- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Should You Own Applied Materials (AMAT) Ahead Of Earnings?

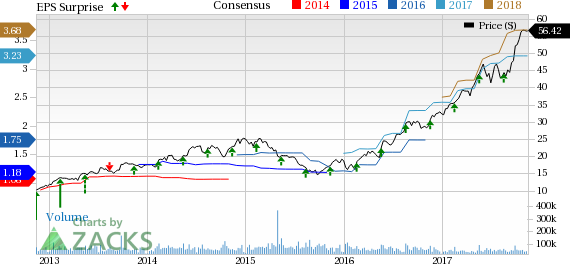

On Thursday, November 16th, Applied Materials (NASDAQ:AMAT) will release its fourth quarter earnings results fter the bell. The company is a Zacks Rank 2 (Buy), and have a Value, Growth, and Momentum score of B.

Dave will look at Applied Materials’s past earnings, take a look at what is currently going on with the company, and give us his thoughts on their upcoming earnings announcement.

Furthermore, Dave will uncover some potential options trades for investors looking to make a play on Applied Materials ahead of earnings.

Applied Materials in Focus

Applied Materials, Inc. expertise in modifying materials at atomic levels and on an industrial scale enables customers to transform possibilities into reality. The Company offer consulting, spare parts, services, automation software, upgrades and legacy equipment to improve the performance and productivity of the customer's equipment and fab operations. Applied Materials offers a diverse array of flexible service solutions to increase equipment uptime and factory efficiency, enabling fabs to focus on chip production, while lowering cost per wafer. The Company's display service portfolio has been developed to address the customers' specific needs and offers a variety of services that provide support for every maintenance activity on an Applied Materials display tool. Applied Materials is committed to the success of the customers throughout the product and factory life cycle and their crystalline silicon solar (c-Si) services enable the customers to focus on increasing cell efficiency and meeting factory goals.

Applied Materials is expected to report earnings at $0.90 per share according to the Zacks Consensus Estimate. Last quarter they beat earnings expectations by 3.61%. They reported earnings at $0.86 per share, beating their estimate of $0.83. They have an average earnings surprise of 2.66% over the last 4 quarters.

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Defense stocks took a tumble heading into 2025 as President Trump returned to the White House for his second term. Trump has stated his intent as a peacemaker to bring the wars in...

Using the Elliott Wave Principle (EWP), we have been tracking the most likely path forward for the Nasdaq 100 (NDX). Although there are many ways to navigate the markets and to...

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.