- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Risk Premia Forecasts: Major Asset Classes

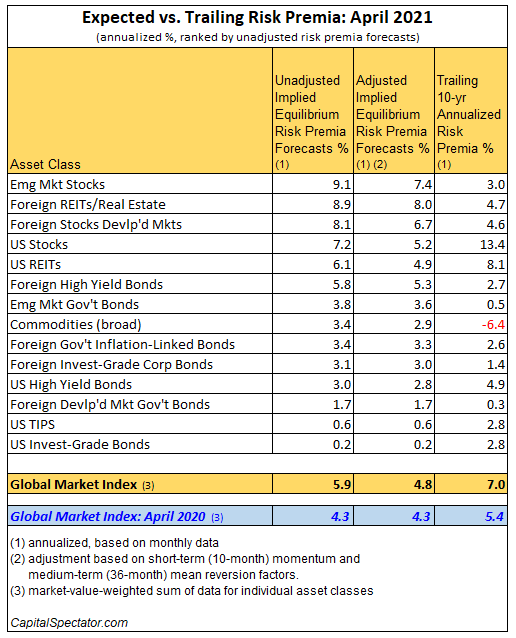

The expected risk premium for the Global Market Index (GMI) in the long run ticked higher again in April, rising to 5.9% annualized—modestly above theprevious month’s estimate.

The current expected return estimate—defined as performance above the “risk-free” rate—is still well below the previous realized performance peak for GMI, but today’s revision represents a solid bounce off the lows for recent projections.

GMI is an unmanaged, market-value-weighted portfolio that holds all the major asset classes (except cash) and represents a theoretical benchmark of the “optimal” portfolio. Using standard finance theory as a guide, this portfolio is considered the best choice for the average investor with an infinite time horizon.

Accordingly, GMI is useful as a baseline to begin research on asset allocation and portfolio design. GMI’s history suggests that this benchmark portfolio is competitive with most active strategies, especially after adjusting for risk and trading costs.

Using recent market activity to adjust the benchmark’s outlook reduces the forward estimate substantially. For example, modifying the numbers to incorporate short-term momentum and medium-term mean-reversion market factors (defined below) reduces GMI’s ex ante risk premium to an annualized 4.8%.

All forward estimates are wrong in some degree, but GMI projections are expected to be relatively reliable vs. the forecasts for the individual asset classes that are used to generate the benchmark’s forecast.

Predictions for the individual market components are subject to greater uncertainty vs. aggregating the forecasts for projecting GMI’s risk premia—a process that may cancel out some of the errors in the underlying market estimates.

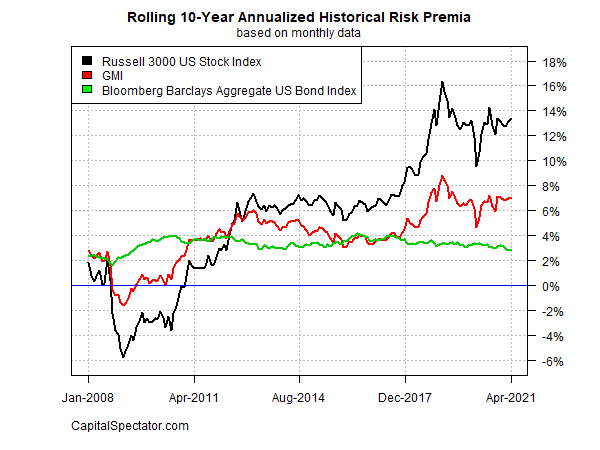

For historical context, here’s a chart of rolling 10-year annualized risk premia for GMI, US stocks (Russell 3000), and US Bonds (Bloomberg Aggregate Bond) through last month. Note that GMI’s realized 10-year risk-premium performance (red line) in recent history has been relatively steady and is currently 7.0% annualized, well below the previous peak of 8%-plus.

The current risk premium forecast for GMI—5.9%—suggests that investors should manage expectations down for multi-asset-class strategies relative to results in recent years.

Now, let’s turn to a summary of the methodology and rationale for the estimates above. The basic idea is to reverse engineer expected return, based on risk assumptions. Rather than trying to predict return directly, this approach relies on the moderately more reliable model of using risk metrics to estimate the performances of asset classes.

The process is relatively robust in the sense that forecasting risk is slightly easier than projecting return. With the necessary data in hand, we can calculate the implied risk premia with the following inputs:

- an estimate of GMI’s expected market price of risk, proxied here with the Sharpe ratio, which is the ratio of risk premia to volatility (standard deviation).

