- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Rally In Emerging Market Stocks Rolled On Last Week

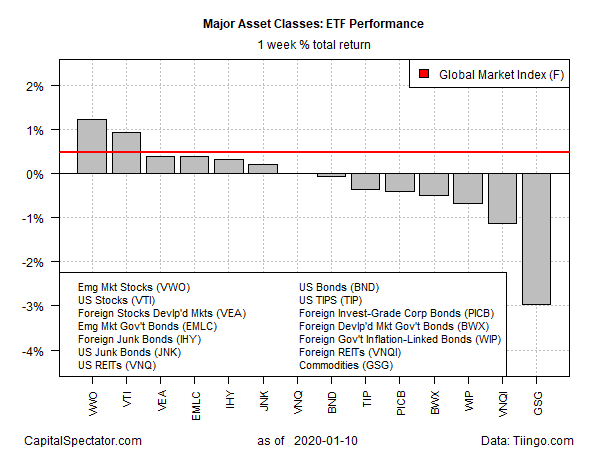

Another week, another gain for shares in emerging markets, which posted the strongest gain for the major asset classes over the trading week through January 10, based on a set of exchange traded funds.

Vanguard FTSE Emerging Markets (NYSE:VWO) rose 1.2% last week, marking the sixth straight weekly advance for the fund. Except for a three-week lull in November, VWO has increased in every week since late-September.

The rally continued in overseas trading today, fueled by reports that the US and China will sign a partial trade deal this week. “With most of the broad strokes of a rather limited deal already revealed, what markets will be watching for more closely will be the precise legal wording of the deal,” advises Vishnu Varathan, a senior economist at Mizuho Bank.

Last week’s big loser: commodities. Notably, crude oil fell amid the easing of Mideast tensions. Prices spiked following the US drone attack that killed Iran’s top general the week before, but the risk premium has faded in recent days as signs emerged that the threat of an escalating conflict receded. The shift in perceptions weighed on iShares S&P GSCI Commodity-Indexed Trust (NYSE:GSG), which tumbled 3.0% last week – the first weekly loss for the fund since late-November.

The rally in stocks generally last week helped lift an ETF-based version of the Global Market Index (GMI.F) — an unmanaged benchmark that holds all the major asset classes (except cash) in market-value weights. GMI.F rose 0.5% over the five trading days through Jan. 10.

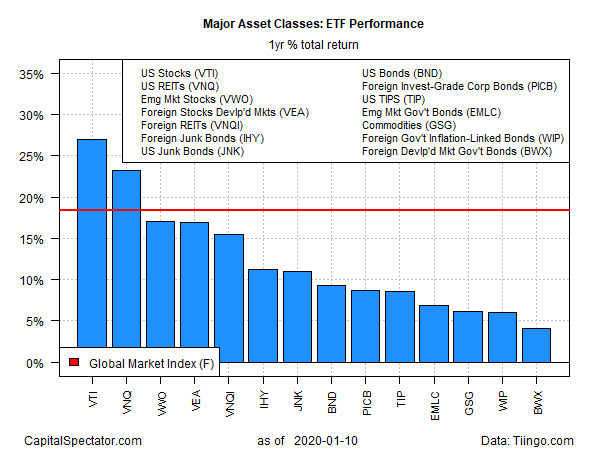

For the one-year trend (252 trading days), US equities continue to lead among the major asset classes. Vanguard Total Stock Market (NYSE:VTI) is up 27.0% on a total return basis. That’s a modest edge over the second-best one-year gain, posted by US real estate investment trusts (REITs) via Vanguard Real Estate (NYSE:VNQ), which is ahead by 23.3% for the trailing one-year window.

All the major asset classes are enjoying gains over the past 12 months. The weakest rally is currently in foreign bonds. SPDR Bloomberg Barclays International Treasury Bond (NYSE:BWX) is up a relatively mild 4.0% for the year through Friday’s close.

Meantime, GMI.F continues to post a strong one-year gain: 18.4% after factoring in distributions.

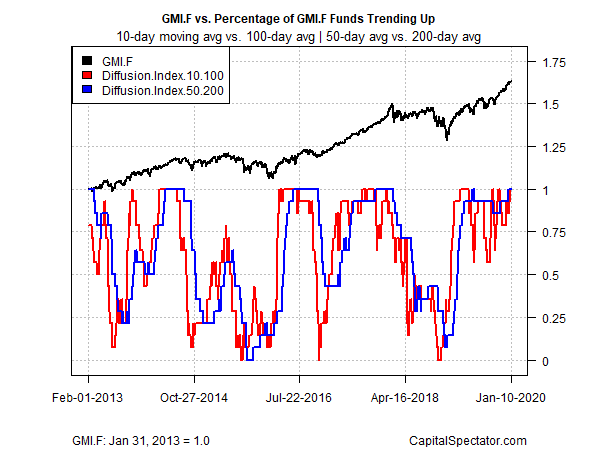

Reviewing the ETFs listed above through a momentum lens shows that bullish sentiment prevails across the board. The analysis is based on two sets of moving averages. The first compares the 10-day moving average with its 100-day counterpart — a proxy for short-term trending behavior (red line in chart below). A second set of moving averages (50 and 200 days) represent the intermediate measure of the trend (blue line). As of Friday’s close, all the funds are reflecting upside trend signals for both short- and medium-term trailing windows.

Related Articles

Several economic indicators are raising concerns and investor anxiety about a potential recession. When combined with persistent economic and geopolitical concerns, these...

If the Vanguard S&P 500 Index ETF (VFV) doesn’t give you enough large-cap U.S. equity exposure as a Canadian investor, Invesco NASDAQ 100 Index ETF (QQC) is one of the most...

The major market indexes have struggled this year to produce returns. Many actively managed ETFs have fared better than their index counterparts. Here are 3 top actively managed...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.