- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Regeneron (REGN) Beats On Q3 Earnings & Sales, Shares Up

Regeneron Pharmaceuticals, Inc. (NASDAQ:REGN) reported third-quarter of 2017 results wherein both earnings and sales beat expectations on the back of strong performance of eye-care drug Eylea.

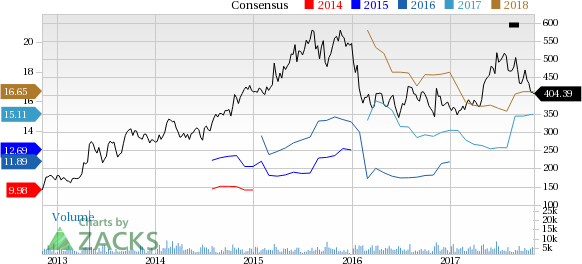

Regeneron’s stock has gained 10.1% year to date outperforming the industry’s 4.7% rally. The company’s shares moved up in the pre-market trading and we expect shares to gain further momentum.

The company reported earnings of $3.99 per share in the third-quarter beating the Zacks Consensus Estimate of $3.93 compared with $3.13 recorded in the year-ago quarter.

Total revenues in the second quarter increased 23% year over year to $1.5 billion driven by strong sales of Eylea. Revenues were above the Zacks Consensus Estimate of $1.46 billion.

Regeneron has co-developed Eylea with the HealthCare unit of Bayer (DE:BAYGN) AG (OTC:BAYRY) . The company is solely responsible for the sales of the eye drug and is entitled to profits in the United States. However, it shares profits and losses equally with Bayer from ex-U.S. Eylea sales, except in Japan, where the company receives a royalty on net sales.

Quarterly Highlights

Net product sales increased to $957 million in the reported quarter, up 11.7% year over year. The majority of sales came from Eylea in the United States ($953 million, up 10.4%).

Revenues also include Sanofi (NYSE:SNY) and Bayer collaboration revenues of $482 million, compared with $336 million in the year-ago quarter. Collaboration revenues from Sanofi were $245.2 million in the quarter, compared with $144.4 million a year ago. Praluent recorded global net sales of $49 million in the reported quarter, up from $38 in the year-ago quarter. We note Praluent has been developed in collaboration with Sanofi. Product sales for Praluent are recorded by Sanofi, while Regeneron shares profits or losses from the commercialization of the drug.

Dupixent sales came in at $89 million. The drug was approved earlier in 2017 for the treatment of adults with moderate-to-severe atopic dermatitis.

R&D expenses decreased 2.5% while selling, general and administrative increased 13.6% during the quarter.

2017 Outlook

The company reaffirmed its sales guidance for Eylea. In 2017, Regeneron expects Eylea net sales to grow around 10% in the United States.

The company now expects adjusted unreimbursed R&D expenses in the range of $885-$915 million, down from the earlier guidance of $925-$965 million.

In May 2017, the FDA approved Kevzara for the treatment of adult patients with moderately to severely active rheumatoid arthritis who have an inadequate response or intolerance to one or more disease modifying anti-rheumatic drugs. The drug was also approved in Europe in June 2017.

Enrolment was completed in the phase III study, PANORAMA, evaluating Eylea in patients with non-proliferative diabetic retinopathy without diabetic macular edema.

The company also received a significant boost when the FDA approved Dupixent (dupilumab) injection for the treatment of adults with moderate-to-severe atopic dermatitis. The drug was also approved in Europe in September 2017.

A phase III study evaluating Praluent in homozygous familial hypercholesterolemia was initiated in fourth-quarter 2017.

Our Take

Regeneron’s third-quarter results were impressive as both earnings and sales beat estimates driven by strong Eylea sales. Dupixent launch in the United States for moderate-to-severe atopic dermatitis is progressing well. The drug was also approved in Europe. The geographic expansion of the drug will further boost sales. Moreover, the company is also looking to expand Dupixent’s label in uncontrolled asthma.

Zacks Rank& Key Pick

Regeneron currently carries a Zacks Rank #4 (Sell).

A better-ranked stock in the health care sector worth considering is Exelixis, Inc. (NASDAQ:EXEL) , carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Exelixis’ earnings per share estimates increased from 26 cents to 43 cents for 2017 and increased from 63 cents to 70 cents for 2018 over the last 30 days. The company delivered positive earnings surprise in the trailing four quarters with an average beat of 572.92%. The company’s shares have moved up 78.3% so far, this year.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Sanofi (SNY): Free Stock Analysis Report

Bayer AG (BAYRY): Free Stock Analysis Report

Regeneron Pharmaceuticals, Inc. (REGN): Free Stock Analysis Report

Exelixis, Inc. (EXEL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Professional traders get paid because of one skill and one skill only: the ability to foresee what the world (or the economy, at least) might look like in six to nine months....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.