- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

S&P 500: Can We Expect Some Outperformance?

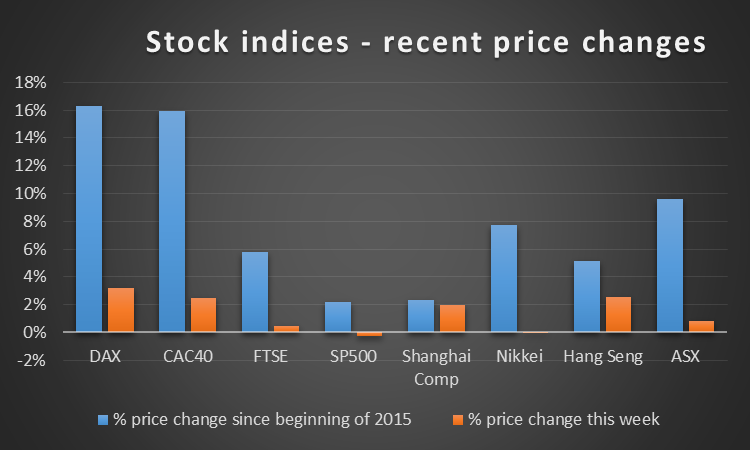

The S&P 500 index underperformed most of the major indices last week, as shown in the graph below. It has also underperformed since the beginning of the year -

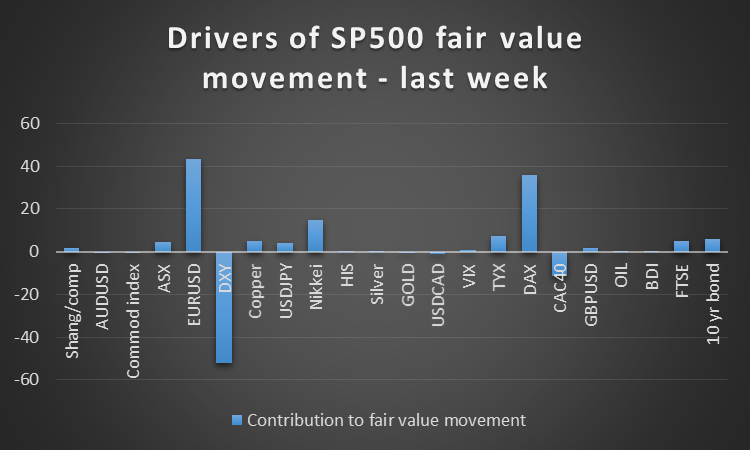

Largely as a result of the firming in other stock indices and the 13 basis point drop in the 30 year bond rate, the fair value of the S&P 500 increased over the week. The graph below analyzes the fair value increase in more detail -

The increase in the S&P’s fair value occurred alongside a weakening in the index - such a disparity would normally be a signal to buy the S&P short term. Taking positions based on disparities between fair value and price change of the S&P 500 index over the last 90 days would have yielded a small annualized gain, of 3.2%, with volatility of 14%.

This tentative buy signal is reinforced by our assessment that the S&P is undervalued on fundamentals - we have its fair value at 4% below the current price. Taking positions based on this signal of under/over valuation would have generated an annualized return of 8% with volatility of 14% over the last 90 days.

Further support for the outperform view is given by our signal based on the lead given by the change in the Baltic Dry Index (BDI) of raw material shipping freight rates. This index is widely seen as a leading indicator of world economic growth, with increases viewed as bullish and conversely. Based on the relationship between movements in the BDI and S&P 500 index over the last six years, the 11% drop in the BDI over the last month bodes for a short term increase in the S&P.

Trading this signal would have yielded a 9.2% annualized gain with volatility of 15% over the last six years.

What to watch for

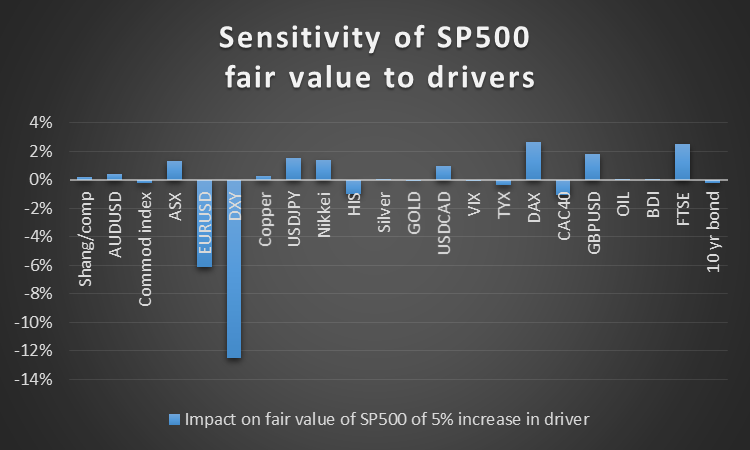

The graph below shows the sensitivity of the S&P’s fair value to various drivers –

The graph highlights the index’s sensitivity to USD currency pair exchange rates. These could undergo some volatility this week with the release of the PMIs and jobs data, which could translate into some volatility in the S&P. However, looking back over the last three years, the volatility of changes in the S&P 500 index for the week leading up to the non farm payrolls print has been no greater than for all weeks.

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Professional traders get paid because of one skill and one skill only: the ability to foresee what the world (or the economy, at least) might look like in six to nine months....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.