- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Semtech (SMTC) Q4 Earnings & Revenues Surpass Estimates

Semtech Corporation’s (NASDAQ:SMTC) fiscal fourth-quarter 2020 non-GAAP earnings of 40 cents per share surpassed the Zacks Consensus Estimate by 5 cents. However, the reported earnings decreased 2.4% sequentially and 27.3% year over year.

Non-GAAP revenues of $138 million decreased 2.1% sequentially and 13.8% from the prior-year quarter. The decrease was due to softer demand from industrial and consumer end markets, partially offset by stronger demand from enterprise computing and communications end markets.

Revenues surpassed the Zacks Consensus Estimate by 2.6% and came at the higher end of the guided range of $130-$140 million.

Its key growth drivers are product differentiation, operational flexibility, and specific focus on fast-growing segments and regions.

Let’s delve into the numbers in detail:

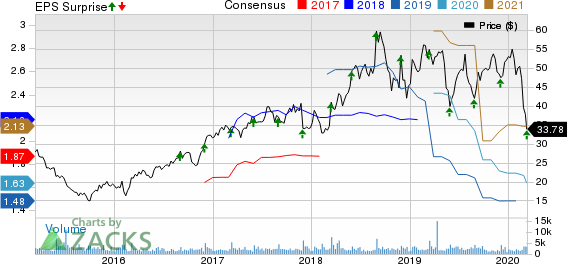

Semtech Corporation Price, Consensus and EPS Surprise

Revenues by End Market

Sales to the enterprise computing end market — which represented 32% of its total revenues — increased on a sequential basis, driven by a strong rebound in PON demand. Also, communications end market increased sequentially, representing 10% of the total revenues.

However, revenues from the industrial market decreased from the prior-year quarter and represented 31% of total net revenues.

Also, sales to the high-end consumer market represented 26% of total revenues and decreased sequentially due to lower smartphone demand. Roughly 18% of high-end consumer revenues were attributable to mobile devices and 8% to other consumer systems.

Revenues by Product Group

Signal Integrity Product Group revenues contributed 43% to total sales. The reported figure increased 1% sequentially. The sequential increase was driven by stronger demand from data center and base station segments.

Revenues from Protection Product Group represented 27% of the total revenues. The figure was down 6% sequentially due to weak smartphone demand.

However, management expects prospects for protection platforms in mobile devices, displays and accessories to remain positive in the near term as 5G smartphones integrate higher performance interfaces and more advanced photography devices.

Revenues from Wireless and Sensing Product Group, which contributed 30% to total revenues, decreased 2% sequentially.

Bookings

Bookings, which accounted for roughly 37% of shipments, decreased on a sequential basis during the quarter. The book-to-bill ratio was above 1.

Margins and Net Income

Non-GAAP gross margin was 61.5%, down 10 basis points (bps) sequentially and 60 bps from the year-ago quarter.

Semtech’s adjusted selling, general and administrative expenses increased 4.6% year over year to $29.8 million. However, product development and engineering expenses decreased 1% from the year-ago quarter to $24.1 million.

As a result, its operating margin of 22.5% was down 150 bps sequentially and 640 bps year over year.

Balance Sheet & Cash Flow

Semtech ended the quarter with cash and cash equivalents of $293.3 million versus $283.1 million in the fiscal third quarter. Accounts receivables were $61.9 million, up from $61.4 million in the fiscal third quarter. Long-term debt was $194.7 million, up from $179.1 million in the fiscal third quarter.

During the quarter, cash flow from operations was $45.3 million, capital expenditure amounted to $2.6 million and free cash flow totaled $42.6 million.

During the quarter, the company repurchased 0.5 million shares for $27.6 million.

Guidance

For fiscal first-quarter 2021, management expects revenues in the range of $125-$135 million. The corresponding Zacks Consensus Estimate for the quarter is pegged at $135.43 million.

Non-GAAP gross profit margin is expected within 61-62%. Management projects SG&A expenses within $28-$29 million, and research and development costs in the range of $24-$25 million. Non-GAAP earnings per share are expected in the range of 30-36 cents. The Zacks Consensus Estimate for the same is pegged at 35 cents.

Zacks Rank and Stocks to Consider

Semtech currently has a Zacks Rank #4 (Sell). Some better-ranked stocks in the broader technology sector include Stamps.com Inc. (NASDAQ:STMP) , eBay Inc. (NASDAQ:EBAY) and Atlassian Corp. (NASDAQ:TEAM) . While Stamps.com and eBay sport a Zacks Rank #1 (Strong Buy), Atlassian carries a Zacks Rank #2 (Buy).You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term earnings growth for Stamps.com, Atlassian Corp. and eBay is currently projected at 15%, 22.3% and 11.3%, respectively.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

eBay Inc. (EBAY): Free Stock Analysis Report

Semtech Corporation (SMTC): Free Stock Analysis Report

Atlassian Corporation PLC (TEAM): Free Stock Analysis Report

Stamps.com Inc. (STMP): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Whenever Wall Street authoritative figures, such as a large institution or individual investor, decide to shift a view on a specific stock or industry, retail traders can...

Monster Beverage (NASDAQ:MNST) faces headwinds that make it a potentially scary buy, including weakness in the alcohol segment. With the alcohol business contracting in Q4 2024,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.