- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Record-Low Treasury Yield Amid Virus Threat May Benefit Stocks

Wall Street is reeling under the impact of the coronavirus outbreak despite the Fed’s emergency rate cut of 50 basis points. On Mar 3, the Fed fund rate was reduced to 1-1.25% from the prior range of 1.50-1.75%. Notably, this was the first unscheduled rate cut by the central bank since October 2008.

Despite the rate cut, investors rushed toward safe-haven sovereign government bonds, which resulted in historically low yields. Meanwhile, record-low Treasury yields are likely to help some stocks emerge as a lucrative alternative in this uncertain financial climate.

Fed Takes Strong Measure But Fails to Instill Optimism

The immediate response of market participants to the surprising 50 basis point rate cut by the Fed two weeks before its scheduled meeting during Mar 17-18, was disappointing. Wall Street remained extremely choppy with the three major stock indexes — the Dow, the S&P 500 and the Nasdaq Composite — tumbling 2.9%, 2.8% and 3%, respectively.

Despite reaffirming the stability of the U.S. economic fundamentals, Fed Chairman Jerome Powell said “we saw a risk to the outlook for the economy and chose to act.” However, Powell said that the Fed is unlikely to expand its balance sheet or intensify quantitative easing program through government bond purchase, much to the chagrin of investors.

Notably, a 50 basis point rate cut was already factored in the market price by investors. It seems that market participants were more interested regarding the Fed Chairman’s take on the current economic scenario and its plans to sustain the largest expansion. Notably, several industry experts are already asking for another 50 basis point cut in benchmark rate either this month or two cuts in March or April of a quarter percentage point each.

Treasury Yields Plunge

Following the Fed’s failed attempt to inspire confidence among investors on risky assets like equities, market participants continued their panicked rush to safe-haven U.S. Treasury Notes. As a result, the yield on the benchmark 10-Year US Treasury Note plunged below 1% level to 0.914% for the first time in history — finally settling at 1.005%.

Likewise, the yield on short term 2-Year US Treasury Note plummeted to 0.723% — its lowest since August 2016. The yield on the long term 30-Year US Treasury Note tumbled to a record-low 1.622%. Year to date, the yields on the 10 and 30 Year Treasury Notes have nosedived 90 and 75 basis points, respectively.

A Ray of Hope for Stocks

The record-low Treasury yields in fact fell below the average dividend yield of the S&P 500 index — popularly known as the stock market’s barometer. On Mar 3, the estimated dividend yield of the S&P 500 was 1.91%, well above the 2-Year, 10-Year and 30-Year Treasury Yields.

In their rush to transfer money to safe-haven government bonds from risky equities, market participants have shifted too much money to the bond market resulting in plunging yields. At this stage, any company, which has a history of paying out regular dividend, with higher dividend yield than the benchmark Treasury Notes, will be a more preferable asset for investors.

Our Top Picks

At this stage, investment in high-yielding, S&P 500 stocks that pay out regular dividend will be a prudent move. We narrowed down our search to six large-cap (market capital > 100 billion) stocks as these stocks have strong business model and long history of operation. Each of our pick has carry a Zacks Rank # 2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

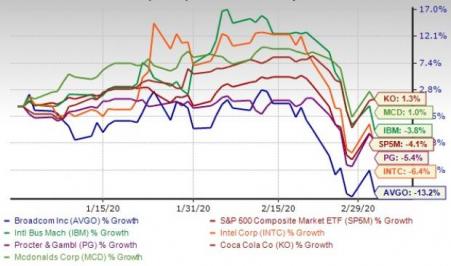

The chart below shows the price performance of our six picks year to date.

International Business Machines Corp. (NYSE:IBM) : The leading provider of advanced IT solutions, including computer systems, software, storage systems and microelectronics offers a current dividend yield of 4.82%. The company has an expected earnings growth rate of 4.3% for the current year. The stock price is 23.2% below its 52-week high recorded on Feb 6.

Broadcom Inc. (NASDAQ:AVGO) : The premier designer, developer and global supplier of a broad range of semiconductor devices offers a current dividend yield of 4.56%. The company has an expected earnings growth rate of 8.8% for the current year (ending October 2020). The stock price is 20.9% below its 52-week high recorded on Jan 24.

The Coca-Cola Co. (NYSE:KO) : The beverage company, which manufactures, markets and sells various nonalcoholic beverages worldwide offers a current dividend yield of 2.86%. The company has an expected earnings growth rate of 6.6% for the current year. The stock price is 7.3% below its 52-week high recorded on Feb 21.

The Procter & Gamble Co. (NYSE:PG) : The leading provider branded consumer packaged goods in North and Latin America, Europe, the Asia Pacific, Greater China, India, the Middle East, and Africa offers a current dividend yield of 2.50%. The company has an expected earnings growth rate of 18.3% for the current year (ending June 2020). The stock price is 8.4% below its 52-week high recorded on Jan 24.

McDonald's Corp. (NYSE:MCD) : The leading fast-food chain that currently operates roughly 38,000 restaurants in more than 100 countries offers a current dividend yield of 2.47%. The company has an expected earnings growth rate of 8.9% for the current year. The stock price is 11.2% below its 52-week high recorded on Aug 9, 2019.

Intel Corp. (NASDAQ:INTC) : The leading provider of computing, networking, data storage and communication solutions worldwide offers a current dividend yield of 2.27%. The company has an expected earnings growth rate of 2.5% for the current year. The stock price is 23.8% below its 52-week high recorded on Jan 24.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

International Business Machines Corporation (IBM): Free Stock Analysis Report

Intel Corporation (INTC): Free Stock Analysis Report

McDonald's Corporation (MCD): Free Stock Analysis Report

Coca-Cola Company (The) (KO): Free Stock Analysis Report

Procter & Gamble Company (The) (PG): Free Stock Analysis Report

Broadcom Inc. (AVGO): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.