- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Salesforce (CRM) Q3 Earnings & Sales Top, Lifts FY18 View

Salesforce.com Inc. (NYSE:CRM) posted strong third-quarter fiscal 2018 results with the top and bottom line surpassing the Zacks Consensus Estimate and management’s guided range. Quarterly revenues and earnings also improved year over year.

The company reported non-GAAP earnings of 39 cents per share, which outpaced the Zacks Consensus Estimate of 37 cents and came ahead of its own guidance range of 31-32 cents as well. Moreover, the figure compared favorably with the year-ago quarter’s earnings of 24 cents, mainly driven by strong top-line growth and efficient cost management, partially offset by increased number of outstanding shares.

So far this year, the stock has outperformed the industry. Salesforce has returned 58.9% compared with 35.7% growth of the industry it belongs to.

Before discussing the fiscal third-quarter results in detail, here are some important business highlights of the quarter.

Amazon Partnership Stoking International Growth

The company still generates only about 30% of total revenues from international operations, which is much lower than its rivals like Microsoft (NASDAQ:MSFT) or Oracle (NYSE:ORCL) composition of around 50%. Nonetheless, Salesforce noted that its partnership agreements with Amazon’s (NASDAQ:AMZN) Amazon Web Services (AWS) last year have been helping it expand its international operations.

Earlier, the company used to run its software at its own data centers, which was curbing its growth potentials. However, the company decided to utilize the AWS data center’s geographical reach to expand its international business in the previous year. In addition, Salesforce has planned to invest about $400 million on AWS’ cloud platform, over the next four years.

Of late, Salesforce also entered into an agreement with AWS to run its software in the latter’s Canadian and Australian data centers. This, in turn, has opened up fresh prospects in the Canadian and Asia-Pacific markets.

During the fiscal third quarter, the company won several deals backed by its international expansion initiatives. Companies like Hilton, DuPont (NYSE:DWDP), National Australia Bank and Hitachi picked Salesforce’s solutions to fuel digital transformation.

Having discussed the third quarter business highlights, let’s now turn to the financial results.

Revenues

Salesforce continued to witness solid growth in revenues. The company’s revenues of $2.68 billion jumped 24.9% year over year and also surpassed the Zacks Consensus Estimate of $2.648 billion. Furthermore, reported revenues came above the guided range of $2.64-$2.65 billion (mid-point: $2.645 billion).

The improvement can be primarily attributable to rapid adoption of the company’s cloud-based solutions. Also, higher demand for the Salesforce ExactTarget Marketing Cloud platform, part of the Salesforce1 Customer Platform, drove the year-over-year upside in revenues.

Now, coming to its business segments, revenues at Subscription and Support climbed about 25.3% from the year-ago quarter to $2.486 billion. Professional Services and Other revenues surged almost 20.5% to $193.7 million.

Geographically, the company witnessed constant currency revenue growth of 21%, 33% and 27% in the Americas, EMEA and APAC, respectively, on a year-over-year basis.

Margins

Salesforce’s non-GAAP gross profit came in at $2.038 billion, up 25.6%. Additionally, gross margin expanded 40 basis points (bps) to 76.1% primarily owing to solid revenue growth that was partially offset by increased investment in infrastructure development including the expansion of the international data centers.

Non-GAAP operating expenses increased up 18.6% from the prior-year quarter to $1.601 billion. However, as a percentage of revenues, operating expenses decreased to 59.8% from 63% in the year-ago quarter. This was primarily because of efficient cost management.

Salesforce posted non-GAAP operating income of $436.9 million compared with the year-ago figure of $272.6 million while operating margin advanced 360 bps to 16.3%. The year-over-year increase in non-GAAP operating margin was mainly driven by improved gross margin and lower operating expenses as a percentage of revenues.

Non-GAAP net income grew 66.4% year over year to $284.4 million while net income margin expanded 260 bps to 10.6%. The benefit from improved gross margin and lower operating expenses as a percentage of revenues on net income margin was partially offset by elevated interest and other expenses.

