- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Raven (RAVN) Beats Q3 Earnings Estimates On Higher Revenues

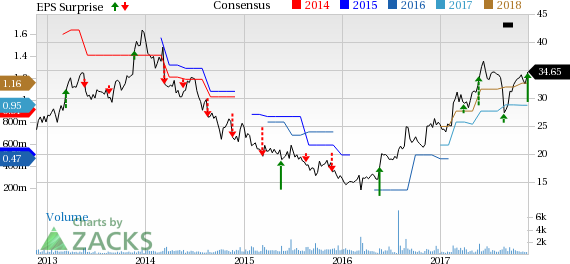

Industrial goods manufacturer Raven Industries, Inc. (NASDAQ:RAVN) reported solid third-quarter fiscal 2018 results, with net income of $12 million or 33 cents per share compared with $5.7 million or 16 cents per share in the year-ago quarter. The two-fold increase in earnings was primarily driven by solid top-line growth. The reported earnings beat the Zacks Consensus Estimate by 12 cents.

Operational Update

Quarterly revenues increased 39.7% year over year to $101.3 million, with improvement in each of the three segments and exceeded the Zacks Consensus Estimate of $85 million. Gross profit increased 68% year over year to $33.3 million, while gross margin improved to 32.9% from 27.4%.

Operating income more than doubled to $17.8 million from $7.4 million in the year-earlier quarter for respective margins of 17.6% and 10.2%, driven by strong operating leverage on higher sales volume.

Segmental Performance

Applied Technology: Sales from this segment improved marginally to $25.3 million, driven by weaker end-market conditions and challenging year-over-year comparisons for new products.

Operating income for the segment was $5.4 million, reflecting a decrease of 16.5% from the prior-year quarter, owing to higher expenses and investments. Operating margin decreased to 21.2% from 25.5%.

Engineered Films: The segment reported sales of $65.1 million, reflecting an increase of 68.9% year over year with strong performances across all markets.

Operating income improved 140.1% to $17.1 million due to higher sales volumes and strong operating leverage. Segment operating margin expanded 780 bps to 26.3%, driven by improved capacity utilization, favorable product mix and continued spending discipline.

Aerostar: Sales in the segment were $11.1 million, increasing 23.3% year over year, driven by growth in stratospheric balloon platform.

The segment reported operating income of $1.4 million against operating loss of $1.4 million in the year-ago quarter. The turnaround was driven by stringent cost-reduction activities, while maintaining focus on strategic R&D efforts.

Project Atlas

During the quarter, Raven launched a company-wide initiative, Project Atlas, in order to replace the existing enterprise resource planning platform. This strategic long-term investment is aimed at improving operating efficiencies, enabling faster integration of future acquisitions, automating a significant portion of internal controls and enhancing the enterprise’s execution of its long-term growth strategy. The project is expected to take approximately three years to complete and cost between $8 and $10 million. The company recorded $0.3 million as costs related to this project during the third quarter of fiscal 2018 and intends to register approximately $1 million per quarter in fiscal 2019.

Financial Update

Raven ended the quarter with cash and cash equivalents of $36.9 million compared with $46.3 million in the prior-year quarter. Cash flow from operations was $30.8 million for the first nine months of fiscal 2018 compared with $38.7 million in the year-ago period.

Moving Forward

Raven expects to exceed prior-year sales and adjusted operating income in fiscal 2018. The company continues to invest for the intermediate and long term. The company is increasing its investment in research and development activities to continue its new product momentum, and keeps looking for additional strategic acquisitions.

Raven currently carries a Zacks Rank #3 (Hold). A few better-ranked stocks in the industry are Danaher Corporation (NYSE:DHR) , Federal Signal Corporation (NYSE:FSS) and Leucadia National Corporation (NYSE:LUK) , each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Danaher has a long-term earnings growth expectation of 10.6%. It beat earnings estimates in each of the trailing four quarters, with an average positive surprise of 2.6%.

Federal Signal beat earnings estimates thrice in the trailing four quarters, with an average positive surprise of 11.5%.

Leucadia has a long-term earnings growth expectation of 18%. It surpassed earnings estimates thrice in the trailing four quarters, with an average positive surprise of 21.2%.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

Danaher Corporation (DHR): Free Stock Analysis Report

Leucadia National Corporation (LUK): Free Stock Analysis Report

Raven Industries, Inc. (RAVN): Free Stock Analysis Report

Federal Signal Corporation (FSS): Free Stock Analysis Report

Original post

Related Articles

Walgreens Boots Alliance Inc. (NASDAQ:WBA) is on the brink of a significant transformation as it nears a deal with Sycamore Partners to become a private entity. The transaction,...

Using the Elliott Wave Principle (EWP), we have been successfully tracking the most likely path forward for the S&P 500 (SPX) over several months. Although there are many ways...

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.