- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Signet's (SIG) Q3 Earnings Meet, Stock Plunges On Bleak View

Signet Jewelers Limited (NYSE:SIG) reported mixed results in third-quarter fiscal 2018, wherein earnings came in line with the Zacks Consensus Estimate but revenues surpassed the same. Notably, both the top and bottom line have surpassed the consensus mark in the previous quarter.

Signet, which recently concluded the first phase of outsourcing of its credit portfolio to Alliance Data Systems as well as Genesis Financial Solutions, faced glitches in the credit transition process. The problem is likely to persist in the final quarter. Consequently, the company trimmed fiscal 2018 guidance.

The company now expected earnings per share in the range of $6.10-$6.50, sharply down from the prior guidance of $7.16-$7.56. Moreover, same store sales are anticipated to decline by mid-single digit, compared with the prior estimate of down low to mid-single digit. The company anticipated fourth-quarter same store sales to decline in the range of low to mid-single digits.

The impact of the bleak outlook is clearly visible on shares of this Hamilton, Bermuda-based company, which are down nearly 17% during the pre-market trading session. Nevertheless, the stock has witnessed a sharp gain of 45.4% in the past three months, compared with the industry’s increase of 15.9%.

However, the company is improving digital marketing efforts and also made changes to organizational structure. Taking in to account the success attained on its Customer-First Omni-channel strategy and other endeavors, Signet retained outlook. The company had earlier announced that it will sell $1 billion of prime-only credit quality accounts receivable to Alliance Data Systems Corporation (NYSE:ADS), as a part of its plan to outsource its in-house credit program.

The company is striving hard to position itself on growth trajectory. The company will invest between $245 million and $260 million toward opening of new Kay off-mall stores, remodeling, information and technology advancement as well as toward augmenting distribution facilities.

Coming to the Facts

Signet’s third-quarter adjusted earnings of 15 cents per share came in line with the Zacks Consensus Estimate. However on a GAAP basis, the company reported loss of 20 cents primarily due to cost related to the first phase of credit outsourcing as well as the R2Net buyout and also due to hurricanes.

The retailer of diamond jewelry and watches generated total sales of $1,156.9 million that decreased 2.5% year over year and also came below the Zacks Consensus Estimate of $1,172 million. Sales were negatively impacted by lower bridal sales and customer transactions. Moreover, same store sales were down 5% compared with a decrease of 2% registered in the prior-year period due to hurricanes and glitches in the credit transition process. E-commerce sales came in at $80.7 million, up 56.4% on a year-over-year basis.

Gross profit declined 8.3% to $321.1 million, while gross margin contracted 170 basis points (bps) to 27.8%. Operating income came in at $5.5 million, sharply down from the $32.1 million, while operating margin declined 220 bps to 0.5%.

Segment Discussion

Sales at the Sterling Jewelers Division dipped 1.9% to $698.7 million. Same store sales were down 6.2%, reflecting a decline of 7.6% in the number of transactions but an increase of 1.6% in average transaction value.

Sales at the Zale Division edged down 3.6% to $323.6 million. Same store sales decreased 2.5%, reflecting a slump in the number of transactions by 6.9%. However, average transaction value rose by 2.5%. Same store sales for Piercing Pagoda's jumped 2.1% and sales increased 3.7% to $55.4 million.

Sales at the UK Jewelry Division dropped 1.5% to $128.4 million. Same store sales fell 5.1%, reflecting a decline of 12.9% in the number of transactions but an increase of 8.3% in average transaction value.

Other segment sales came in at $6.2 million.

Other Details

Signet ended the fiscal quarter with cash and cash equivalents of $113.4 million, net accounts receivable of $640.1 million and inventories of $2,466.1 million. Long-term debt and total shareholders’ equity were $696.8 million and $2,139 million, respectively.

In fiscal 2018, the company plans to close 215-225 stores, while opening 90-100 fresh stores. As of Oct 28, 2017, the company operated 3,639 stores.

Signet currently carries a Zacks Rank #3 (Hold).

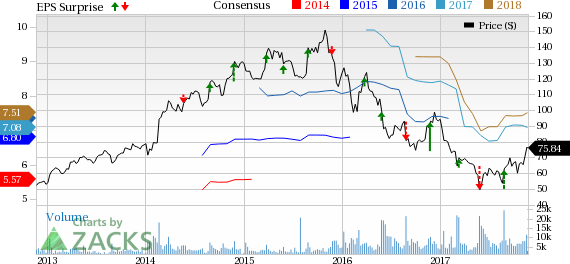

Signet Jewelers Limited Price, Consensus and EPS Surprise

3 Retail Stocks Likely to Steal the Show

Some better-ranked stocks worth considering from the retail space are American Eagle Outfitters, Inc. (NYSE:AEO) , Boot Barn Holdings, Inc. (NYSE:BOOT) and Shoe Carnival (LON:CCL), Inc. (NASDAQ:SCVL) , each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

American Eagle Outfitters delivered an average positive earnings surprise of 3.9% in the trailing four quarters and has a long-term earnings growth rate of 8.7%.

Boot Barn Holdings has an impressive long-term earnings growth rate of 15.7%.

Shoe Carnival delivered an average beat of 20% in the last four quarters and has a long-term earnings growth rate of 12%.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

American Eagle Outfitters, Inc. (AEO): Free Stock Analysis Report

Shoe Carnival, Inc. (SCVL): Free Stock Analysis Report

Signet Jewelers Limited (SIG): Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Walgreens Boots Alliance Inc. (NASDAQ:WBA) is on the brink of a significant transformation as it nears a deal with Sycamore Partners to become a private entity. The transaction,...

Using the Elliott Wave Principle (EWP), we have been successfully tracking the most likely path forward for the S&P 500 (SPX) over several months. Although there are many ways...

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.