- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Small Cap Value Style 3Q16: Best And Worst ETFs

The Small Cap Value style ranks last out of the twelve fund styles as detailed in our 3Q16 Style Ratings for ETFs and Mutual Funds report. Last quarter, the Small Cap Value style ranked last as well. It gets our Dangerous rating, which is based on an aggregation of ratings of 17 ETFs and 252 mutual funds in the Small Cap Value style as of August 4, 2016. See a recap of our 2Q16 Style Ratings here.

Figures 1 and 2 show the five best and worst rated ETFs and mutual funds in the style. Not all Small Cap Value style ETFs and mutual funds are created the same. The number of holdings varies widely (from 13 to 1364). This variation creates drastically different investment implications and, therefore, ratings.

Investors seeking exposure to the Small Cap Value style should buy one of the Attractive-or-better rated ETFs or mutual funds from Figures 1 and 2.

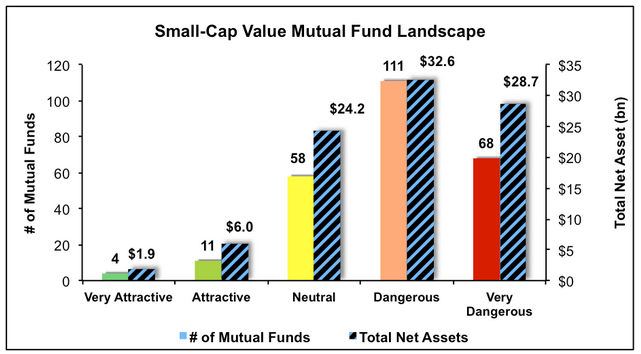

Figure 1: ETFs with the Best & Worst Ratings – Top 5

* Best ETFs exclude ETFs with TNAs less than $100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

First Trust Mid Cap Value AlphaDEX (NASDAQ:FNK) is excluded from Figure 1 because its total net assets (TNA) are below $100 million and do not meet our liquidity minimums.

Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5

* Best mutual funds exclude funds with TNAs less than $100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

PowerShares S&P SmallCap Low Volatility Portfolio (NYSE:XSLV) is the top-rated Small Cap Value ETF and Royce Small-Cap Value Fund (RVFIX) is the top-rated Small Cap Value mutual fund. XSLV earns an Attractive rating and RVFIX earns a Very Attractive rating.

Guggenheim Invest S&P MidCap 400 Pure Value (NYSE:RFV) is the worst rated Small Cap Value ETF and Dunham Small Cap Value Fund (DASVX) is the worst rated Small Cap Value mutual fund. RFV earns a Dangerous rating and DASVX earns a Very Dangerous rating.

The Buckle Inc (NYSE:BKE) ($26/share) is one of our favorite stocks held by RVFIX and earns a Very Attractive rating. Since 1998, Buckle has grown after-tax profit (NOPAT) by 11% compounded annually.

BKE has improved its return on invested capital (ROIC) from an already impressive 16% in 1998 to a top-quintile 25% during the past twelve months. Despite the impressive fundamental improvements, BKE remains undervalued.

At its current price of $26/share, Buckle has a price-to-economic book value (PEBV) ratio of 0.6. This ratio means that the market expects Buckle’s NOPAT to permanently decrease by 40%. If Buckle can grow NOPAT by just 1% compounded annually for the next 5 years, the stock is worth $54/share today – a 108% upside.

Flagstar Bancorp Inc (NYSE:FBC) ($26/share) is one of our least favorite stocks held by PSLAX and earns a Very Dangerous rating. Flagstar Bancorp was featured in the Danger Zone in May 2014 and operations have not improved since.

Over the past decade, Flagstar’s NOPAT has declined by 6% compounded annually. FBC’s ROIC has declined from 10% in 2005 to a bottom-quintile 1% over the last twelve months. Despite the deteriorating fundamentals, FBC remains overvalued.

To justify its current price of $26/share FBC must grow NOPAT by 10% compounded annually over the next 15 years. These expectations seem overly optimistic given Flagstar’s decade of declining profit.

