- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Snapchat May Get Tencent's Help Publishing Video Games

Snap Inc. (NYSE:SNAP) recently disclosed an investment by Shenzhen, China-based Tencent Holding Limited and its affiliates. Following the announcement, the Chinese game maker expressed its intention to help Snapchat in publishing video games on its platform and improving ad sales.

Reuters quoted Tencent management saying, "The investment enables Tencent to explore cooperation opportunities with the company on mobile games publishing and newsfeed as well as to share its financial returns from the growth of its businesses and monetization in the future."

We believe moving toward video games will be a positive for Snap, which has been experiencing a slowdown in its user base and revenue growth rates over the last few quarters.

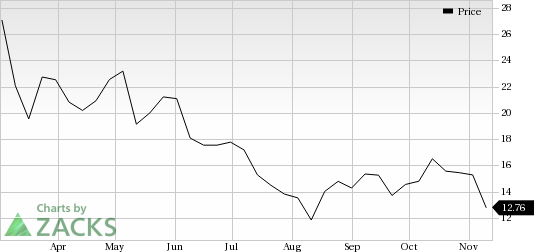

Notably, shares of Snap have lost 47.9% of its value since its listing date of Mar 2, 2017 against 17.9% growth of its industry.

Mobile Games Hold Solid Potential

Snapchat’s association with Tencent, the leading gaming company in the world, will help it to bring popular games on its platform, which in turn will drive user growth.

Per Newzoo, Riot Games’ (owned by Tencent) League of Legends is the United States and Europe’s most popular PC game.

Despite strong demand for gaming consoles like Microsoft’s (NASDAQ:MSFT) Xbox One, Sony’s PlayStation 4 and Nintendo Switch, we note that mobile games have become one of the fastest growing segments in the video game market.

Newzoo projects mobile game revenues to grow in the range of 32% - 40% from 2017 - 2020. Per Newzoo, mobile gaming will be extremely lucrative and account for 42% of the total gaming market in 2017.

Snapchat’s major rival Facebook Inc. (NASDAQ:FB) launched Instant Games on both Facebook and Messenger platforms last year. For Instant Games, Facebook collaborated with the likes of Bandai Namco, Konami, Zynga as well as Activision Blizzard’s King Digital Entertainment.

Snapchat’s foray into the video game space might help it to overshadow the growing dominance of Instagram whose total addressable market (TAM) is three times that of Snap.

Advertising Revenues – Primary Contributor

As advertising forms the mainstay of Snap’s revenues, a slowdown in user base growth rate may look unattractive to advertisers. This may dampen the company’s growth opportunities.

In the last reported quarter, ad impressions witnessed a 400% year-over-year surge. However, management noted on the last conference call that the company’s transition to programmatic auction resulted in over 60% year-over-year decline in cost per thousand (CPM), which impacted advertising revenues. We believe the company will benefit from such an auctioning model in due course.

The company’s investment in third-party measurement solution for advertisers has yielded positive results. Notably, Take-Two Interactive’s (NASDAQ:TTWO) video game publishing subsidiary, 2K benefited from Snap Ads and Lenses, which helped it to find out the demand for NBA 2K18 video game and its popularity among users.

Snapchat’s new conversion tracking tool, Snap Pixel, to help advertisers measure traffic growth on their websites, is being tested. We believe once the feature is rolled out, it will help the company to attract advertisers.

If the company can channel the investment from Tencent in the right direction, it may prove to be a key driver going ahead in our view.

Zacks Rank

Currently, Snap carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

Facebook, Inc. (FB): Free Stock Analysis Report

Snap Inc. (SNAP): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Take-Two Interactive Software, Inc. (TTWO): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

“Quality” stocks with strong fundamentals tend to be rewarding places to stash hard-earned money. Since 2009, investing in a basket of quality stocks over a standard index has...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.