- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Scandi Central Banks Don’t Disappoint, U.K GDP Surprises

It’s business as usual from two of Scandinavia’s key central banks Thursday as Norway’s Norges and Sweden’s Riksbank left their main overnight funding rates unchanged.

In the U.K, GDP beat expectations despite June’s Brexit vote.

Norges seems done for now

Norway’s decision was as expected, judging that the current cost of borrowing (+0.5% since March) will help keep inflation close to their +2.5% target as the economy gathers pace. Last month’s inflation rate was +2.9%, down from an elevated +3.3% pace set in August.

Norges Bank officials said consumer prices inflation had been lower than expected but “overall the economic outlook implies that the key policy rate should remain unchanged at this meeting and “in the period ahead.”

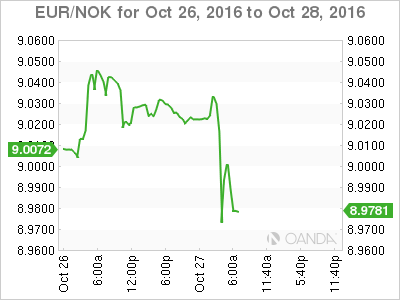

The markets immediate response saw the single unit come under pressure – EUR/NOK has fallen to €8.99 from €9.02 – as investors deem the bank’s statement more “neutral” than “dovish.” In Governor Olsen’s post rate decision press conference he noted that the krone was stronger than their September forecast.

Short-term Norwegian bonds are stable and trading little changed – two-year debt currently yields +0.71%, while 10-year product is trading at +1.33%.

Riksbank a “dove”

There were no surprises from Sweden’s Riksbank, it too held its main repo rate steady at -0.5%, however, unlike the Norges decision, the probability of a cut in December is on the rise.

Riksbank officials indicated that they expect the rate to stay at this level for six- months longer than first estimated last month, adding that the probability that the benchmark rate will be cut further has increased.

Officials do not expect to begin raising rates until early 2018, and sees the average rate for 2017 at -0.6%, down from -0.5% previously, and the 2018 rate at -0.3%, against +0.0% previously.

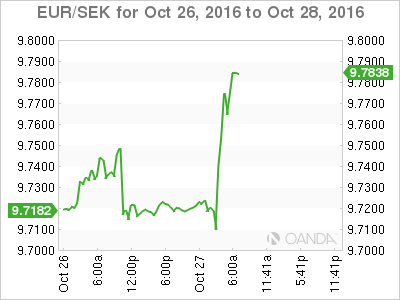

EUR/SEK has had a knee jerk reaction. The SEK briefly strengthened, but has since quickly turned lower outright as details of the Riksbank decision became much clearer. EUR/SEK is currently trading up around +€9.7790, compared with around €9.7126 before the decision.

U.K economy see Q3 growth, but….

Data this morning indicates that the U.K economy fared better than expected in the first three-months following their historic vote to exit the European Union in June.

In the most comprehensive snapshot of their economy since the Brexit vote, data shows that their economy has expanded +0.5% in Q3 (+0.3% exp.), an annualized rate of +2%, but down Q/Q when it grew +0.7%, an annualized rate of +2.7%.

This mornings release certainly paints a better picture than expected, but take heed, a deeper slowdown is expected to remain ahead. Ongoing uncertainty over the U.K’s ties to the E.U continues to weigh on business investment and the pounds demise (£1.2222) is yet to hurt the U.K consumer via an inflation squeeze.

Today’s print should take the Bank of England (BoE) out of the picture next week. In August, a majority of members expected to cut rates again this year assuming that GDP would disappoint, however, today’s surprise should keep Carney and company on the sidelines watching for concrete evidence that Q4 will struggle.

Sterling rally short lived

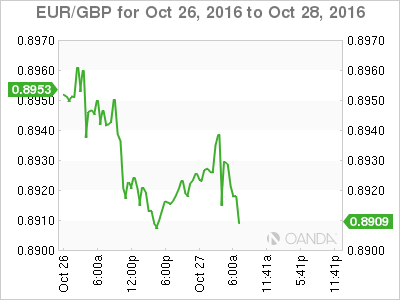

The pounds immediate gains on the release have been short-lived – GBP/USD trades at £1.2225, pulling back after initially rising to a one-week high just north of £1.2262.

Much of this market remains sceptical that sterling gains are sustainable. With that mindset, GBP ‘offers’ continue to appear on the topside with most pound rallies being sold into.

Current market expectations are looking for the pound to retest its “flash” crash Oct. 7 lows outright again (£1.1649).

Related Articles

An aggressive fiscal spending proposal by Germany has attracted bullish animal spirits into EUR/USD. A significant rally in the longer-end German Bund yields is likely to alter...

USD/JPY trades heavy despite widening yield differentials Non-farm payrolls loom large as traders focus on the unemployment rate. Mixed signals in data could see choppy trade,...

US Dollar Key Points Traders are starting to price in the potential for outright contraction in the US economy. Meanwhile, Germany’s announcement of a €500B infrastructure and...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.