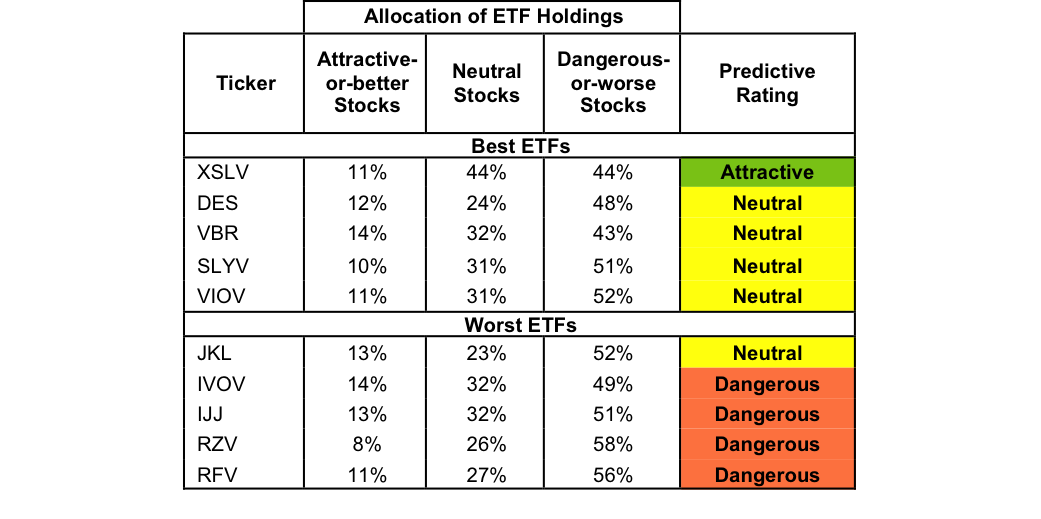

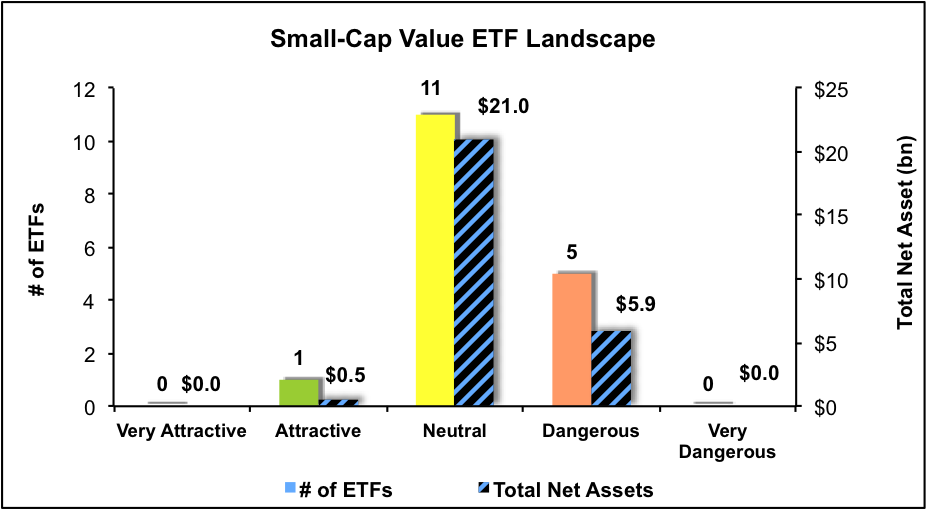

Figures 3 and 4 show the rating landscape of all Small Cap Value ETFs and mutual funds.

Figure 3: Separating the Best ETFs From the Worst Funds

Sources: New Constructs, LLC and company filings

Figure 4: Separating the Best Mutual Funds From the Worst Funds

Sources: New Constructs, LLC and company filings

Disclosure: David Trainer and Kyle Martone receive no compensation to write about any specific stock, style, or theme.

Related Articles

While market cap weighting is still the go-to for many investors due to its low cost and low turnover, it's becoming increasingly fragile these days thanks to the concentration...

The oldest ETF, the SPDR S&P 500 Trust, had the most inflows in February. The $14.6 billion in inflows allowed it to surpass the Vanguard S&P 500 ETF. Which ETFs saw the...

Leveraged exchange-traded funds (ETFs) substantially increase the potential reward of an investment by affording investors the chance to generate double or triple the returns of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.