dow [DJI:^DJI] closed up 61 points and just 1% away from its Dec. 31 record high and close. The Nasdaq Composite [CME:NQH14] closed up 5.85 points.

Algos take a breather

After Tuesday’s 28.5 handle up day, the S&P went into rest mode. Wednesday’s total E-mini S&P 500 [CME:ESH14] volume including Globex was a low 1.25 million contracts and yesterday’s total volume was only 1.28 million. With less volume over the last few days there has been a noticeably lower level of program and algorithmic trading. When there is less trade there are fewer stops and fewer big orders—what the algos feed off of.

After a small gap up Wednesday the S&P traded in a four-handle range almost all day and, with the exception of the late day six-handle selloff, the futures traded in a narrow range all day yesterday. Part of the reason for this is the S&P is up so much many of the big shops have positions on and they are not moving. The other part is the speed of the last push up, which again caught the shorts off guard.

Non-Farm Payrolls

The last two jobs numbers fell short and we think the record cold weather will be a factor in today’s numbers also. Economists expect nonfarm payroll to increase by 152,000 in February vs. January’s 113,000. The unemployment rate is expected to drop to 6.5%. One possible positive: Yesterday’s jobless claims dropped to a three-month low with U.S. weekly applications for jobless benefits declining by 323,000. Goldman Sachs on the other hand is looking for a bounceback to a 200,000 nonfarm payroll.

Jan Hatzius, Goldman’s chief economist, cites two reasons for why they expect a higher number:

- Better weather (yes, really). Although the month of January as a whole was quite cold, the payroll survey week was actually somewhat warmer than normal.

- Even excluding the weather impact, the December employment gain looks to be about 50,000 below the recent trend. In [Goldman’s] view, this is implausibly weak relative to other job market measures. This could result in a bounceback to an above-trend pace even outside the weather impact, although it is also possible that the December reading will be revised up.

Hatzius goes on to say that part of the reason they are looking for a higher number is because the expiration of emergency unemployment benefits at year end may have caused another drop in labor force participation. Hatzius also expects a good increase in household employment, which has likewise underperformed job market indicators such as claims.

The Asian markets closed modestly higher and in Europe 9 of 11 markets are trading lower.Today’s economic calendar starts with the employment report, international trade, consumer credit and earnings from Foot Locker, and New York Fed President William Dudley speaks on the economy in New York.

Our view

The S&P made its 50th new high in a year yesterday and is up 177% since its March 2009 lows. They say the 6th year of a bull market has an average gain of 26%. How is it possible that the U.S. can be almost $17 trillion in debt, with zero interest rates, and the S&P could be trading 1900?

It’s called quantitative easing and while the plan may be to lower it in the U.S. it’s full steam ahead in Europe. Our view is the S&P is on its way to 1885 and then 1900. Even if the number comes in bad we still expect the S&P to go back up after it sells off. We will also be paying attention to our “Counter Trend Friday” trading rule.

As always, keep an eye on the 10-handle rule and please use protective stops when trading futures and options.

- In Asia, 6 of 11 markets closed higher: Shanghai Comp. -0.08%, Hang Seng -0.19%, Nikkei +0.92%

- In Europe, 9 of 11 markets are trading lower: DAX -0.46%, FTSE -0.06% at 5:00 am.

- Morning headline: “S&P 500 Seen Higher Ahead Of Jobs Number ”

- Total volume: 1.28Mil ESH14 and 7.5K SPH14 contracts traded

- S&P Fair Value: 1875.93 (futures 1.82 above at 1877.75 as of 7:04 AM CT)

- Economic calendar: Employment report, international trade, consumer credit, William Dudley speaks and earnings from Foot Locker.

- E-mini S&P 5001877.75+1.50 - +0.08%

- Crude98.55-0.22 - -0.22%

- Shanghai Composite0.00N/A - N/A

- Hang Seng22660.49-42.48 - -0.19%

- Nikkei 22515274.07+139.32 - +0.92%

- DAX9350.75-192.12 - -2.01%

- FTSE 1006712.67-75.82 - -1.12%

- Euro1.3875

Related Articles

• Inflation data, Fed FOMC minutes, Trump tariff news and the start of Q1 earnings season will be in focus this week. • Cal-Maine Foods' strong growth trajectory makes it a...

Trump’s tariff shock sent markets reeling—but Buffett’s playbook might offer a way through. While stocks plunge, Berkshire hits record highs—proof that panic isn't strategy. Want...

A Wall Street axiom states that the stock markets lead the economy by about six months. While not a perfect predictor, the stock market reacts to investor expectations about...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.