- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Breaking News

Ross Stores (ROST) Stock Climbs On Q3 Earnings & Revenue Beats

Ross Stores, Inc. (NASDAQ:ROST) just released its third quarter 2017 financial results, posting earnings of $0.72 per share and revenues of $3.33 billion. Currently, Ross Stores is a Zacks Rank #2 (Buy) and is up over 6% to $69.91 per share in after-hours trading shortly after its earnings report was released.

Ross Stores, Inc:

Beat earnings estimates. The company posted earnings of $0.72 per share, beating the Zacks Consensus Estimate of $0.67 per share.

Beat revenue estimates. The company saw revenue figures of $3.33 billion, topping our consensus estimate of $3.27 billion.

Ross Stores third-quarter earnings popped 16% year-over year, while the company’s sales jumped 8%. The discount giant’s comparable store sales rose 4% from the year-ago period. The company’s net earnings surged from $245 million to $274 million.

Based on its successful quarter, Ross Stores raised its fourth-quarter guidance. The company now expects to post a year-over-year sales increase between 2% and 3%. Ross Stores also projects it will post Q4 EPS in the range of $0.88 to $0.92.

“Our third quarter sales and earnings outperformed our expectations despite being up against our toughest prior year comparisons and two major hurricanes during the quarter,” CEO Barbara Rentler said in a statement.

“We are pleased with these strong results, which reflect our continued market share gains in a challenging retail environment. Operating margin of 13.3% was better-than-expected, mainly due to a combination of higher merchandise margin and leverage on above-plan sales.”

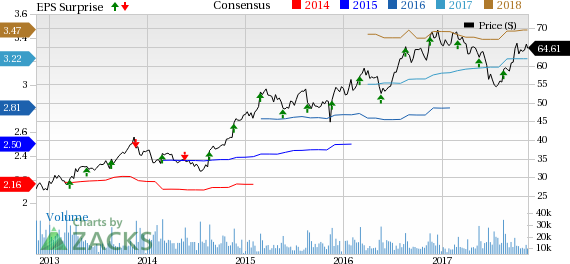

Here’s a graph that looks at Ross Stores’ Price, Consensus and EPS Surprise history:

Ross Stores, Inc. is headquartered in Dublin, California and operates Ross Dress for Less, one of the largest off-price apparel and home fashion chains in the United States—with 1,384 locations. Ross offers first-quality, in-season, name brand and designer apparel, accessories, footwear and home fashions.

Check back later for our full analysis on Ross Stores’ earnings report!

Zacks’ Best Private Investment Ideas

While we are happy to share many articles like this on the website, our best recommendations and most in-depth research are not available to the public.

Starting today, for the next month, you can follow all Zacks' private buys and sells in real time. Our experts cover all kinds of trades… from value to momentum . . . from stocks under $10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors.

Click here for Zacks' private trades >>

Original post

Zacks Investment Research

Related Articles

In a striking reversal of fortunes, equities in developed markets ex-US are now leading the major asset classes in 2025 while US shares are posting a modest loss year to date,...

US index futures broke lower after Marvell Technology's earnings missed. Nasdaq and S&P 500 are now testing key support zones. Meanwhile, Amazon, Oracle, Tesla and...

There was some modest buying today from the open, but volume was light and markets are below trading range support established during the latter part of 2024. It's hard to see...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.