- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Scotts Miracle-Gro (SMG) Announces Preliminary Results For Q2

The Scotts Miracle-Gro Company (NYSE:SMG) reported preliminary results for second-quarter fiscal 2020 (ending Mar 28, 2020). The company stated that the demand for its U.S. Consumer and Hawthorne businesses has witnessed a surge in recent weeks, particularly in edible gardening, professional growing and pest-control-focused categories.

Scotts Miracle-Gro expects company-wide sales to rise 16-17% year over year in the fiscal second quarter. Sales in the U.S. Consumer and Hawthorne units are expected to increase around 12% and at least 55% in the quarter, respectively.

In the U.S. Consumer division, the company has witnessed a sharp rise in demand in March, which is expected to boost consumer purchases by nearly 25% in the fiscal second quarter. Moreover, purchases of soil and insect control rose roughly 35% and 45% in March, respectively.

Per the company, the demand in all areas of the business increased in recent weeks. However, it remains cautious of potential challenges from a dramatic slowing of the economy in the coming weeks. Also, it has no liquidity concerns and is well-positioned to resume normal business operations once the crisis passes.

The company also noted that some capital expenditure may be delayed until the next year, while share repurchase activities have been suspended. While Scotts Miracle-Gro is not changing the full-year view at present, it has acknowledged potential risks to consumer purchases in the coming months. Also, it has not witnessed any significant disruptions so far, in terms of incoming supplies and raw material or delays in shipments to retailers and other customers. All of the major retail partners of the company are designated as essential services and have been remained open.

Scotts Miracle-Gro intends to announce its fiscal second-quarter results on May 6.

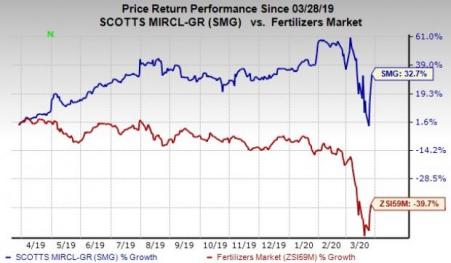

Shares of the company have gained 32.7% in the past year against the industry’s 39.7% decline.

Zacks Rank & Other Key Picks

Scotts Miracle-Gro currently carries a Zacks Rank #2 (Buy).

Few other top-ranked stocks in the basic materials space are Newmont Corporation (NYSE:NEM) , Franco-Nevada Corporation (TSX:FNV) and Novagold Resources Inc. (NYSE:NG) , all currently sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Newmont has an expected earnings growth rate of 72% for 2020. The company’s shares have gained 35.7% in the past year.

Franco-Nevada has an expected earnings growth rate of 37.6% for 2020. Its shares have returned 46.6% in the past year.

Novagold has an expected earnings growth rate of 11.1% for fiscal 2020. The company’s shares have surged 104.3% in the past year.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Newmont Goldcorp Corporation (NEM): Free Stock Analysis Report

Franco-Nevada Corporation (FNV): Free Stock Analysis Report

The Scotts Miracle-Gro Company (SMG): Free Stock Analysis Report

Novagold Resources Inc. (NG): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.