- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Salesforce (CRM) Q4 Earnings Beat Estimates, Revenues Up Y/Y

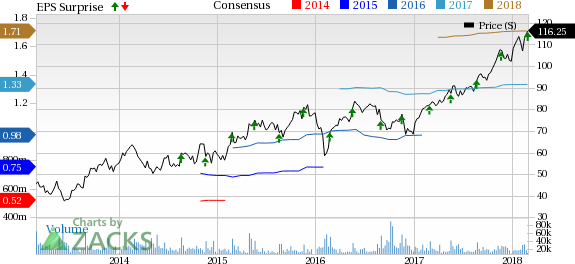

Salesforce.com Inc. (NYSE:CRM) reported fourth-quarter fiscal 2018 non-GAAP earnings of 35 cents per share, which beat the Zacks Consensus Estimate by a couple of cents and came ahead of the guided range of 32-33 cents. The figure jumped 25% primarily driven by strong top-line growth.

Revenues of $2.85 billion increased 24.3% year over year and surpassed the Zacks Consensus Estimate of $2.81 billion. Furthermore, revenues came above the guided range of $2.80-$2.81 billion. Revenues grew 21% at constant currency (cc). The improvement can be primarily attributable to rapid adoption of the company’s cloud-based solutions.

Shares increased 1.25% in after-hour trading.

Top-line Details

Now, coming to its business segments, revenues at Subscription and Support increased about 25.8% from the year-ago quarter to $2.66 billion. Professional Services and Other revenues climbed 6.9% to $193.7 million.

Sales Cloud, Service Cloud, Platform and other and Marketing & Commerce Cloud grew 16%, 28%, 37% and 33%, respectively.

Geographically, the company witnessed revenue growth of 19%, 31% and 26% at constant currency (cc) in the Americas, Europe and Asia Pacific, respectively, on a year-over-year basis.

Customer adoption improved in the quarter. Of the top 10 customers up for renewal in the quarter, eight expanded their relationship with Salesforce.

The number of deals worth more than $1 million grew 43% in the quarter. Average deal size continued to expand. Salesforce’s clientele also expanded with the addition of Siemens, ABB, Deutsche Bahn, BBVA (MC:BBVA), and Alphabet (NASDAQ:GOOGL) Google during the quarter.

Salesforce is also aggressively penetrating varied industries like financial services and healthcare. During the quarter, the company expanded relationships with TD Bank, Pacific Life, Mass Mutual, Anthem and Cancer Treatment Centers of America.

The company’s ecosystem continues to expand, with 55% of new business generated from partners like Dell, IBM (NYSE:IBM) and Amazon.com (NASDAQ:AMZN) . The new strategic partnership with Google will connect Salesforce with Google Cloud and Google Analytics.

The partnership with Amazon Web Services (AWS) has been helping Salesforce expand its international operations in countries like Australia and Canada.

Earlier, the company used to run its software at its own data centers, which was curbing its growth potential. However, the company decided to utilize the AWS data center’s geographical reach to expand its international business. In addition, Salesforce plans to invest about $400 million on AWS’ cloud platform over the next four years.

Operating Details

Salesforce’s non-GAAP gross profit came in at $2.18 billion, up 25.4% from the year-ago quarter. Gross margin expanded 70 basis points (bps) to 76.6%, primarily owing to solid revenue growth.

Non-GAAP operating expenses increased 24.5% year over year to $1.80 billion. As a percentage of revenues, operating expenses increased 10 bps to 63.1%. The increase in expenses was due to higher commissions and other selling-related expenses.

Management stated that selling costs increased due to accelerated hiring of sales people, international expansion and continuing investments in new businesses.

Salesforce posted non-GAAP operating income of $384.4 million, up 30.2% year over year. Operating margin expanded 60 bps to 13.5% driven by an improved gross margin base and lower operating expenses as a percentage of revenues.

Balance Sheet & Cash Flow

Salesforce exited the quarter with cash, cash equivalents and marketable securities of $4.52 billion compared with $3.63 billion in the previous quarter.

As of Jan 31, 2018, total deferred revenues were $7.09 billion, up 28% on a year-over-year basis (25% at cc). Unbilled deferred revenues surged 48% to $13.3 billion.

Salesforce generated operating cash flow of $2.74 billion and free cash flow of $913.6 million.

Guidance

For first-quarter fiscal 2019, revenues are projected between $2.925 billion and $2.935 billion, an increase of 23% year over year.

Non-GAAP earnings are expected in the range of 43–44 cents per share.

Deferred revenues are anticipated to increase in the range of 23–24% year over year.

For fiscal 2019, revenues are projected between $12.6 billion and $12.65 billion, an increase of 20–21% year over year.

Operating margin is expected to expand 125-150 bps. Non-GAAP earnings are expected in the range of $2.02–$2.04 per share.

Operating cash flow is anticipated to increase in the range of 20–21% year over year. Capital expenditure is expected to be approximately 5% of revenues.

Conclusion

Impressive fourth-quarter results and achievement of the $10 billion revenue milestone in fiscal 2018 makes Salesforce confident of its ability to reach its long-term target of $20–$22 billion in revenues by fiscal 2022.

We consider the rapid adoption of the Salesforce1 Customer Platform to be a positive. The company’s diverse cloud offerings, expanding partner base and considerable spending on digital marketing are key catalysts. Additionally, strategic acquisitions and the resultant synergies are anticipated to prove conducive to growth in the long haul.

In view of increasing customer adoption and satisfactory performances, market research firm, Gartner acknowledged Salesforce as the leading social CRM solution provider. We believe that the rapid adoption of the company’s platforms indicates solid growth opportunities in the ever-growing cloud computing segment.

Zacks Rank & Stock to Consider

Salesforce currently carries a Zacks Rank #3 (Hold).

Aspen Technology (NASDAQ:AZPN) is a better-ranked stock in the same sector with a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Aspen is currently projected to be 10.50%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Salesforce.com Inc (CRM): Free Stock Analysis Report

Aspen Technology, Inc. (AZPN): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Nvidia is scheduled to release its Q4 earnings report at 4:20PM ET on Wednesday. A call with CEO Jensen Huang is set for 5:00PM ET. The chipmaker’s results will serve as a...

Warren Buffett has always critiqued airline stocks for being overly capital-intensive, exhibiting low growth, and relying heavily on cyclical consumer travel patterns—further...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.