- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Thursday's FX Technicals

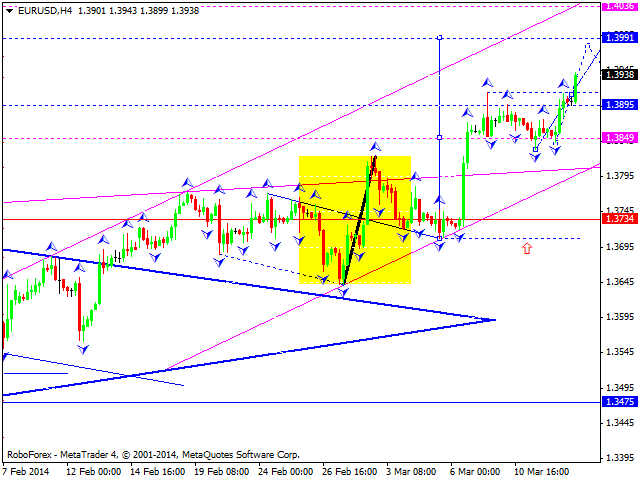

- EUR/USD

Euro is moving upwards; market has broken another consolidation channel upwards and continues growing up. We think, today price may reach level of 1.3990, stat new correction, and then continue its ascending movement towards level of 1.4100.

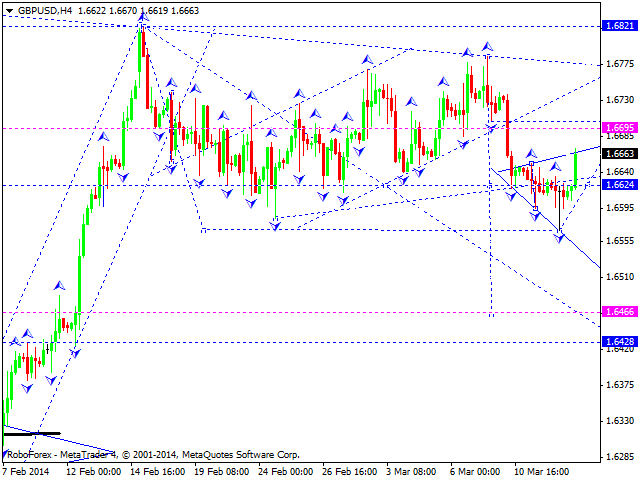

Pound is moving inside consolidation channel; market has reached minimum of this correction. We think, today price may continue moving upwards. However, we should note, that according to main scenario, pair is expected to fall down to reach level of 1.6480 and only after that continue growing up to reach level of 1.7000.

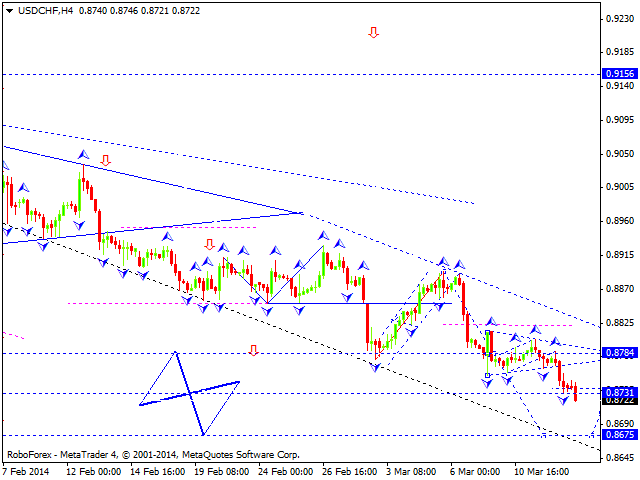

Franc reached level of 0.8730 and right now is moving downwards. We think, today price may form another consolidation channel near level of 0.8730 and then to continue forming descending structure to reach level of 0.8300.

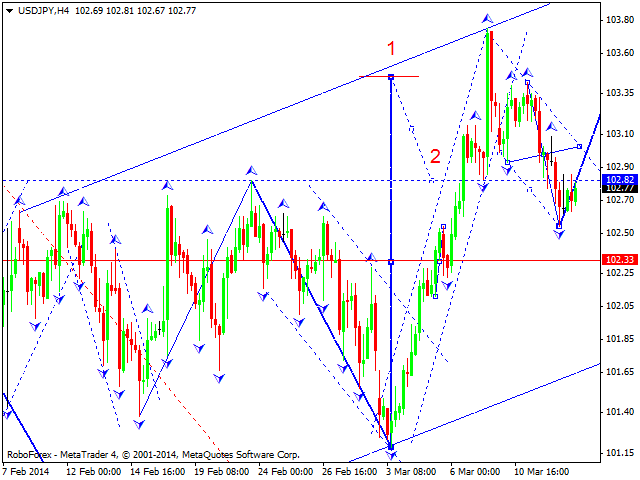

Yen is forming reversal pattern for new ascending movement. We think, today price may leave its descending channel; next target is at 104.40. Later, in our opinion, instrument may form another descending structure towards level of 100.00.

