- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Smucker's (SJM) Focus On Buyouts & Savings Plan Bodes Well

Gains from buyouts and alliances along with a focus on innovation and digital advancements bode well for The J. M. Smucker Company (NYSE:SJM) despite lower net price realization and the U.S. baking business divestiture. We believe that such upsides are likely to help the company drive the top line. Also, the company’s bottom line has been rising year over year, thanks to a solid cost-saving plan.

Smucker’s Sales Under Pressure

Smucker has been witnessing drab sales for a while. In third-quarter fiscal 2020, net sales amounted to $1,972.3 million that missed the consensus mark of $1,973 million. Moreover, the top line dropped 2% year over year, mainly due to lower volume/mix in the U.S. Retail Pet Foods segment. Further, reduced net price realization in other segments is a deterrent. This led to a negative impact of 5 percentage point in the U.S. Retail Coffee Market unit’s revenues. The same also put pressure on the company’s International and Away From Home segment. Persistence of such headwinds is concerning.

Apart from this, the divestiture of the U.S. baking business has been leading to unfavorable year-over-year comparisons on Smucker’s top line. Moreover, this is expected to weigh on the company’s performance in fiscal 2020. In fact, management issued a drab sales outlook for the year. The company expects net sales to decline 3% year over year. The top-line view includes a loss of $105.9 million stemming from the divestiture of the U.S. baking business and $25.4 million from non-comparable sales associated with Ainsworth.

Nonetheless, Smucker continues to make concerted efforts to improve the top line.

Factors Likely to Support the Stock

We note that the company’s acquisition of Ainsworth (completed in May 2018) has been aiding the performance of the U.S. Retail Pet Foods category. Other noteworthy acquisitions of the company include Big Heart Pet Brand (pet food maker), Sahale Snacks (branded nut and fruit snacks maker), Enray Inc. (manufacturer of organic, gluten-free ancient grain products), and coffee brands and business operations of Rowland Coffee, among others. Additionally, Smucker’s agreement with Keurig Green Mountain (KGM) and Dunkin’ Brands to manufacture and sell the K-Cup category of products has been yielding results since fiscal 2016.

Evidently, Dunkin’ Brand grew 4% in third-quarter fiscal 2020. Also, the company has been consistently extending the partnership with KGM to augment K-Cup business opportunities. Notably, Smucker reported 7% sales growth for all K-Cup brands in the third quarter. Apart from this, the company is accelerating marketing support for growth brands. Further, Smucker has effectively launched advertising campaigns for ten brands in fiscal 2020. Additionally, the growing trend of online customers has urged the company to take notice of its e-commerce channel to boost sales. Notably, during third-quarter fiscal 2020, e-commerce sales improved double digits and contributed 5% to total U.S. retail sales.

Further, the company has been performing well on the bottom-line front, courtesy of its robust saving efforts. In fiscal 2019, the company delivered savings of nearly $30 million through the right-spend program. Going ahead, management is focused on cost reduction and optimization efforts to ensure greater profitability. Markedly, SD&A costs are expected to decline nearly 2.5% year over year in fiscal 2020.

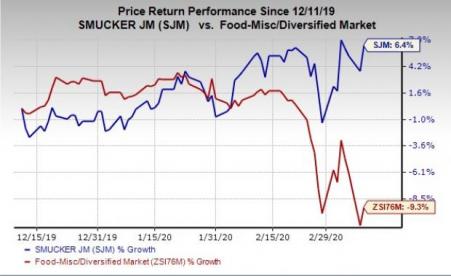

Shares of this Zacks Rank #3 (Hold) company have gained 6.4% in the past three months against the industry’ s decline of 9.3%.

3 Food Stocks You Can’t Miss

Darling Ingredients (NYSE:DAR) , with a Zacks Rank #1 (Strong Buy), delivered a positive earnings surprise in the last reported quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

Lamb Weston (NYSE:LW) has a long-term earnings growth rate of 8.8% and a Zacks Rank #2 (Buy).

Hain Celestial (NASDAQ:HAIN) , with a Zacks Rank #2, delivered a positive earnings surprise of 7%, on average, in the trailing four quarters.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

The Hain Celestial Group, Inc. (HAIN): Free Stock Analysis Report

The J. M. Smucker Company (SJM): Free Stock Analysis Report

Darling Ingredients Inc. (DAR): Free Stock Analysis Report

Lamb Weston Holdings Inc. (LW): Free Stock Analysis Report

Original post

Related Articles

Walgreens Boots Alliance Inc. (NASDAQ:WBA) is on the brink of a significant transformation as it nears a deal with Sycamore Partners to become a private entity. The transaction,...

Using the Elliott Wave Principle (EWP), we have been successfully tracking the most likely path forward for the S&P 500 (SPX) over several months. Although there are many ways...

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.