- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Recessions And Bear Markets

Summary:

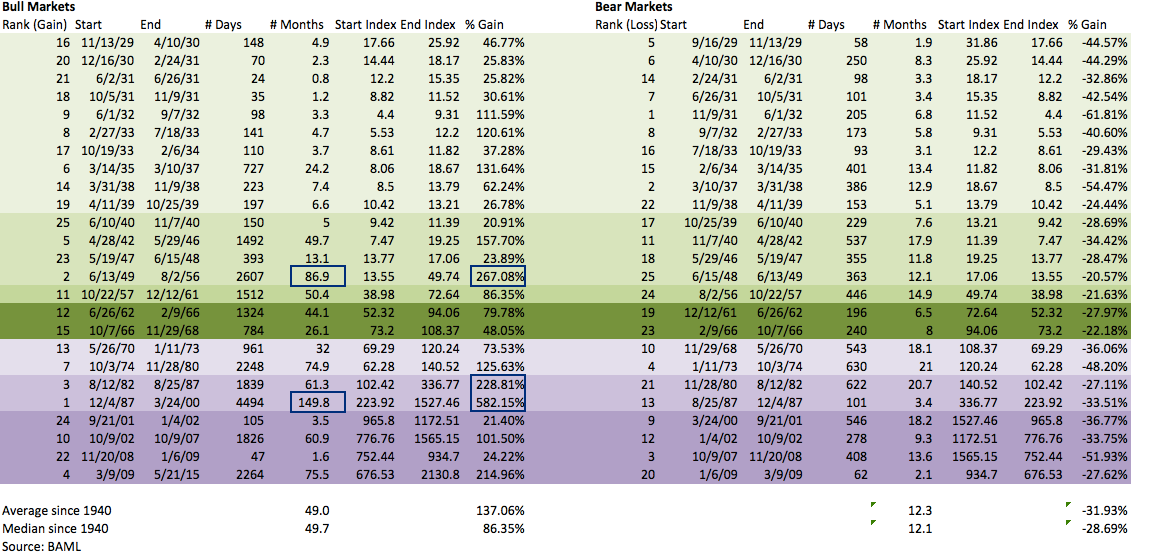

Bear markets rarely take place outside of an economic recession. In the post-World War II era, only two bear markets have occurred outside a recession. The first (1966) occurred amid rapidly rising interest rates. The second (1987) occurred after a euphoric 50% rise in equities over a 10-month period. For what it is worth, the current market and economic environment is nothing like either of these situations.

* * *

The commonly accepted definition of a bear market is a loss of more than 20% in the stock market index. Yes, 20% is an arbitrary number but so are 15% and 25%. For better or worse, 20% is the accepted benchmark.

Since the end of World War II, there have been 10 bear markets (see note below). Only 2 bear markets have occurred outside of an economic recession: 1966 and 1987.

The simple fact is that equity bear markets almost always take place within the context of an economic decline. This fact should not be surprising: declining employment and consumption typically leads to declining sales and profits for companies. Add in the propensity of equity valuations to fall when consumers are feeling gloomy and you have the basic recipe for a bear market.

Nothing unites the 1966 and 1987 bear markets except that both were very short: 8 months and 3 months, respectively. If SPX falls into a bear market in February, it would be the longest bear market outside of a recession during this period.

The 1966 bear market took place amid rapidly rising Federal Funds Rates (which increased from 4% to 6% during 1966). The 1987 bear market occurred after SPX rose nearly 50% during the prior 10 months; it was a euphoric blow off top. For what it is worth, the current market and economic environment is nothing like either of these situations.

Not all recessions lead to bear markets, but most do. There have been 10 recessions since the end of World War II and only 2 did not lead to a bear market: 1953-54 and 1990-91. The Dow Jones declined by 4% in both 1953 and 1990, so neither was a booming year for equities.

A recession is commonly defined as consecutive quarterly declines in GDP. The US is not in a recession: GDP grew 1% and 0.5% in the last two quarters (here).

US equity markets could fall into a bear market now, and the US economy could fall into a recession in 2016. But there is scant evidence that the US faces an imminent recession (post and post) and bear markets outside of recessions have been rare, brought on either by rapidly rising interest rates or investor euphoria, neither of which is present at the moment.

Notes:

The table above was compiled by BAML. We combined the 2000 and 2002 bear markets and the 2007-08 and 2009 bear markets as there's little logic in segregating them into separate events.

We excluded the 1929 to 1946 period in our analysis. There were multiple bull and bear markets amid the most severe economic recession in history, followed by the largest war build-up in history. There's no compelling reason to include this era, but doing so would not change the conclusions.

Related Articles

Lately, volatility has been off the charts. We’re seeing triple-digit swings in stocks, and the market is getting a real taste of the wild ride that comes with a president who...

White House announces tariff exemptions for Canada and Mexico Soft ADP jobs report poses downside risks to NFP Euro extends rally ahead of ECB decision Wall Street rebounds, WTI...

Gold Remains Flat Ahead of the NFP Report Despite a declining US dollar (USD), the gold (XAU/USD) price was mostly flat yesterday as the market focused on the upcoming US nonfarm...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.