- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Rent-A-Center Stock Gains 11% On Strategic Alternatives Plan

Rent-A-Center, Inc. (NASDAQ:RCII) , which has been struggling to cope with the change in retail landscape, is still looking for "strategic and financial alternatives" and also announced job cuts. Additionally, the company has received bid from different parties for a possible sale. We expect Rent-A-Center to come out with a decision regarding possible sale in the second quarter of 2018.

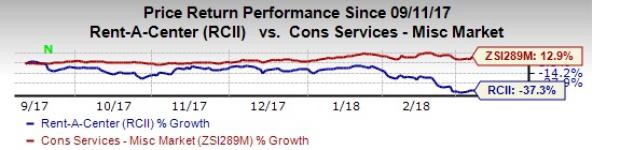

The company’s shares, which have been struggling, declining more than 37.3% in the past six months compared with the industry’s gain of 12.9%, took a sharp U-turn following the news. As a result, the stock gained 11.1% in after-hour trading session yesterday.

Notably, Rent-A-Center’s major shareholder, Engaged Capital and activist investor, Marcato Capital, have been compelling management to look for strategic alternatives. In the past, the company has also rejected buyout offer from Private equity firm — Vintage Capital. Per Rent-A-Center, Vintage offer "significantly undervalues the company".

Moreover, Rent-A-Center added that in an effort to reduce cost the company will reduce workforce by 250. This effort will not only help the company to “better align” organizational structure but is likely to result in annual cost savings of $65-$85 million from operations under the strategic plan. The layoff of 250 employees will generate $28 million in annual run-rate cost savings, with nearly $20 million to be recognized in 2018.

Meanwhile, management has undertaken initiatives to strengthen the performance of its Core U.S. segment. In an attempt to augment cash flow generation from Core U.S. business, the company is focusing on rates, terms and purchase options that are much more aligned with the customer’s needs. Also, it is optimizing product mix, increasing the average ticket price, upgrading workforce, concentrating on lowering delinquency rates and rationalizing existing stores.

Despite these efforts, investors remain concerned about the Zacks Rank #4 (Sell) company’s waning top and bottom lines. Since the past eight quarters, Rent-A-Center has been witnessing a year-over-year decline across its top and bottom lines. In fourth-quarter 2017 adjusted loss of 41 cents a share was wider than the Zacks Consensus Estimate of a loss of 7 cents and a loss of 23 cents incurred in the year-ago period. Total revenue of $639 million also declined 6.6% year over year, missing the consensus mark of $659 million.

Key Picks

Better-ranked stocks in the same space are Monro, Inc. (NASDAQ:MNRO) , Weight Watchers International, Inc. (NYSE:WTW) and H&R Block, Inc. (NYSE:HRB) . While Monro and Weight Watchers International sport a Zacks Rank #1 (Strong Buy), H&R Block carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Monro has an impressive long-term earnings growth rate of 13.7%.

Weight Watchers International delivered a positive earnings surprise in the trailing four quarters, with an average beat of 42.2%.

H&R Block has a long-term earnings growth rate of 11%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Rent-A-Center Inc. (RCII): Free Stock Analysis Report

H&R Block, Inc. (HRB): Free Stock Analysis Report

Weight Watchers International Inc (WTW): Free Stock Analysis Report

Monro Muffler Brake, Inc. (MNRO): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.