- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

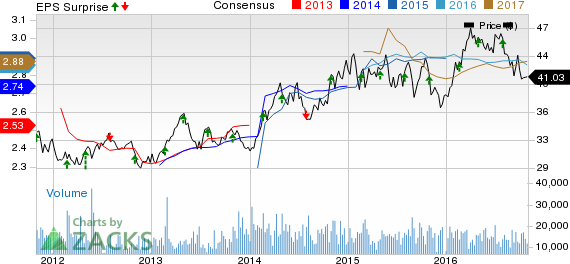

Public Service (PEG)Tops Q3 Earnings, Lowers '16 EPS View

Public Service Enterprise Group Inc. (NYSE:PEG) , or PSEG, reported third-quarter 2016 adjusted operating earnings of 88 cents per share, beating the Zacks Consensus Estimate by 8.6%. Earnings also improved 10% on a year-over-year basis, reflecting the benefits from the company’s expanded investment program.

Excluding the one–time adjustments, the company’s reported quarterly earnings were 64 cents per share, down 26.4% from 87 cents a year ago.

Total Revenue

Revenues of $2,450 million in the reported quarter missed the Zacks Consensus Estimate of $2,543 million by 3.7%, and fell 8.8% from the year-ago figure of $2,688 million.

During the reported quarter, electric sales volume increased 3.6% to 12,792 million kilowatt-hours, while gas sales volume decreased 0.5% to 861 million therms.

For electric sales, results reflected a 7.2% volume increase in the residential sector, a 1.5% rise in the commercial and industrial sector, a 1.3% growth in street lighting and 4.8% growth interdepartmentally.

Total gas sales volume in the reported quarter decreased due to 7.5% drop in firm sales volume of gas. However, a 1.5% growth was observed in non-firm sales volume of gas.

Highlights of the Release

Operating income tanked 29% year over year to $577 million in the quarter. Total operating expenses were $1,873 million, almost in line with the year ago quarter’s figure.

Interest expenses in the reported quarter were $99 million, up 3.1% from the year-ago level.

Segment Performance

PSE&G: Segment earnings were $255 million, up from $222 million in the prior-year period. Quarterly results reflect growth from expanded investment in electric and gas transmission and distribution facilities.

PSEG Power: The segment generated earnings of $139 million versus $206 million a year ago. The downside was due to the impact of the known decline in average prices on energy hedges and a decline in operating costs.

PSEG Enterprise/Other: The segment generated operating loss of $67 million, compared to operating earnings of $11 million in the third quarter of 2015.

Financial Update

As of Sep 30, 2016, cash and cash equivalents were $450 million, compared with $271 million as of Sep 30, 2015.

Long-term debt as of Sep 30, 2016 was $10,697 million, up from the 2015-end level of $9,568 million.

Public Service Enterprise Group generated $2,761 million in cash from operations in the first nine months of 2016, down 14.4% year over year.

2016 Guidance

The company lowered the higher limit of its earnings guidance. The company currently expects its earnings to be in the range of $2.80–$2.95, compared to the earlier earnings guidance range of $2.80–$3.00 per share.

PSE&G’s operating earnings are still expected in the range of $900–$935 million.

The company also continues to expect PSEG Power operating earnings in the $460–$525 million band.

PSEG Enterprise/Other’s operating earnings are still estimated to be $65 million.

Other Utility Releases

DTE Energy Company (NYSE:DTE) reported third-quarter 2016 operating earnings per share of $1.96, beating the Zacks Consensus Estimate of $1.54 by 27.3%. Reported earnings were also up 40% from the year-ago figure of $1.40.

Entergy Corporation (NYSE:ETR) reported third-quarter 2016 operating earnings of $2.31 per share, beating the Zacks Consensus Estimate of $1.95 by 18.5%. The reported number also improved 21.6% from $1.90 reported a year ago.

CMS Energy Corporation (NYSE:CMS) reported third-quarter 2016 adjusted earnings per share of 70 cents, beating the Zacks Consensus Estimate of 60 cents by 16.7%. Quarterly earnings also increased 32.1% from the year-ago figure of 53 cents.

Zacks Rank

Public Service Enterprise Group currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

CMS ENERGY (CMS): Free Stock Analysis Report

ENTERGY CORP (ETR): Free Stock Analysis Report

DTE ENERGY CO (DTE): Free Stock Analysis Report

PUBLIC SV ENTRP (PEG): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Nvidia is scheduled to release its Q4 earnings report at 4:20PM ET on Wednesday. A call with CEO Jensen Huang is set for 5:00PM ET. The chipmaker’s results will serve as a...

Warren Buffett has always critiqued airline stocks for being overly capital-intensive, exhibiting low growth, and relying heavily on cyclical consumer travel patterns—further...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.