- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Breaking News

Risk Aversion Dominates As Recession And Trade Worries Grow

The S&P 500 fell to a 12-week low as investors continue to worry about trade and growth concerns, while a global bond rally took the 3-Month and 10-Year curve initially fall further into inverted territory. No major developments occurred on the trade front in the US session, so China’s retaliatory plans were pretty much recirculated throughout the session. The base case has shifted for the trade war to be extended throughout the summer, driving global growth worries into high gear. The global bond rally saw the 10-year Treasury yield fall to 2.2098% before rebounding to 2.2605% at the close. The dramatic inversion of the 3-month and 10-year yields has yet to see the 10-year and 2-year invert, but that could be a matter of time if trade angst remains for the next few weeks. The dollar continued its onslaught to its major trading partners, while gold prices delivered minimal gains.

The focus in Asia will temporarily shift to Australian data as the first quarter reading of private capital expenditures is expected to fall from 2.0% to 0.5% and building approvals for the month of April, are expected to improve to a flat reading from prior 15.5% decline. The markets are already heavily pricing in aggressive cuts from the RBA starting with the next meeting, so Australian dollar weakness might be already priced in. Traders will await any additional updates or official responses from China.

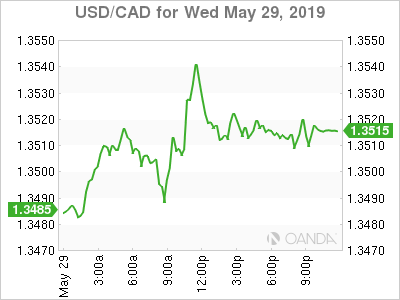

- CAD – Markets ignore BOC optimistic comments

- Mueller – Presser disappoints; focus shifts to Pelosi

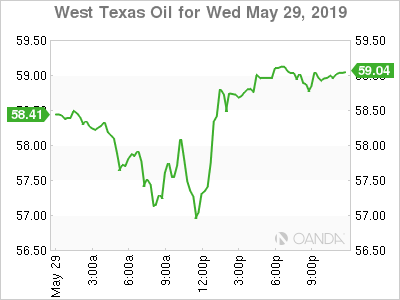

- Oil – OPEC + production cuts are unlikely to be renewed

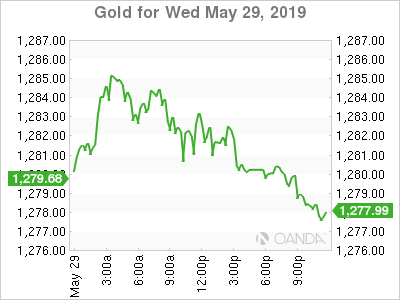

- Gold – Slowly grinding higher

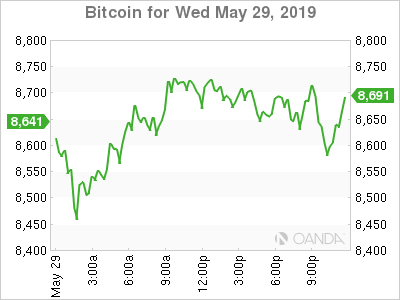

- Bitcoin – The bulls are here to stay

Mueller

Special Counsel Robert Mueller’s press conference provided little insight into his investigation into Russian election meddling, disappointing both sides of the aisle, but mainly Democrats. Mueller confirmed his findings that were delivered in his 448-page report, adding that he is resigning and closing his office.

Democrats will focus on his statement that “If we had had confidence the president clearly did not commit a crime we would have said so.” Since Mueller was not allowed to pursue charges with a sitting President, Congressional Democrats need to decide if they will move forward on obstruction charges. All eyes are on House Speaker Nancy Pelosi to see if she will open impeachment proceedings against President Trump. Republicans did not want to see Mueller emphasize his lack of ability to charge the President, providing Democrats with some momentum to keep the investigation open.

CAD

The Bank of Canada (BOC) rate decision kept rates steady at 1.75% and noted that the degree of accommodation being provided by the current policy interest rate remains appropriate. The central bank highlighted that strong job growth suggests that businesses see the weakness in the past two quarters as temporary. The markets did not believe any of the hawkish comments and continued to sell the loonie following the rate decision. The current implied probabilities saw all rate hike expectations erased with now the markets seeing a 27% chance of a rate cut at the October 30th meeting.

The Canadian dollar is now breaking out of a longer-term descending triangle and technical traders could target further upward momentum.

Oil

Crude prices plummeted earlier as trade tensions reached the highest levels with China queuing up their response to the additional tariffs from the US. In addition to the recent string of trade tensions that are driving global demand worries, oil prices have been dragged down by growing expectations we may see OPEC and allies fail to agree upon when to meet next, and more importantly if they can agree on continuing productions, while filling the void from sanctioned stricken countries. The last two and a half years saw OPEC be successful in having the 14-nation group grow into 24 nations that could agree on production cuts. The main non-OPEC member, the Russians appear to be the key to having a meaningful extension of cuts and they may not want to agree on production cuts if the Saudis get to increase production from the void filled from Iranian sanctions. If global demand continues to fall, the effects of production cuts may do little to thwart a massive wave of selling.

West Texas Intermediate crude did recover the most of the near 4% decline after MPLX LP noted they will be restarting the Ozark pipeline, thus supporting oil to travel out from Cushing to the mid-west and avoiding an unnecessary build with inventories.

Meanwhile, in Norway, the Venezuelan government and the opposition held another round of talks that aimed for a peaceful resolution with the presidential election. Nothing of substance was reached and while another round of talks may be on the horizon, markets are not expecting any major breakthroughs.

Gold

Gold prices are slowly advancing as trade war concerns and slower global growth will likely deliver continued market turbulence in the short-term. The yellow metal’s gains have been minimal due to falling ETF demand and a stronger dollar.

A key economic warning indicator shows the gold-silver ratio shows that one ounce of gold can buy 88.67 ounces of silver, the highest level since 1993 and around 5 ounces from the record high. With no updates on the trade front expected until we get closer to the end of June G20 summit, we could see safe-havens continue to remain bid in the short-term.

Bitcoin

Bitcoin’s bullish trend appears to be supported by growing large institutional interest and improvements with security. The crypto world saw prices stabilized following the endorsements from Fidelity, Microsoft (NASDAQ:MSFT) and Facebook (NASDAQ:FB). Last year, cryptocurrencies sold off heavily on hacking news, stolen coins, and failure in delivering an ETF. Bitcoin has also been supported by the tougher regulatory process for launching a new initial coin offering (ICO), thus making it too expensive, complicated and time-consuming for new offerings.

Related Articles

Investor’s bearish sentiment has surged to levels that generally align with server market corrections and crashes. While concerns about the recent market correction have risen,...

The latest economic indicators aren’t supporting our resilient-economy thesis. Nevertheless, we are sticking with it for now. Consider the following: The Atlanta Fed’s GDPNow...

US imposes increased tariffs on its closest trading partners US equities decline as risk appetite remains weak Dollar records losses against major currencies Oil and cryptos...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.