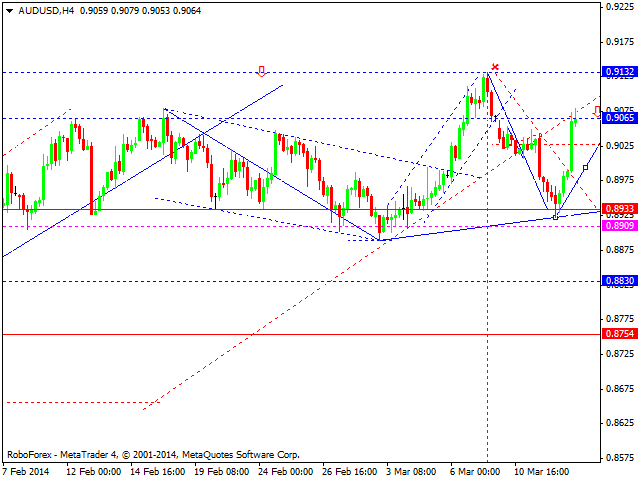

Australian Dollar completed correctional structure and returned to the level where the channel was broken; this movement may be considered as the right shoulder of head & shoulders reversal pattern. We think, today price may form reversal structure, leave this correctional channel, and then continue falling down. Next target is at level of 0.8990.

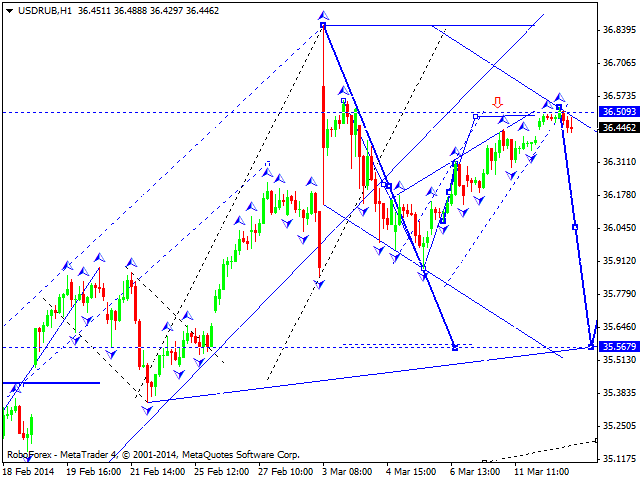

Ruble completed another ascending structure. We think, today price may fall down towards level of 35.60, form reversal structure, and continue growing up to reach level of 37.60.

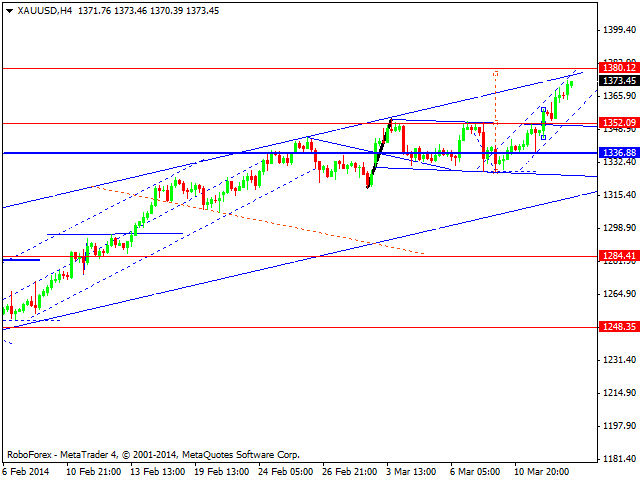

Gold is still forming ascending structure towards level of 1377 or even 1380. Later, in our opinion, instrument may fall down towards level of 1352 to test it from above and then continue growing up to reach level of 1490.

RoboForex Analytical Department

Related Articles

The US dollar fell last week due to Trump's inconsistent trade policies and signs of a slowing economy. February's non-farm payroll data disappointed, with unemployment...

The Canadian dollar is steady at the start of the week. USD/CAD is trading at 1.4385, up 0.06% on the day. The Canadian dollar declined 0.50% on Friday after Canada’s job report...

As investors attempt to keep up with the daily shift in President Trump’s tariff policies, the February CPI report out of the United States on Wednesday will likely come as a...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.