- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Smucker (SJM) Posts Upbeat Q2 Earnings & Sales, Shares Up

The J. M. Smucker Company (NYSE:SJM) posted second-quarter fiscal 2018 results, wherein earnings and revenues beat the Zacks Consensus Estimates. Shares of the company have increased approximately 5% during the pre-market trading session on Nov 16.

However, the company lowered the higher end of its earnings guidance for fiscal 2018, thanks to anticipated higher freight expenses and industry-wide headwinds for the remaining part of the fiscal year.

We also note that in the past month the stock has gained 1.8%, as against the industry’s decline of 0.1%.

Quarter in Details

Adjusted earnings in the second quarter were $2.02 per share, which surpassed the Zacks Consensus Estimate of $1.89. However, earnings declined 1.5% year over year.

Net sales in the quarter increased 0.5% year over year to $1,923.6 million and also beat the consensus estimate of $1,895 billion. Sales during the quarter were favorably impacted by increased net pricing for peanut butter and Smuker’s brand. Lower volume/mix stemming from the decline in oil and baking category products were offset by gains from the pet food segment. Net sales received benefits of $5.4 million owing to favorable currency exchange.

Adjusted gross profit fell 1.5% to $746.2 million. Adjusted operating income for the reported quarter also declined 3.3% to $383.2 million. Gross margin and adjusted operating margin contracted 80 basis points to 38.8% and 19.9%, respectively.

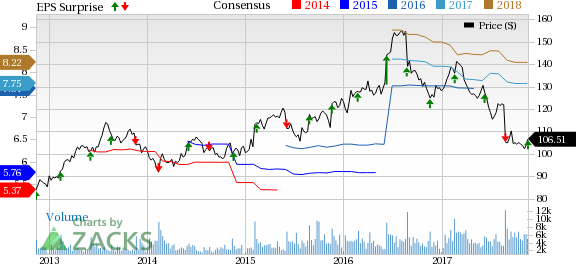

J.M. Smucker Company (The) Price, Consensus and EPS Surprise

Segment Performance

U.S.Retail Coffee Market: The company's largest segment, U.S. Retail Coffee Market, reported a 0.2% growth in sales to $552.7 million. This was mainly due to a modest rise in net price realization. Also, lower volume/mix from the Folgers brand was majorly offset by gains reaped from the Dunkin' Donuts and Café Bustelo brands.

Segment profit declined 18.2% to $152.6 million, due to higher costs of green and unfavorable volume/mix impacts.

U.S.Retail Consumer Foods: Sales in the segment declined 4.6% in the quarter to $531.5 million. Higher net price realization, driven by the Jif and Smucker's brands, added 4% to sales. This was offset by 9% lower volume/mix from the Crisco and Pillsbury brands.

Segment profit increased 10% to $130.9 million as the impact of lower volume/mix was offset by higher pricing and reduced marketing expense.

U.S.Retail Pet Foods: Net sales increased 4% to $521.7 million in the quarter owing to improved volume/mix, primarily related to the Nature's Recipe and Meow Mix brands. Segment profit improved 7% to $122.9 million on the back of positive synergies and cost-saving efforts. These were partially offset by higher marketing expenses.

International and Away from Home: Effective May 1, 2017, the company's U.S. Foodservice business was renamed Away From Home.

Net sales increased 5% from the prior-year quarter to $287.3 million, reflecting favorable volume/mix driven by the Jif and Smucker's brands and positive impacts of currency rates. Segment profit increased 4% to reach $53.7 million owing to favorable volume mix and currency rates. These were partially offset by expenses related to the construction of the Smucker's Uncrustables production facility in Longmont, Colorado.

Financials

Smucker exited the quarter with cash and cash equivalents of $180.3 million, long-term debt of $4.30 billion and total shareholders’ equity of $7 billion. Cash flow from operations amounted to $130.3 million. The company generated free cash flow of $69.9 million during the quarter.

Fiscal 2018 Outlook

Following the second-quarter results, Smucker lowered the high end of its earnings guidance. The company envisions fiscal 2018 earnings in the range of $7.75-$7.90 per share, compared with the previous range of $7.75-$7.95. The company anticipates earnings for the fiscal year to be affected by unfavorable industry conditions and higher freight costs. Net sales for the fiscal year is anticipated to decline slightly or remain flat compared with the prior year.

However, management continues to expect capital expenditure of about $310 million in fiscal 2018, and also anticipates to generate free cash flow of about $775 million.

Zacks Rank & Key Picks

Smucker carries a Zacks Rank #3 (Hold). Investors interested in the same sector may also consider stocks such as McCormick & Company, Inc (NYSE:MKC), MGP Ingredients, Inc. (MGPI) and US Foods Holding Corp. (USFD). All these stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

McCormick delivered an average positive earnings surprise of 4.1% in the trailing four quarters. It has a long-term earnings growth rate of 9.4%.

MGP Ingredients delivered an average positive earnings surprise of 9.9% in the trailing four quarters. It has a long-term earnings growth rate of 15%.

US Foods Holding delivered an average positive earnings surprise of 5.9% in the trailing four quarters. It has a long-term earnings growth rate of 15%.

Zacks’ Best Private Investment Ideas

While we are happy to share many articles like this on the website, our best recommendations and most in-depth research are not available to the public.

Starting today, for the next month, you can follow all Zacks' private buys and sells in real time. Our experts cover all kinds of trades… from value to momentum . . . from stocks under $10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors.

Click here for Zacks' private trades >>

J.M. Smucker Company (The) (SJM): Free Stock Analysis Report

McCormick & Company, Incorporated (MKC): Free Stock Analysis Report

MGP Ingredients, Inc. (MGPI): Free Stock Analysis Report

US Foods Holding Corp. (USFD): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Broadcom stock is in a dynamic rebound phase. Markets seem optimistic ahead of the earnings release. Let's take a deep dive into what to expect from the report. Get the...

Consumers are feeling the pinch from inflation every time they go to the grocery store. Money is a zero-sum game; as disposable income and buying power erodes, consumers are...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.