- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Sanguine Prospects For Cable Television Industry's Near Term

The Zacks Cable Television industry primarily comprises companies that provide integrated data, video and voice services. The industry participants like Comcast (CMCSA) offer pay-TV services, including Internet-based streaming content. Some of the companies like DISH Corporation (DISH) provide equipment like satellite dish, digital set-top receivers and remote controls.

Typically, cable companies either build their own network backbone or lease physical access to the network backbone from telecommunications companies. They also purchase licenses to provide subscribers access to cable television channels owned by programmers and distributed over the network backbone. Cable companies also sell advertising spots on their channels.

The industry requires high capital expenditure on infrastructure to enhance services. Moreover, the industry is highly regulated by the Federal Communications Commission (FCC).

Here are the industry’s four major themes:

- The growing demand for high-speed Internet including broadband has benefited the cable television industry participants like Comcast and Charter Communications (NASDAQ:CHTR) (CHTR). Improving Internet speed is driving demand for high-quality video and the trend of binge viewing. Further, improving broadband ecosystem in international markets along with proliferation of smart TVs is anticipated to drive growth. Moreover, surging work-from-home trend and online-learning practice due to the coronavirus-induced quarantines and lockdowns spiked Internet usage, which is benefiting the industry participants.

- The cable television industry is witnessing rapid evolution of distribution platforms as well as embracing new players and advanced technologies. Declining profitability of residential video services due to increasing programming costs and retransmission fees has made survival difficult for traditional companies. Additionally, rising need for on-demand content has led to the mushrooming of streaming service providers like Netflix (NASDAQ:NFLX), Hulu, HBO and Amazon (NASDAQ:AMZN) Prime. This has made it particularly tricky for traditional cable television companies to maintain a viewer base. Further, the traditional pay-TV industry is maturing with widespread consolidation. Moreover, residential voice service revenues are declining due to the rising shift to wireless voice services.

- Growing consumer preference for digital and subscription services instead of linear pay-TV and rental or outright purchase has compelled industry participants to alter their business models. Moreover, consumers’ unfavorable disposition, particularly toward advertising, has hit industry participants hard. Cable television companies are now offering a variety of alternative packages, including skinny bundles, which are delivered at lower costs than traditional offerings. They are also innovating in terms of original content to remain competitive against streaming service providers.

- Cable television’s ability to generate ad revenues outside traditional TV platforms such as websites and any digitally-consumed platforms provides increased scope for target-based advertising. However, weakness in auto, which is a major ad category, is a concern for the industry. Moreover, cancellation of big sports events like the Tokyo Olympics due to the coronavirus pandemic is expected to hurt ad-sales in the near term. Further, the industry faces significant regulatory hurdles related to mergers and acquisitions.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Cable Television industry is housed within the broader Zacks Consumer Discretionary sector. It carries a Zacks Industry Rank #24, which places it in the top 9% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all member stocks, indicates solid near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

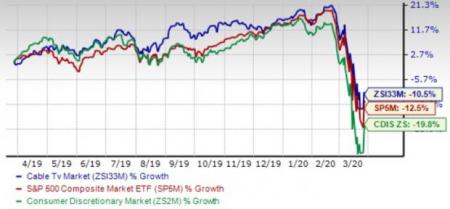

Industry Outperforms Sector, S&P 500

The Zacks Cable Television industry has outperformed the broader Zacks Consumer Discretionary sector as well as the S&P 500 composite over the past year.

The industry has declined 10.5% over this period compared with the broader sector’s fall of 19.8%. The S&P 500 has also decreased 12.5%.

One-Year Price Performance

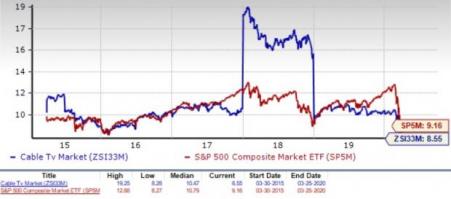

Industry’s Current Valuation

On the basis of the trailing 12-month EV/EBITDA, a commonly used multiple for valuing cable companies, we see that the industry is currently trading at 8.55X compared with the S&P 500’s 9.16X and the sector’s 8.91X.

Over the past five years, the industry has traded as high as 19.25X, as low as 8.27X and at the median of 10.47X as the chart below shows.

EV/EBITDA Ratio (TTM)

Stocks to Watch

Cable companies are trying to fast adapt to the changing industry landscape. Focus on providing bundled offerings and on-demand programming content that cater to changing consumer behavior bodes well for industry participants.

Currently, none of the stocks in the Zacks Cable Television industry flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Here, we present two stocks that have a Zacks Rank #2 (Buy) and are well-positioned to grow in the near term.

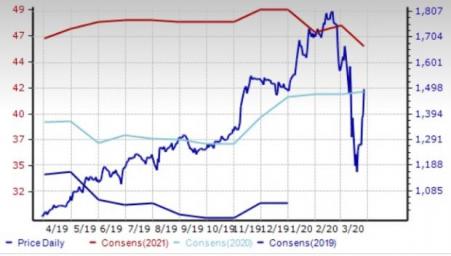

Cable One (CABO): This Phoenix, AZ-based broadband communications provider has soared 51.5% in the past year. The Zacks Consensus Estimate for this company’s 2020 earnings has inched up 0.6% to $41.68 over the past 30 days.

Price and Consensus: CABO

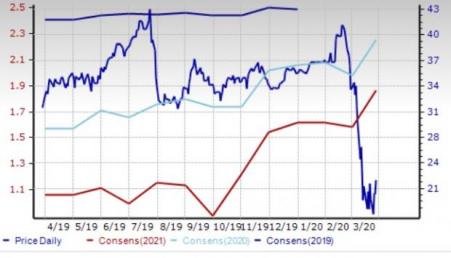

DISH Network: This Englewood, CO-based Pay-Tv service provider has declined 28.5% in the past year. The consensus estimate for this company’s 2020 earnings has increased 8.7% to $2.25 per share over the past 30 days.

Price and Consensus: DISH

DISH Network Corporation (NASDAQ:DISH): Free Stock Analysis Report

Comcast Corporation (NASDAQ:CMCSA): Free Stock Analysis Report

Charter Communications, Inc. (CHTR): Free Stock Analysis Report

Cable One, Inc. (CABO): Free Stock Analysis Report

Original post

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.