- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Match Group A Strong Buy On Growing Clout Of Dating Apps

Match Group, Inc. (NASDAQ:MTCH) has demonstrated impressive performance on the bourses consistently over the past three years. The stock, which was valued at $14 three years back, currently trades close to $71, reflecting a five-fold jump.

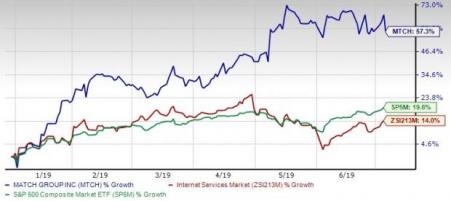

Notably, the company has gained approximately 18.5% since it reported first-quarter 2019 results on May 7. Year to date, shares of Match Group have returned approximately 57.3% significantly outperforming the industry’s rally of 14%.

In the same period, this Zacks Rank #1 (Strong Buy) stock has outperformed S&P 500 index's growth of 19.6%.

Year to Date Price Performance

The outperformance can primarily be attributed to robust adoption of Tinder offering, which is driving financial performance. We note that Match Group has a positive earnings surprise of 20.24% in the trailing four quarters.

Key Drivers

Strong product portfolio comprising Tinder, Match.com, OkCupid (acquired in February 2011), Meetic, PlentyOfFish (acquired in July 2015) and Hinge are aiding Match Group's top line.

Tinder has been the key catalyst behind the company's year-over-year revenue growth. Direct revenues from Tinder grew 38% year over year in the last-reported quarter. Tinder average subscribers increased 36% year over year and came in at 4.7 million. This marked an increase of 384,000 sequentially and 1.3 million year over year.

Better-than-expected renewal rates for Gold remain a positive. In the first quarter, Average Revenue per Subscriber (ARPU) in Tinder grew 2% year over year, primarily due to Gold adoption.

Exploring Growth Opportunities in India to Augment Growth

Match Group is leaving no stone unturned to capitalize opportunities in India. The country is currently experiencing demographic dividend, wherein majority of the population is below 35 years of age. A burgeoning well educated middle class, increasing spending power and rapid adoption of smartphones are enhancing the company’s business prospects.

In the first quarter, management noted that with initial levels of investment in India, OkCupid downloads soared 600% year over year in first quarter. Tinder and OkCupid dating apps are becoming increasingly popular among single millennials in the country. Management notes that migration of youngsters to bigger cities and lessening allegiance to arranged marriage are favoring growth prospects in India.

Growing Internet penetration in overall South-east Asia and impending launch of Tinder Lite are expected to be tailwinds.

Encouraging Estimate Revisions

Over the last 60 days, fiscal 2019 estimates were revised 17.9% upward driving the Zacks Consensus Estimate to $1.91 per share. The figure reflects year-over-year growth of 25.7%.

Wrapping Up

Match Group is considered to have pioneered the concept of online dating, which is why it enjoys a first mover's advantage in this market. The company has been benefiting from increasing subscriber addition in the form of membership subscriptions.

With robust initiatives, expanding international presence and accretive acquisitions, Match Group is likely to gain further momentum.

We suggest investors to buy the stock as odds in favor of an upside at least in the near-term are high.

Other Key Picks

Some other top-ranked stocks worth considering in the broader sector are Rosetta Stone Inc. (NYSE:RST) , Five9, Inc. (NASDAQ:FIVN) and j2 Global, Inc. (NASDAQ:JCOM) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term earnings growth rate for Rosetta Stone, Five9 and j2 Global is pegged at 12.5%, 10% and 8%, respectively.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Match Group, Inc. (MTCH): Free Stock Analysis Report

j2 Global, Inc. (JCOM): Free Stock Analysis Report

Five9, Inc. (FIVN): Free Stock Analysis Report

Rosetta Stone (RST): Free Stock Analysis Report

Original post

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.