- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Ross Stores (ROST) Stock Slips Despite Q4 Earnings Beat

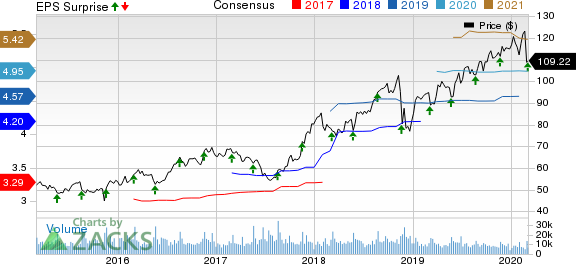

Ross Stores, Inc. (NASDAQ:ROST) reported robust fourth-quarter fiscal 2019 results, wherein both top and bottom lines surpassed the Zacks Consensus Estimate. This marks the third straight quarter of positive earnings and sales surprise. Further, earnings and sales improved on a year-over-year basis.

However, the company provided a cautious view for the first quarter and fiscal 2020 on its strong year-over-year comparisons as well as the ongoing uncertain macro-economic, political and retail environments.

Additionally, Ross Stores stated that its guidance does not account for the potential impacts of the spread of coronavirus on its results. However, the company warned investors that the highly uncertain supply-chain disruptions in China might hurt its performance. Furthermore, it remains concerned about the negative effects on the U.S. consumer demand if the virus spreads.

Despite the strong results, shares of Ross Stores declined 3.2% in the after-hours session on Mar 3 as management warned that further spread of coronavirus might alter growth prospects. In the past three months, shares of the Zacks Rank #3 (Hold) company have declined 3.8% against the industry’s growth of 0.1%.

Q4 Highlights

Ross Stores posted earnings of $1.28 per share, which beat the Zacks Consensus Estimate of $1.26 and surpassed the company’s guidance of $1.20-$1.25. Further, earnings grew 7% from $1.20 per share reported in the prior-year period.

Total sales rose 7.4% to $4,413.4 million and also surpassed the Zacks Consensus Estimate of $4,372 million. Comparable-store sales (comps) improved 4%, driven by higher traffic and increased average basket size. Comps also outpaced the company’s guidance of 1-2%.

Comps gained from strength in the children's category and the Midwest region. Also, sales trends in the ladies business continued to improve in the quarter. Further, the company benefited from strong customer response for merchandise in dd’s DISCOUNTS stores, which aided the top line and operating profit.

Cost of goods sold (“COGS”) rose 7.8% to $3,224.2 million. As a percentage of sales, COGS grew 30 basis points (bps) due to higher distribution expenses of 45 bps and a decline in merchandise margins of 5 bps, which were offset by lower buying costs of 10 bps, and leverage in freight and occupancy expenses of 5 bps each. Higher distribution costs were attributed to unfavorable timing of packaway-related expenses and higher wages. Meanwhile, merchandise margins were affected by some pressure from tariffs.

Selling, general and administrative expenses increased 4.5% to $601.9 million. As a percentage of sales, SG&A expenses decreased 40 bps on lower incentive bonus and other miscellaneous costs.

Operating margin of 13.3% expanded 10 bps and was slightly better than the company’s guidance of 13-13.2%. Operating margin primarily benefited from better merchandise margin and higher sales.

Store Update

As of Feb 1, 2020, Ross Stores operated 1,805 outlets, including 1,546 Ross Dress for Less stores and 259 dd's DISCOUNTS stores.

In fiscal 2020, the company expects to open 100 stores, comprising 75 Ross and 25 dd's DISCOUNTS. This does not include its plans to close or relocate 10 older stores. In first-quarter fiscal 2020, the company plans to open 28 stores, including 21 Ross and seven dd's DISCOUNTS.

Financials

Ross Stores ended fiscal 2019 with cash and cash equivalents of $1,351.2 million, long-term debt of $312.9 million, and total shareholders’ equity of $3,359.2 million.

In the reported quarter, the company repurchased 2.7 million shares for $309 million. This brings the total share repurchases in fiscal 2019 to 12.3 million for $1,275 million. With this, the company has reached the mid-point of its current share repurchase authorization of $2.55 billion. In fiscal 2020, it expects to complete the aforementioned share repurchase authorization by buying back the remaining $1.275 billion worth of shares.

Concurrent to the earnings release, Ross Stores raised its quarterly dividend rate to 28.5 cents per share, reflecting a 12% increase from the prior rate of 25.5 cents. The raised dividend is payable Mar 31 to shareholders of record as of Mar 17.

Guidance

For fiscal 2020, the company expects earnings per share of $4.67-$4.88, reflecting ongoing pressure from tariffs. Notably, it reported $4.63 earnings per share in fiscal 2019. The Zacks Consensus Estimates for earnings is pegged at $4.94.

The company expects a 4-5% increase in total sales for fiscal 2020, with comps growth of 1-2%. Operating margin is projected at 13-13.2%, whereas it reported 13.4% in fiscal 2019. The decline in operating margin mainly reflects ongoing pressure on merchandise gross margin due to tariffs and slight deleverage of expenses based on the comps growth outlook. Moreover, the company estimates net interest income of $8 million for fiscal 2020, with a tax rate of 24%. It also projects capital expenditure of $730 million for the fiscal year.

For the first quarter of fiscal 2020, the company anticipates earnings per share of $1.16-$1.21, whereas it earned $1.15 in the year-ago period. The Zacks Consensus Estimates for first-quarter earnings is pegged at $1.24.

Moreover, the company expects a 4-5% improvement in total sales, with comps growth of 1-2%. It expects operating margin of 13.6-13.8%, whereas it reported 14.1% in the prior-year quarter. Moreover, the company estimates net interest income of $2 million for the fiscal first quarter, with a tax rate of 23%.

Better-Ranked Retail Stocks to Watch

Burlington Stores (NYSE:BURL) has a long-term earnings growth rate of 15.1% and carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Costco Wholesale Corporation (NASDAQ:COST) has a long-term earnings growth rate of 8.1% and a Zacks Rank #2.

Genesco Inc. (NYSE:GCO) has a long-term earnings growth rate of 5% and a Zacks Rank #2.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Ross Stores, Inc. (ROST): Free Stock Analysis Report

Costco Wholesale Corporation (COST): Free Stock Analysis Report

Genesco Inc. (GCO): Free Stock Analysis Report

Burlington Stores, Inc. (BURL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.