- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

QIAGEN's Coronavirus Test Kit Development Gets BARDA Funding

QIAGEN N.V. (NYSE:QGEN) announced that it is working to develop a QIAstat-Dx test kit to distinguish the novel SARS-CoV-2 coronavirus from 21 other serious respiratory infections. The company also announced that it will receive advanced development support from the U.S. Department of Health and Human Services’ (“HSS”) Office of the Assistant Secretary for Preparedness and Response (“ASPR”) for this purpose.

Notably, QIAGEN’s QIAstat-Dx solution is the first syndromic testing product, which has been selected for development through ASPR's Biomedical Advanced Research and Development Authority (“BARDA”) streamlined selection process, known as an easy broad agency announcement (“EZ-BAA”). BARDA has confirmed contributing $598,000 to the company to help speed up the evaluation process to detect SARS-CoV-2.

With the milestone, QIAGEN aims to strengthen foothold in the global Molecular Diagnostics market.

A Peek Into QIAstat-Dx

The QIAstat-Dx system was launched in Europe in 2018, whereas it was made available in the United States in mid-2019. It enables fast, cost-effective and easy-to-use syndromic testing, with Sample to Insight workflows.

Significance of the Funding

The company is working toward an accelerated development of the test kit to further expand its capacity to meet the testing demand. The test kit will be able to provide faster test results, thus, aiding faster diagnosis of patients with respiratory ailments.

Per QIAGEN, it is partnering with customers and public health authorities globally to scale up its coronavirus testing capacity, and make available the Sample to Insight QIAstat-Dx respiratory panel with SARS-CoV-2 detection. Along with the QIAstat-Dx test cartridges, the company is prioritizing the production of the QIAamp and EZ1 sample technologies per the U.S. Centers for Disease Control’s testing guidelines.

The company can proactively help combat the global pandemic as it is not facing any supply chain interruptions from China or other markets. Currently, QIAGEN is also working toward mitigating any supply delays or allocations being faced by customers.

Notably, the company believes that its deliberations with the FDA along with the funding from the HHS will allow it to help the United States to contain the outbreak. Although the availability of the testing panel will vary on regions, it will be available in CE-IVD marking in Europe and other markets in the coming weeks.

Industry Prospects

Per a report by Grand View Research, the global molecular diagnostics market size was valued at $9.2 billion in 2019 and is anticipated to reach $18.2 billion by 2027, witnessing a CAGR of 9%. Factors like technological progress in molecular diagnostics and the rising prevalence of infectious diseases are expected to drive the market.

Given the global condition of the market amid the COVID-19 outbreak, QIAGEN’s efforts are noteworthy.

Recent Developments in Molecular Diagnostics

Of late, the company has been working to combatting the COVID-19 outbreak.

It is currently providing various testing solutions for SARS-CoV-2, including enabling laboratory-developed tests (LDTs), mid and high-throughput automation, and two new RT-PCR tests for the detection of SARS-CoV-2. However, the RT-PCR tests (developed at QIAGEN sites in China and the United States) will be available for research purposes only.

In February, the company announced the shipping of its latest QIAstat-Dx Respiratory Panel 2019-nCoV test kit to four hospitals in China for evaluation purposes.

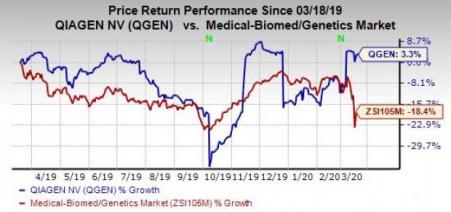

Price Performance

Shares of QIAGEN have gained 3.4% in the past year against the industry’s 18.3% decline.

Zacks Rank & Other Key Picks

Currently, the company carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks from the broader medical space are ResMed Inc. (NYSE:RMD) , Medtronic plc (NYSE:MDT) and Hill-Rom Holdings, Inc. (NYSE:HRC) .

ResMed has a projected long-term earnings growth rate of 14.4%. It currently carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Medtronic’s long-term earnings growth rate is estimated at 7.4%. The company presently has a Zacks Rank #2.

Hill-Rom’s long-term earnings growth rate is estimated at 11.1%. It currently carries a Zacks Rank #2.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Medtronic PLC (MDT): Free Stock Analysis Report

ResMed Inc. (RMD): Free Stock Analysis Report

QIAGEN N.V. (QGEN): Free Stock Analysis Report

Hill-Rom Holdings, Inc. (HRC): Free Stock Analysis Report

Original post

Related Articles

• Trump’s trade war, U.S. jobs report, and last batch of Q4 earnings will be in focus this week. • Costco's earnings report is seen as a potential catalyst for growth, making it a...

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.