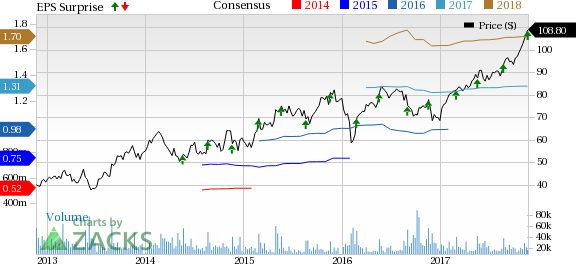

Salesforce.com Inc Price, Consensus and EPS Surprise

Balance Sheet & Cash Flow

Salesforce exited the reported quarter with cash and cash equivalents and marketable securities of $3.63 billion compared with $3.50 billion in the previous quarter. Accounts receivable were $1.520 billion compared with $1.569 million at the end of the fiscal first quarter. As of Oct 31, 2017, total deferred revenues were $4.39 billion, up 26% on a year-over-year basis.

During the first three quarters of fiscal 2018, the company generated operating cash flow of $1.687 billion. Also, it generated free cash flow of $1.290 billion in the first nine months of fiscal 2018.

Guidance

Buoyed by better-than-expected fiscal third-quarter results, the company provided an encouraging guidance for the fiscal fourth quarter and raised its outlook for the full year as well. For the fiscal fourth quarter, the company anticipates revenues in the range of $2.801-$2.811 billion (mid-point: $2.806 billion), representing a year-over-year increase of 22-23%. The guided range is higher than the Zacks Consensus Estimate of $2.79 billion.

Further, the company expects non-GAAP earnings per share in the band of 32-33 cents. On a GAAP basis, the same is anticipated between 3 cents and 4 cents. The Zacks Consensus Estimate is currently pegged at 33 cents.

Additionally, Salesforce raised its revenues and earnings outlook for fiscal 2018. Revenues are now anticipated to come in the range of $10.43-$10.44 billion (mid-point $10.435 billion), up from the previous projection of $10.35-$10.40 billion (mid-point $10.375 billion), representing a 24% year-over-year increase. The Zacks Consensus Estimate is currently pegged at $10.39 billion.

By completing this target, the company is expected to achieve the $10 billion mark in revenues faster than any other enterprise software company.

Similarly, Salesforce now projects non-GAAP earnings to lie between $1.32 and $1.33 while GAAP earnings are expected to be in the range of 12-13 cents. This compares with the previous guidance range of $1.29-$1.31 on non-GAAP basis and 7-9 cents on GAAP basis. The Zacks Consensus Estimate is currently pegged at $1.31.

Our Take

Salesforce reported strong fiscal third-quarter results, wherein both the top and bottom lines fared better than the Zacks Consensus Estimate as well as marked significant year-over-year improvement. Meanwhile, the company continues to witness solid growth in revenues. The robust revenues were primarily backed by growth across all its business segments and the Salesforce ExactTarget Marketing Cloud platform.

Going ahead, the company’s upbeat outlook signifies that it will continue to witness growth in near-term. Additionally, the fiscal fourth-quarter revenue outlook is impressive. We are also encouraged by the fact that the company will achieve $10 billion in sales in fiscal 2018.

The higher number of deal wins and geographical contributions during the reported quarter are also positive. We consider the rapid adoption of the Salesforce1 Customer Platform will be a positive. Overall, the company’s diverse cloud offerings and considerable spending on digital marketing remain catalysts. Additionally, strategic acquisitions and the resultant synergies are anticipated to prove conducive to growth over the long run.

In view of increasing customer adoption and satisfactory performances, market research firm, Gartner, acknowledged Salesforce as the leading social CRM solution provider. Also, Forbes recently named Salesforce as the most innovative company in the world again. We believe that the rapid adoption of Salesforce’s platforms indicates solid growth opportunities in the ever-growing cloud computing segment.

Salesforce currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Salesforce.com Inc (CRM): Free Stock Analysis Report

Oracle Corporation (ORCL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Walgreens Boots Alliance Inc. (NASDAQ:WBA) is on the brink of a significant transformation as it nears a deal with Sycamore Partners to become a private entity. The transaction,...

Using the Elliott Wave Principle (EWP), we have been successfully tracking the most likely path forward for the S&P 500 (SPX) over several months. Although there are many ways...

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.