- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Raytheon Wins $60M Deal For Enhanced Paveway II Program

Raytheon Company’s (NYSE:RTN) Missile Systems business segment recently won a contract for providing support equipment and support hours for Enhanced Paveway II bomb. Work related to the deal is scheduled to be over by Feb 28, 2019.

Valued at $59.7 million, the contract was awarded by the Air Force Life Cycle Management Center, Eglin Air Force Base, FL. Fiscal 2016 and 2018 procurement funds will be utilized to finance the task, which will be executed at Tucson, AZ.

A Brief Note on Enhanced Paveway II

The Enhanced Paveway II belongs to Paveway family of laser guided bombs. These bombs have revolutionized tactical air-to-ground warfare by converting "dumb" bombs into precision guided munitions. Paveway bombs make up more than half the air-to-ground precision guided weapons used in Operation Iraqi Freedom. The Paveway II version is the weapon of choice for more than 40 customers.

Newer versions of the Paveway bomb include GPS/INS guidance capabilities. The latest Paveway bomb combines the accuracy and flexibility of traditional laser-guided weapons with the all-weather capability of GPS guidance, creating a product which lowers the required sortie count and weapon inventory while increasing the mission’s success rate.

Our View

With the increase in cyber-attacks, terrorism threats and geopolitical instability, there is an immediate need of all countries to elevate their level of security and defense. Major defense contractors like Raytheon, AeroVironment, Inc. (NASDAQ:AVAV) , Orbital ATK, Inc. (NYSE:OA) , Rockwell Collins, Inc. (NYSE:COL) are putting their best to make most of this opportunity and expand their business worldwide. Moreover, the frequent cross-border counter-missile testing conducted by the United States and North Korea has further boosted the prospect of missile-makers like Raytheon.

In particular, Raytheon’s Missile Systems segment has been clinching significant awards from the United States as well as international customers, courtesy of its high-end, combat-proven advanced arsenals. To this end, last month, the company won a $300 million worth modification contract from the U.S. Army for supplying Tube-launched Optically-tracked Wireless-guided missiles.

Notably this segment witnessed 10% sales growth in the third quarter of 2017, with Raytheon’s Paveway program being one of the primary growth drivers. We believe the recently won award reflects the strong demand that the Paveway program already boasts and with the similar ones anticipated in the near future, will enable the company to enhance its business in the ever-expanding missile market.

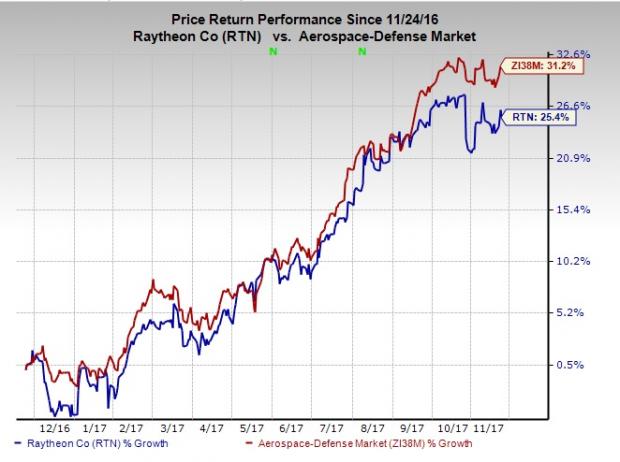

Price Performance

Raytheon’s stock has returned 25.4% over a year, underperforming the 31.2% rally of the industry it belongs to. This might have been caused by the earlier budget cuts inflicted by the U.S. government.

Zacks Rank

Raytheon currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Rockwell Collins, Inc. (COL): Free Stock Analysis Report

AeroVironment, Inc. (AVAV): Free Stock Analysis Report

Orbital ATK, Inc. (OA): Free Stock Analysis Report

Raytheon Company (RTN): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Whenever Wall Street authoritative figures, such as a large institution or individual investor, decide to shift a view on a specific stock or industry, retail traders can...

Monster Beverage (NASDAQ:MNST) faces headwinds that make it a potentially scary buy, including weakness in the alcohol segment. With the alcohol business contracting in Q4 2024,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.