- the expected volatility (standard deviation) of each asset

- the expected correlation for each asset with the overall portfolio (GMI)

The estimates are drawn from the historical record since the close of 1997 and are presented as a first approximation for modeling the future. The projected premium for each asset class is calculated as the product of the three inputs above. GMI’s ex ante risk premia is computed as the market-value-weighted sum of the individual projections for the asset classes.

The framework for estimating equilibrium returns was initially outlined in a 1974 paper by Professor Bill Sharpe. For a more practical-minded summary, see Gary Brinson’s explanation of the process in Chap. 3 of The Portable MBA in Investment.

I also review the model in my book Dynamic Asset Allocation. Here’s how Robert Litterman explains the concept of equilibrium risk premium estimates in Modern Investment Management: An Equilibrium Approach:

"We need not assume that markets are always in equilibrium to find an equilibrium approach useful. Rather, we view the world as a complex, highly random system in which there is a constant barrage of new data and shocks to existing valuations that as often as not knock the system away from equilibrium.

"However, although we anticipate that these shocks constantly create deviations from equilibrium in financial markets, and we recognize that frictions prevent those deviations from disappearing immediately, we also assume that these deviations represent opportunities.

"Wise investors attempting to take advantage of these opportunities take actions that create the forces which continuously push the system back toward equilibrium. Thus, we view the financial markets as having a center of gravity that is defined by the equilibrium between supply and demand.

"Understanding the nature of that equilibrium helps us to understand financial markets as they constantly are shocked around and then pushed back toward that equilibrium."

The adjusted risk premia estimates in the table above reflect changes based on two factors: short-term momentum and long-term mean reversion. Momentum is defined here as the current price relative to the trailing 10-month moving average. The mean reversion factor is estimated as the current price relative to the trailing 36-month moving average.

The raw risk premia estimates are adjusted based on current prices relative to the 10-month and 36-month moving averages. If current prices are above (below) the moving averages, the unadjusted risk premia estimates are decreased (increased).

The formula for adjustment is simply taking the inverse of the average of the current price to the two moving averages as the signal for modifying the projections.

For example: if an asset class’s current price is 10% above it’s 10-month moving average and 20% over its 36-month moving average, the unadjusted risk premium estimate is reduced by 15% (the average of 10% and 20%).

What can you do with the forecasts in the table above? You might start by considering if the expected risk premia are satisfactory… or not.

If the estimates fall short of your required return, you might consider how to engineer a higher rate of performance by way of customizing asset allocation and rebalancing rules. Keep in mind that GMI’s raw implied risk premia are based on an unmanaged market-value weighted mix of the major asset classes.

In theory, that’s the optimal asset allocation for the average investor with an infinite time horizon. Unless you’re a foundation or pension fund, this time-horizon assumption is impractical and so there’s a reasonable case for a) modifying Mr. Market’s asset allocation to suit your particular needs and risk budget; and b) adding a rebalancing component to your investment strategy.

You might also estimate risk premia with alternative methodologies for additional insight about the near-term future (an excellent resource: Expected Returns: An Investor’s Guide to Harvesting Market Rewards by Antti Ilmanen).

For instance, let’s say that you have confidence in the dividend-discount model (DDM) for predicting equity market performance over the next 3 to 5 years. After crunching the numbers, you find that DDM tells you that the stock market’s expected performance will differ by a considerable degree vs. the equilibrium-based estimate for the long run. In that case, you have some tactical information to consider.

Keep in mind, too, that combining forecasts via several models may provide a more reliable set of predictions vs. estimates from any one model. Indeed, a number of studies published through the years document that combined forecasts tend to be more robust vs. single-model projections.

What you can’t do is get blood out of a stone.

No one really knows what risk premia will be in the months and years ahead, which is why relying on forecasting alone (particularly for the short-term future) is asking for trouble.

In other words, you should deviate from Mr. Market’s asset allocation carefully, thoughtfully, and for reasons other than assuming that you’re smarter than everyone else (i.e., the market).

Related Articles

1. S&P 500 Likely to Hold at 200-Day MA (1) Will S&P 500 indexes find support at their 200-day moving averages? We think so. Sentiment is quite bearish and the next batch...

According to the most recent Polymarket odds, 39% of betters believe recession is on the table during 2025, which is an uptick of 18% over the last week. However, many hold the...

Lately, volatility has been off the charts. We’re seeing triple-digit swings in stocks, and the market is getting a real taste of the wild ride that comes with a president who...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.