- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

ReneSola (SOL) Misses Q3 Revenues, Reflects Solid Pipeline

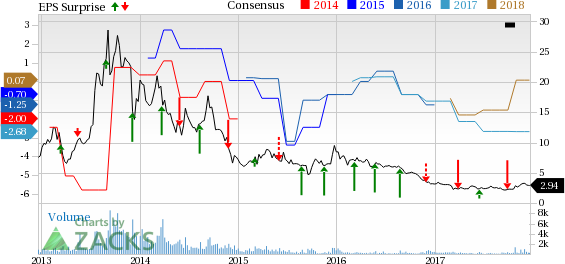

ReneSola Ltd. (NYSE:SOL) generated net revenues of $36.3 million in third-quarter of 2017, which missed the Zacks Consensus Estimate of $41 million by 11.5%. However, revenues improved 23.9% year over year.

Operational Highlights

Gross margin of 17.55% in the quarter expanded 912 basis points (bps) year over year but contracted 5238 bps, sequentially.

Operating expenses amounted to $2.5 million, up 24.1% from the prior-year quarter but down 20.3% from the preceding quarter.

Operating income during the quarter was $3.8 million. The company had reported operating income of $0.4 million in third-quarter 2016 but incurred loss of $2 million in the previous quarter.

ReneSola’s income before income tax and noncontrolling interests from continuing operations was $4 million in the third quarter against a loss of $0.8 million in the prior-year quarter and loss of $0.6 million in the second-quarter of 2017.

As of Sep 30, 2017, the company had a pipeline of more than 1.1 gigawatts of projects in various stages, of which 579.3 megawatts (MW) are late-stage projects. Of these late-stage projects, 167.4 MW are under construction.

Financial Condition

As of Sep 30, ReneSola had cash and cash equivalents of $5.2 million compared with $3 million as of Jun 30, 2017.

Long-term borrowings were $30.4 million as of Sep 30, almost in line with that at the end of Jun 30.

Guidance

ReneSola projects fourth-quarter 2017 revenues in the band of $55−$60 million with overall gross margin in the 10-15% range. Also, the company expects to connect 60 MW to 80 MW of projects during the quarter.

Business Update

In August 2017, ReneSola announced the sale of project rights of 13.3 MW of community solar projects in Minnesota to Nautilus Solar Energy, LLC with revenues expected to be recognized in the fourth quarter. In September, the company completed the disposition of manufacturing and LED distribution businesses and the related liabilities.

Peer Releases

Yingli Green Energy Holding Company Ltd. (NYSE:YGE) incurred an adjusted net loss of $2.70 per American Depositary Share (ADS) in third-quarter 2017, wider than the Zacks Consensus Estimate of a loss of $2.61. The company had reported a loss of $2.18 per ADS in the year-ago quarter.

JinkoSolar Holding Co., Ltd. (NYSE:JKS) reported third-quarter 2017 earnings per ADS of 4 cents that missed the Zacks Consensus Estimate of 17 cents by 76.5%. The reported figure also declined 95.7% from the year-ago quarter earnings of 92 cents per ADS.

First Solar Inc. (NASDAQ:FSLR) reported third-quarter 2017 adjusted earnings of $1.95 per share, beating the Zacks Consensus Estimate of 85 cents by a whopping 129.4%. Its revenues of $1,087 million in the quarter surpassed the Zacks Consensus Estimate of $824 million by 31.9%.

Zacks Rank

ReneSola currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

First Solar, Inc. (FSLR): Free Stock Analysis Report

Renesola Ltd. (SOL): Free Stock Analysis Report

JinkoSolar Holding Company Limited (JKS): Free Stock Analysis Report

Yingli Green Energy Holding Company Limited (YGE): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.